The growing cost of healthcare makes a well-rounded financial plan essential

The cost of treatment for serious illnesses like cancer, especially new technologies and treatments, has soared in the past few years which makes having a financial plan in place to help you through a major health crisis absolutely crucial.

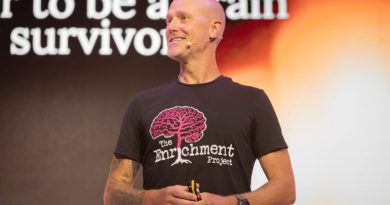

“Cancer remains a highly emotive illness that has far reaching implications for both the patient and their family. Unfortunately, people suffering from this disease can often face a punishing treatment regimen that makes it difficult or even impossible to work and earn an income. Added to this, the spiralling cost of cancer treatment can become a major financial hurdle to overcome. It’s a good example of why it’s so important to put together a well-rounded financial and healthcare plan with the help of a professional advisor,” explains Ryan Chegwidden, Product Head at Hollard Life.

In recent years, new drugs called ‘biologicals’ have improved cancer survival and remission rates to unprecedented levels. Although ground-breaking, and proven to mean the difference between life and death in many clinical trials, biologicals come with a hefty price tag. These drugs can cost anything from R100 000 to R500 000 per course depending on the type and severity of cancer being treated and are rarely covered by your medical aid.

“In the face of the rising cost of treatment for illnesses like cancer, many medical schemes have started to limit oncology benefits and exclude expensive, advanced treatments. If you were to be diagnosed with cancer, you may soon find that your medical aid only funds the essential treatments you need and nothing further would only be available with a significant amount of self-funding. The interplay between health insurance products from medical aid to critical illness, disability and even gap cover requires an experienced eye to get the balance of benefits right for each person’s unique circumstances,” says Rafique Saville, Principal Officer of Professional Financial Solutions.

It’s exactly this situation that Rafieq’s client, Mary*, found herself in when she was diagnosed with peritoneal cancer in 2015. In fact, this was Mary’s second cancer diagnosis after surviving breast cancer in 2008. (*Name changed to protect her privacy)

Mary did not respond to conventional chemotherapy and radiotherapy which lead to her being put on biological treatments at a huge cost that her medical aid did not cover. With stage 4 peritoneal cancer (a rare cancer that affects the tissue that lines the abdomen), Mary required her biological treatment every 16 days at a cost of R26 000 per vial – costs which she had to cover herself. She has been on this treatment regime for a year now and her cancer is stable, has not spread any further and doctors are hopeful about recovery. But it has come at price – 23 treatments per year comes in at R600 000. Thankfully, Mary’s critical illness policy with Hollard paid out a substantial lump sum within days of diagnosis and submission of the necessary paperwork. Had it not been for this cash lump sum that she used to pay for the biological treatment, the outcome could have been very different today.

“People don’t often consider the fact that the financial implications of a serious illness may run well beyond the cost and duration of the initial treatments,” says Ryan Chegwidden. “High rehabilitation costs can also be incurred over an extended period of time. Post treatment, living with cancer may require a complete change in lifestyle. In addition, if you are seriously ill, it is likely that you will also experience a loss of income due to being unable to work for an extended period of time, possibly even permanently. For the self-employed, this presents an even greater risk. These are costs that will not be covered by your medical aid and the financial implications are far-reaching. Cases such as this demonstrate why it is essential to have critical illness and disability cover in place. However, in planning your cover, it is important to remember that critical illness and disability products are not replacements for medical aid; but complimentary benefits in a well-structured healthcare portfolio ” he explains.

“As a financial planner, we often experience the exact impact that financial planning has on our client’s lives first hand,” says Rafique Saville. “In Mary’s situation, one important lesson stands out for me – medical aid is vital however it is simply not enough. Mary was thankfully well covered with medical aid, critical illness and disability cover which means that she emerged from her illness not only with her health intact, but her finances too. A good financial plan ensures that you have the funds available to enable you to choose your preferred treatment, the best technology available and the best post treatment options,” he concludes.