Difficult times for the consumer in the market for higher priced vehicles

Absa Commentary on the September NAAMSA Sales Report

Vehicle Sales and Exports

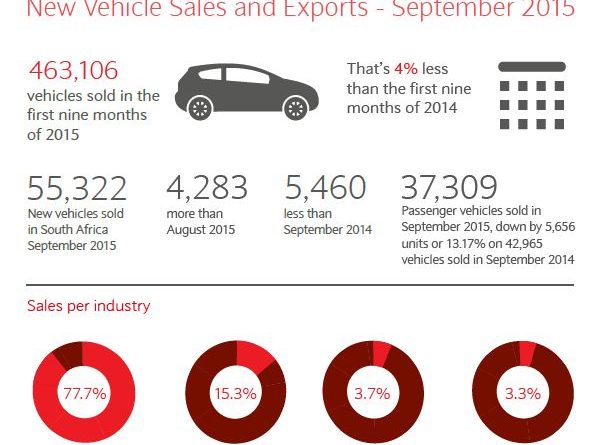

- A total of 55 322 new vehicles were sold in September 2015, which were 4 283 units and 8,4% more than total sales in August. Sales volumes were down by 5 460 units in September from the same month last year, resulting in a decline of 9% year-on-year (y/y). Year-to-date sales were down by 4% to just more than 463 000 units compared with the first nine months of last year.

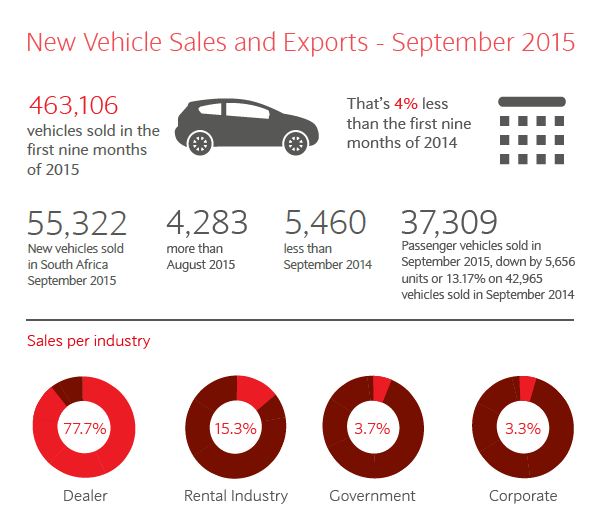

- Of total industry sales of 55 322 units in September, 77.7% represented dealer sales, 15.3% represented sales to the vehicle rental industry, 3.7% represented sales to the government, and 3.3% of sales were to corporate fleets.

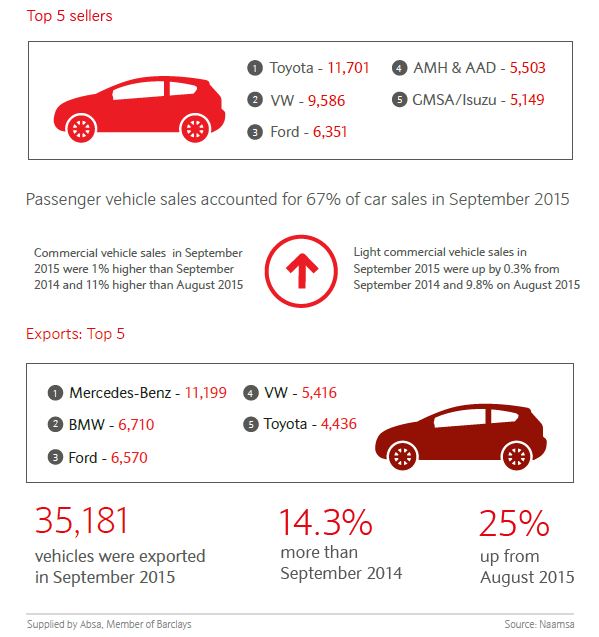

- Passenger vehicles sales amounted to 37 309 units (67.4% of total vehicle sales) in September, which were 13.7% down on a year-on-year basis, but up by 7% from August. Commercial vehicle sales were up by 1.1% y/y in September, with light commercial vehicles sales (27.3% of total vehicle sales) marginally higher by only 0.3% y/y, while rising 9,8% month-on-month to 15 121 units.

- The overall daily sales rate was 2 634 units in September, up from 2 552 units in August.

- New vehicle exports increased by 14.3% y/y and 25.3% m/m to a total of 35 181 units in September. Year-to-date export volumes were up by 33.7% y/y to a total of more than 260 500 units.

Vehicle Finance

- Vehicles are currently mostly financed over a 72-month period with used vehicles only marginally impacting the average financing term. The main driver of this remains affordability, but it has the downside of an ever-increasing average contract period, which continues to lengthen the vehicle replacement cycle.

- The ratio of used to new cars financed was 1.72 at the end of July this year. A total of 26 434 used vehicles were financed in July, with the number of new vehicles financed at 15 388. The total number of vehicles financed in the first seven months of the year came to 275 046, of which 173 734 were used and 101 312 were new, with a used-to-new ratio of 1,71 over this period compared with a ratio of 1,62 in January to July last year.

- Comments and statistics on applications received and electronically scored by Absa in September:

- We experienced an increase in the number of applications received and a decrease in the approval rate.

- Applications received and scored with a 72 month finance term = 89%

- Applications received and scored with balloon payments = 30%

Industry Outlook

- Based on trends in the first nine months of the year, new vehicle sales volumes are set to be down this year compared with 2014. The main factors impacting vehicle sales are economic growth, inflation, interest rates, household and business financial conditions, and levels of confidence, which declined further in the first three quarters of the year.

- Entry-level passenger cars, new model releases and manufacturer incentives will continue to be the main contributors to new vehicle sales volumes for the rest of the year.

- New vehicle exports are expected to perform strongly in 2015 compared with last year, impacted by world economic growth that drive the demand for vehicles, local manufacturers’ export programs and an expected weaker rand exchange rate towards the end of the year, which will give further support to vehicle export competitiveness.

- A further 25 basis points interest rate hike is forecast before year-end, with interest rates expected to rise by a cumulative 75 basis points in 2016. The prime lending rate is forecast at 9.75% and 10.5% at the end of 2015 and 2016 respectively. The vehicle sector is an interest-rate sensitive sector, with further interest rate hikes to negatively affect the affordability of and demand for vehicle finance.

Consumer Outlook

- Consumers remain under financial pressure due to an upward trend in inflation and interest rates, while remaining highly indebted. The cost of servicing debt will increase due to expected further interest rate hikes towards year-end and in 2016. Consumers continue to find it difficult to obtain and afford credit for higher-priced vehicles, with the demand for favourably priced entry-level vehicles and good-quality used vehicles remaining strong.

Factors Impacting the Vehicle Sector

- Vehicle prices (exchange rate, taxes, input costs): New vehicle price inflation may remain under upward pressure due to expected further rand weakness towards the end of the year and in 2016.

- Household finances (household income, employment, inflation, ratio of household debt to disposable income and consumer credit-risk profiles), business sector performance and consumer and business confidence: Household finances remain finely balanced with debt levels still high and the percentage of credit-active consumers having impaired credit records remaining on a gradual rising trend. Consumer and business confidence remains low.

- Vehicle finance (interest rates, banks’ risk appetite and lending criteria, legislation and regulation): The demand for and affordability and accessibility of vehicle finance, largely driven by interest rate movements, customer credit-risk profiles and consumer and business confidence, will remain important to the performance of vehicle sales.

- Transport costs (fuel prices and maintenance costs): Fuel prices and vehicle maintenance costs drive transport costs and consumer price inflation, impacting consumer and business spending power.

- Economic performance and vehicle demand and supply (global and domestic economic growth, exports and workforce stability): Global and domestic economic growth will drive domestic vehicle sales and exports, which will be supported by manufacturers’ export programs, with labour market trends and developments impacting vehicle production and export volumes. Vehicle export competitiveness will benefit from a depreciating exchange rate.

Also view:

Vehicle Finance, Car Insurance and Road Safety

Buying and Selling a Vehicle – Informed decisions and the Vehicle Retailer