A friend asked for information that will summarise the different sorts of security devices an insurance company might specify. As this is an important topic to share with a wider audience we decided to share the answer on Insurance Chat as well!

On Insurance Chat we will in the next few months dedicate more time and effort to provide information on effective stolen vehicle recovery. We would however, as a start, like to focus on mechanisms, tools and systems that could help to prevent theft!

On the Car Insurance Blog we find a very important post titled: Layered vehicle security needed for affordable car insurance. In this post we find the following reference to layered vehicle security and the tools available:

“Experts in the car insurance industry believe that no single security system is perfect, but with several layers of vehicle protection, we can go a long way in protecting ownership! A significant portion of vehicles are broken into with the intent of stealing the vehicle itself, so by combining several visible simple, inexpensive physical theft deterrents we will discourage the would-be thief from breaking in driving off with the vehicle! The more layers of protection on your vehicle, the more difficult it is to steal…

What are these layers of protection? The answer can be found in the factors that influence the risk profile of vehicles. These factors include the effectiveness of anti-theft devices, the role of electronic security devices, the age of the vehicle, desirability of the vehicle, intended markets and the marking of vehicles.

There are many types of anti-theft devices available on the market and it should not be difficult to find one that fits your budget and suits your needs. We can distinguish between active and passive anti-theft devices.

- Passive devices automatically arm themselves when the vehicle is turned off, the ignition key removed, or a door is shut. No additional action is required.

- Active devices require some independent physical action before they are set, such as pushing a button, or placing a “lock” over a vehicle component part. This physical action must be repeated every time the anti-theft device is set or it will not function.

Which ant-theft vehicle security systems are available?

- Alarm System: If you don’t have an alarm system, get one! The noise alone may be enough to scare away an inexperienced thief and prevent the break-in. You should install an alarm system that will sound when someone attempts to break in, move, tilt, or start your vehicle.

- Factory-option alarm systems are generally best, but a carefully installed, properly calibrated aftermarket system can provide just as much safety.

- Gear Lock: A gear lock is an affordable and a very effective anti-theft device.

- Steering wheel locks: Consider buying a visible mechanical locking device to lock the steering wheel. These are inexpensive and are recommended by some experts to be the most cost-effective theft deterrent on the market today.

- Immobilizing Device: This prevents thieves from bypassing your ignition and hot-wiring the vehicle. Some of these electronic devices have computer chips in ignition keys. Other devices inhibit the flow of electricity or fuel to the engine until a hidden switch or button is activated.

- High-tech devices also include smart keys, high security locks & keys, fuse cut-offs, kill switches; starter, ignition and fuel disablement.

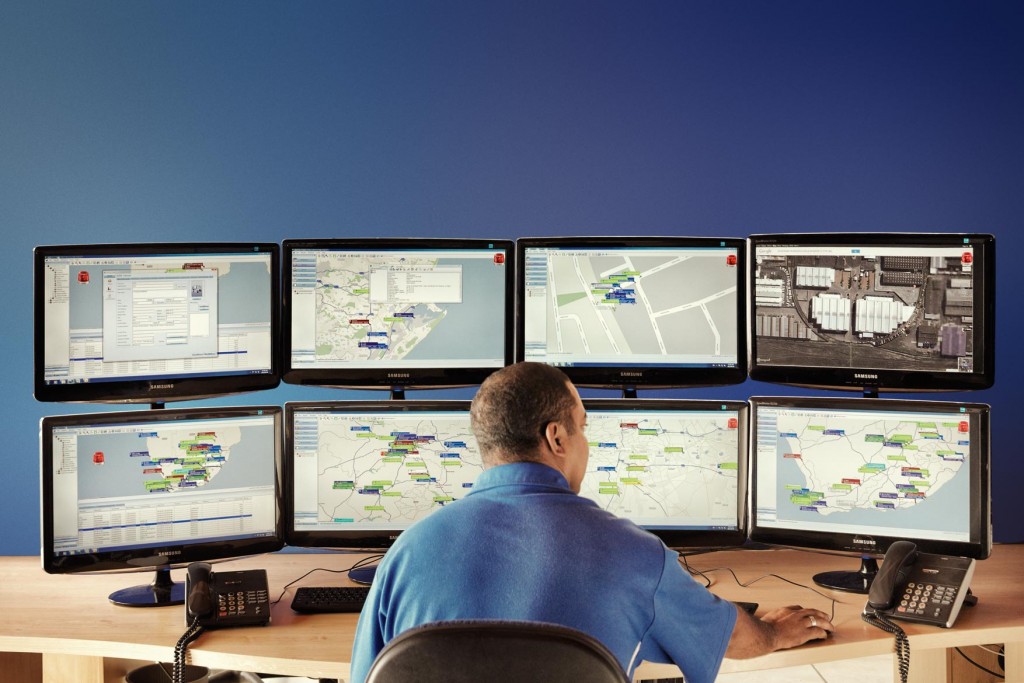

- Tracking Device: These systems have become very accurate and affordable. A tracking device emits a signal to a police or monitoring station when the vehicle is reported stolen. Tracking devices are very effective in helping authorities recover stolen vehicles.

- Etched vehicle security: Etch the vehicle identification number (VIN) onto the doors and fenders of your car with an electric engraver for extra protection. This helps to discourage professional car thieves, who will have to remove the markings to resell the car.

- DataDot Technology: Micro-dotting technology makes it impossible to hide the original identity or a vehicle and makes them less desirable to criminals.

It is also important to have these anti-theft systems installed properly, or you may risk damaging the device or even your car’s electrical system. Ask an expert to do the installation for you!

The vehicle owner should always communicate clearly with the insurer before purchasing an anti-theft device. Ask your insurer which anti-theft systems they require and which of these systems will lower your car insurance premium! Ask them to provide this confirmation in writing. It is common practice for insurers to offer higher insurance discounts for automatic anti-theft devices (such as passive-setting alarms).

Most important is that the mere presence of an anti-theft device is not enough! The anti-theft device needs to be activated – always activate the system when leaving the vehicle – even if you only plan to be away for a short while. In the unfortunate event of a car insurance claim for theft you WILL be asked not only whether there were anti-theft devices – but also whether they were operational or switched on!!”

Conclusion

It is indeed true that Prevention is better than Cure! The best way to protecting our vehicles is to trust more than one device and rather have a layered approach to vehicle safety. Not only do we have to trust these devices -but also sound judgement as to where we park our vehicles. Thieves have become clever too – remain alert to those who use technology such as immobilizer jamming devices to gain access to our vehicles! Stay informed of the trends in vehicle theft and do everything possible to hold on to your vehicle. Remember as well -If all else fails – it is better to be insured!!

Also view:

Vehicle Tracking and Road Safety