Passenger and Light Commercial vehicles drive vehicle sales growth in January!

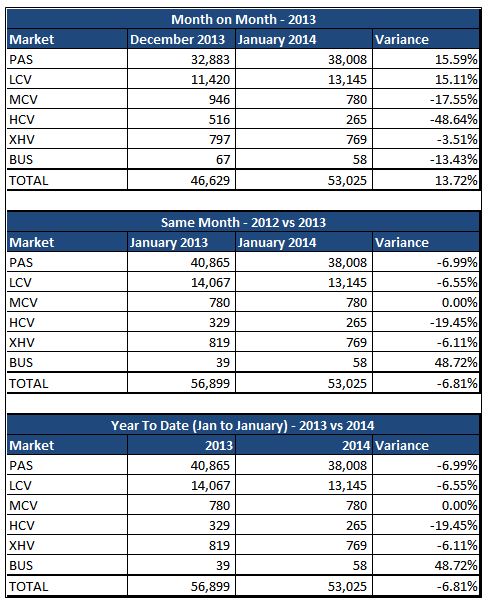

Sales Performance Summary – Total by Market Segment (NAAMSA flash includes Namibia, Lesotho, Swaziland & Botswana):

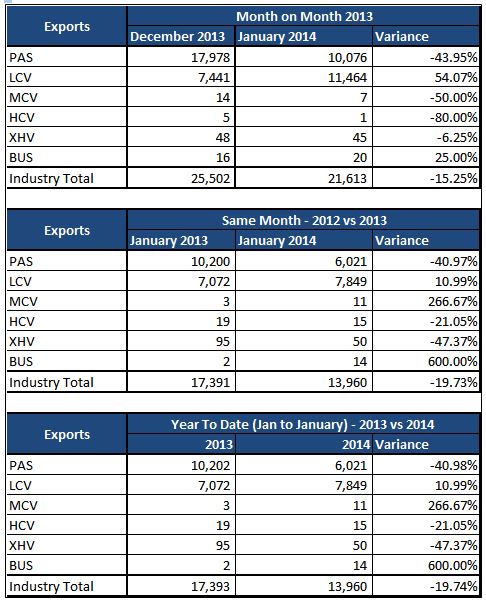

Sales Performance Summary – Exports:

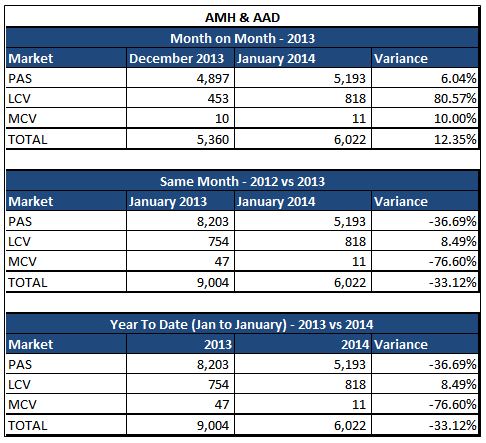

Sales Performance Summary – AMH:

General Comments on January 2014 NAAMSA sales:

- The month of January 2014 experienced 13.7% more sales than December 2013.

- Month on Month all goods types experienced negative growth apart from Passenger and Light Commercial Vehicles which contributed to this month’s growth. Passenger and Light Commercial vehicles grew by 15.6% and 15.1% respectively.

- Year on Year monthly comparison shows a decrease of -6.8% in January 2014 compared to January of 2013. The average sales per day in January 2014 were less than January 2013 by 2,039 to 2,188. (26 days).

- All goods types had negative growth year on year apart from Busses which had 48.7% growth and Medium Commercial Vehicles which remained flat. Passenger and Light Commercial Vehicles declined by -7.0% and -6.6% respectively.

- The average number of sales for January since 2010 has been 48,321 (excl January 2014) and on average January has ranked as the 8th best month since 2010. January 2014 has exceeded the average by 4,704 more vehicles.

General Macro and Industry Comments:

- The country’s Quarter 3: 2013 Gross Domestic Product numbers came in at 0.7% q/q growth. This was on the back of a strong 3.2% q/q growth and is the lowest q/q growth since 2009.

- Softer growth in the trade sector can be explained by the more challenging environment faced by the customer. This is reflected in low consumer confidence levels. The seasonally adjusted Kagiso Purchasing Managers Index (PMI) declined by 2.5 index points to reach 49.9 in December. The index edged below the neutral 50 point mark for the first time since April 2013.

- Headline annual inflation rate (CPI) for all urban areas in December 2013 was 5.4%. This rate was 0.1 of a percentage point higher than the corresponding annual rate of 5.3% in November 2013. The official average annual inflation rate was 5.7% for the year 2013. This was 0.1 of a percentage point higher than the 5.6% annual inflation rate of 2012

- On average, prices increased by 0.3% between November 2013 and December 2013. The Transport index increased to 6.3% in December 2013 from 5.8% in November 2013. This was mainly due to 17 cents per litre increase in the price of petrol. The petrol price will increase by 39 cents a litre and 24 cents a litre for diesel in February. This will have a further knock on impact on inflation numbers.

- The SARB decided to hike the repo rate by 50 bps, and has indicated further hikes cannot be ruled out within the year.

- The rand has weakened against all major currencies – reaching a new high on Wednesday 29th January of R11.38 against the American dollar, a level not seen since October 2008 when the rand reached a high of 11.56.

Imports per Country:

Due to the Euro Zone crisis a number of European car makers have been moving some of their manufacturing plants/facilities into Asia to take advantage of low operating costs.

In 2013 imported vehicles made up 59.8% of the total vehicles sold in South Africa. This is a huge increase in imports compared to 10 years ago, where in 2003 imported vehicles only made up 21.2% of the total vehicles sold. From the 389,461 imported vehicles sold in 2013, 86.6% of these vehicles were Passenger cars. Imported Passenger vehicles make up 74.8% of the total passenger market.

Looking further back to 1994 South Africa only imported vehicles from 5 different countries while in 2013 imported vehicles came from 31 different countries.

The top three countries in which South Africa imported vehicles from in 2013 were India (97,167), South Korea (62,058), and Germany (56,997). India has the highest contribution to the total imports, coming in at 24.9% followed by South Korea (15.9%), and Germany (14.6%).

In 2004 only 1.2% of all imports came from India, accounting for 0.3% of all new vehicle sales. In 2004 there was only one vehicle manufacturer that imported vehicles from India. In 2013 there were 10 different manufacturers of vehicles that imported from India. This has changed tremendously with imports from India now account for 14.9% of all new vehicles sold.

Ticket Value and Pricing

With developed economies growing incrementally a renewed demand in the car market has come about, prompting car prices to rise with the demand. Trans Union published their 2013 annual figures highlighting that South Africa’s new vehicle prices have grown by 3.7% year on year. New vehicle pricing was impacted by various aspects, such as the exchange rate fluctuation and Carbon emissions tax.

From a Standard Bank perspective the value of average financed deals has grown by 7.8% year on year while the prices of new passenger vehicles have grown on average at 13.0% year on year in 2013.

Vehicle Price Inflation on Used Car prices ended the year in negative territory, with prices 2.2% lower than 2012. With the gap between new and used vehicles widening by 5.9%, the pre-owned market will become more attractive, potentially giving rise to fresh sale opportunities in the pre-owned market. Replacement demand for new cars will also probably continue to soften in 2014 as the rapid growth in the new car market seen between 2010 and 2012 softens with the replacement cycle reaching its peak.

2014 Vehicle Sales Prospects:

2013 ended as the third best year for domestic sales, and thus the baseline from which to project growth in 2014 is fairly high. With that in mind and taking into account the last few months’ lack of growth, it is expected that the year ahead will experience significantly muted growth. Factors that will inhibit growth will have a far greater impact than those that are likely to assist growth.

Factors that will inhibit growth include the following:

- Low level of economic growth is expected in 2014, 2.2% for 2014 (Standard Bank Research).

- High level of unemployment (24.7%) is expected to persist.

- Rising inflationary pressures will remain a challenge. Food, fuel, above inflation wage settlements, as well as Exchange Rate fluctuations will pose risks to the inflationary outlook.

- Exchange Rate fluctuations will also have an impact on vehicle pricing. With approximately two-thirds of vehicles sold in RSA being imported (NAAMSA) pricing will be vulnerable to a depreciating Rand.

- South Africa’s debt to disposable income level has moderated slightly to 75.5% in Quarter 3: 2013 from 75.8% in Quarter 2: 2013. This lingering stickiness in pre-existing debt levels presents a notable impediment to incremental credit uptake. The increase in interest rates will put further pressure on an already stretched consumer base.

- The Bureau of Economic Research retail survey shows Retail business confidence decreased by 9 index points to a level of 40 in Quarter 4 of 2013.

- The Replacement Cycle may have reached its peak.

Factors that may assist growth:

- Even with the recent 50 bps increase in the repo rate, the interest rate environment remains favorable for financing of vehicles. However, this is likely to change with the upward movement of interest rates anticipated in the course of the year.

- We have seen an increase in new vehicle prices due to the pressure of exchange rate fluctuations. However, prices of vehicles have grown at a lower rate than that of Consumer Price Inflation. New Vehicle Prices have grown by 3.79% for 2013.

- There is still demand in the second hand market. This bodes well for the new car market as it enables trade-in to be feasible. 2013 experienced a negative growth in used car pricing, ending the year 2.2% down from 2012.

- The South African vehicle market remains competitive – with South Africans crazy about cars, manufacturers are pushing creative marketing and incentive programmes as they fight for market share.

- New model introductions, extended warranties, service plans and sales incentive schemes will remain prevalent in a consumer friendly sales environment.

- Financial institutions have also created a wide variety of financing options to meet the needs of consumers.

[Comments on NAAMSA New Vehicle Sales Report – January 2014 by Sydney Soundy – Head of Standard Bank Vehicle and Asset Finance]

- We have seen an increase in new vehicle prices due to the pressure of exchange rate fluctuations. However, prices of vehicles have grown at a lower rate than that of Consumer Price Inflation. New Vehicle Prices have grown by 3.79% for 2013.