NAAMSA New Vehicle Sales Report – February 2013: What do the numbers tell us?

Comments on February 2013 Naamsa Sales numbers:

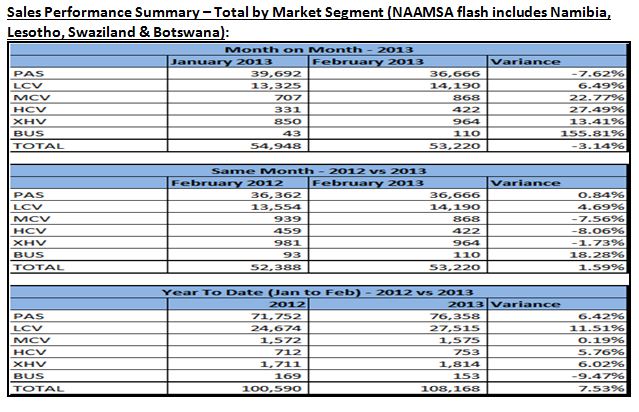

- The industry experienced a decrease in sales volumes in February 2013 compared to January 2013 (-3.14%). The main contributor to the decline was Passenger Vehicles which had negative growth of -7.62%.

- The high growth in January 2013 that was largely driven by the Car Rental volumes had in effect in setting a base that would create negative growth in February.

- Year on Year (February 2012 versus February 2013) sales grew by 1.59%, equating to 832 more vehicles compared to the same time last year.

- For the past three years the month of February has on average been around the 6th lowest month in terms of sales volumes.

- If this trend was to continue in 2013 we would therefore have another 6 months in this year that will record higher sales than this month’s numbers – this would auger well for sales growth in 2013.

- In 2013 vehicle sales volumes may be boosted by the following factors:

- Low Interest Rate environment.

- Total Vehicle Price Inflation has risen at lower rates than that of the CPI.

- Replacement cycle.

- However, the following factors are expected to provide subduing effects on vehicle sales numbers:

- 2012 Year on Year Real GDP figure was 2.5%. Economic growth for 2013 is expected to be flat around 2.5%.

- The Exchange Rate is under pressure and will have a negative effect on Vehicle Price Inflation.

- Increases in food prices, energy (fuel and potential electricity hikes) and transport costs (including toll fees) will impact on consumer disposable income.

- Household Debt to Disposal Income remains high at 76%.

- The number of consumers with impaired credit records remains higher at 46.7%. There has been no improvement in this regard for the last four years.

- Carbon Emissions tax set to rise from April 2013.

- Potential labour interruptions in key industries.

- For the past three years the month of February has on average been around the 6th lowest month in terms of sales volumes.

General Macro and Industry Comments:

- The Minister of Finance, Pravin Gordhan this week announced his budget for the year. He included in his speech a revision downward of GDP growth to 2.7%.

- Standard Banks Economics Desk Forecasts 2.5% GDP growth.

- The Minister expected for softer spending in infrastructure projects, employment growth to be limited in the public sector and what growth there is to be driven by the private sector.

- He warned that South Africa’s sluggish growth and mining strikes in H2:12 had a significant impact on government finances, with the budget deficit consequently wider than expected. The further slippage in SA’s debt and fiscal metrics increases the possibility of a further sovereign rating downgrade from either Moody’s or S&P this year.

- It was mentioned that taxes of CO2 emissions would be raised from April 2013.

- Annual GDP in 2012 was 2.5%. GDP grew quarter on quarter to 2.1% in Q4 last year. Despite the labour unrest Q4 2012 growth was surprisingly driven by the manufacturing industry.

- The Rand Exchange Rate is expected to remain under strain throughout the year. The Consumer Price inflation is expected to stay flat (at around 5.7%) through 2013.

- The Prime Interest Rate remains at its lowest for over thirty years, and has and will play a major part maintaining the South African consumer’s appetite for debt.

Other Observations:

- Locally manufactured vehicles sold domestically compared to Imported and Exported sales

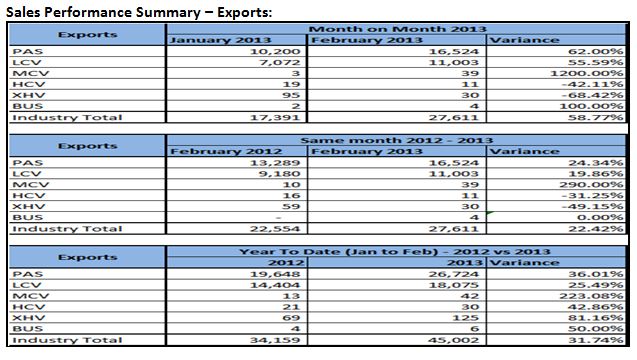

- In 2012, 252,439 vehicles were produced locally in South Africa. More than half of that number was exported (52.4%).

- Passenger and Light Commercial vehicles are the key drivers of these export volumes given the local models produced locally for international markets. Combined those two categories contribute 99.6% of all vehicles exported.

- Locally manufactured vehicles make up only 40.5% of total vehicles sold domestically. Thus imported vehicles contribute to 59.5% of domestic sales.

- 72.3% of all imported vehicles are passenger cars.

- Locally produced LCV’s contribute 71.8% of domestic sales. Popular vehicles in this category are the Ford Ranger and Toyota Hilux which are both locally produced.

- In 2012, 252,439 vehicles were produced locally in South Africa. More than half of that number was exported (52.4%).

- Going Green:

- With CO2 emissions taxes set to be increased and consumers looking to go green the importance of sustainable eco-friendly vehicles cannot be over-stated.

- Hybrid cars have been growing at good rates but off a low base.

- In South Africa Hybrid models have grown over the past three years with 42.27% growth in 2010, 51.45% growth in 2011 and 22.33% Year on Year growth in 2012. This is coming off a low base where number of vehicles sold grew by 123 in 2010, 213 in 2011 and 140 in 2012.

- Some industry experts forecast electric cars will account for 15% of worldwide passenger vehicles sales by 2025.

[ Comments by Sydney Soundy – Head of Standard Bank Vehicle Asset Finance]