Are your travels on Honeymoon covered under travel insurance?

You are in love and have planned the best possible honeymoon at a luxury island resort. You are planning to see the tourist attractions when you are not too deeply involved in getting to know one another…and the last thing on your mind is an earthquake, tsunami or terrorism.

As the saying goes however “Sh*t happens!” – and this need not be food poison from some foreign menu. Often the first test of a happy relationship occurs when away and falling ill or getting stranded far away from home!!

A few questions to consider:

- What if we fall ill? How will the medical costs be covered?

- Are we covered in the event of a car crash or other accident?

- Would it be possible for emergency medical evacuation from a foreign country?

- Who do we contact in a medical emergency?

Have you checked your travel insurance?

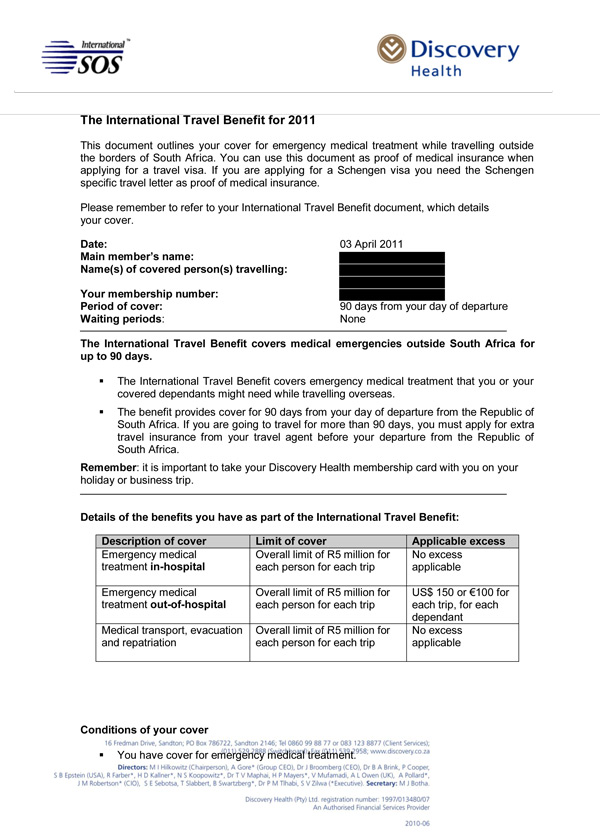

My best friend is getting married this weekend – and I asked the question – “So do you have the necessary travel insurance?” He told me that he bought the flight tickets through his credit card with Discovery – and that they provide travel insurance as well! I asked him to provide me with some confirmation, and I would like to share the info provided:

On the Arrive Alive website we have offered some advise and suggestions to travellers – including the following:

We would like to provide the following suggestions to travellers:

* Keep the following information on hand and in a safe place: The contact details of your insurer and the number of the credit card with which you bought the ticket(s). You will probably need to quote the credit card number when claiming if you have automatic cover.

* Always keep track of who you spoke to if you make contact with your insurance company or with any of its agents.

* Keep proof of payment of your travel insurance policy and keep your airline ticket – they may be needed for claims.

* Make copies of all travel documents, including passport, identity document and the insurance policy, and keep the copies in different bags so that you do not lose everything if some of your luggage goes missing.

* Keep all receipts, valuation certificates and other records of items purchased in case you need to claim. You will need to submit proof of payment for items such as luggage, clothing, electronic goods and jewellery.

* If there are any doubts about your health, go for a medical check-up to establish whether you are fit to travel.

We would like to urge all out honeymooners to gain more insight on the importance of travel insurance and find a detailed discussion on the Arrive Alive website:

Travel Insurance and Safety for Travellers