Does size matter for Car Insurance?

“Is it size or technique that matters?” This is the often asked and joked about question in informal discussion – and seldom has anything to do with the physical act of driving….

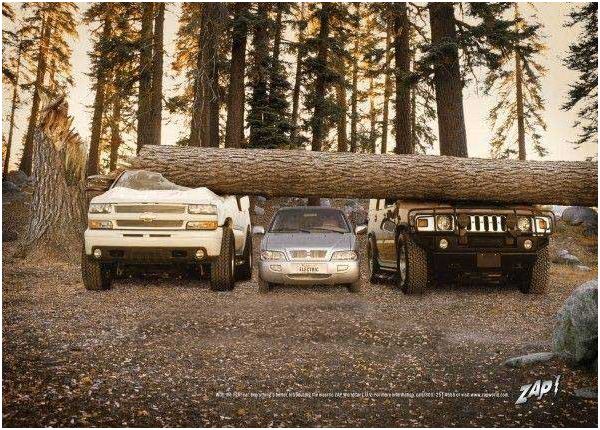

We could ask the Car Insurance question – “Is it the size of my car or the way that I drive that matters?” I received the photo attached below and thought “size” might be an important aspect to consider in our discussions on car insurance. There are most certainly several aspects where large and small could determine the size of your car insurance premium!

• Size of Car / Size of Engine

The size of your vehicle matters less than the size of your engine. Car insurance is usually more expensive on sports cars, not only because of the increased value of the vehicles but also on account of the driving habits of the owners of these vehicles. Owners of vehicles with larger size engines are more likely to be caught speeding or submit claims from vehicle accidents at high speed.

• Size of distance that you drive

The distance that you drive has a very important impact on the car insurance premium that you will pay. The more you drive, the higher the risk of accidents and insurance claims – the les you drive, the less risk and the more affordable the insurance premium!

Some insurance products such as Pay As You Drive , also known as usage based insurance, are developed to reward those drivers who are driving less.

• Size of Place where you live

If you are living in a larger town or city, you are most likely to pay more for your car insurance premium. Important contributing factors to the insurance premium include accidents risks as well as vehicle related crimes. In cities we find higher crime rates and increased traffic congestion resulting in higher risks of vehicle loss and damage.

• Size of vehicle claims history

Your claims and insurance history are important factors considered by your insurance company in calculating the premium payable. If you have been a frequent claimant for the past few years you will be regarded as a “claims risk” and might have to pay significantly more than the client who has a “claims free” insurance record.

• Size of Insurance portfolio

It is important to consider whether you have more than one asset at the same insurance company. You might be able to save on your premium by having both your vehicle[s] and your household insurance at one provider, instead of having different assets separately insured at different providers.

We would like to advise that you pay close attention to all the factors used to calculate your insurance premium. By putting in a small amount of effort in comparing insurance quotes from different providers you might be able to slim down on your sizable insurance premium!!

Also view: