Zoom in on Camera Insurance even if you care for your equipment!!

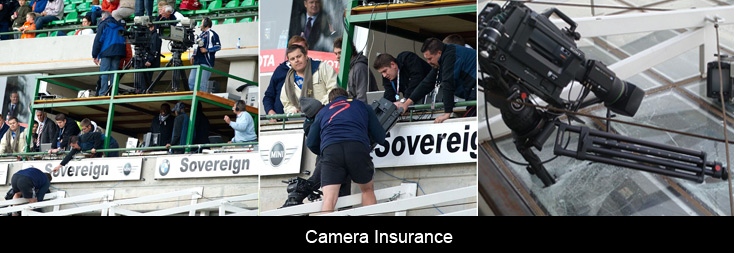

Accidents happen suddenly and without warning. On Saturday, sitting in the media section at the Super Rugby game in the Free State Stadium, I was once more reminded of this. To my left one of the television cameras used by Supersport toppled over and came crashing down on the glass roof of the presidential suite!

I managed to take a few photos and was quizzed by many about what happened. The observations made and questions asked included the obvious –“I wonder what the costs of the damage would be?”

I must congratulate Supersport for the speed, efficiency and professionalism at which they replaced the damaged camera in time for the television broadcast. This same professionalism I believe would also extend towards their financial affairs and the manner in which they insure these costly assets against accidents and loss.

Unfortunately many less professional photographers do not pay enough attention to insuring their equipment. Only when the equipment becomes very expensive and a vital component to earning a living does the amateur photographer take the time to check the insurance of his camera gear.

I have raised a few questions with Outsurance, South Africas leading direct insurer, about the insurance of camera equipment and would like to share a few insights.

Example of Insurance product for Camera Equipment

Outsurance covers camera equipment on both the personal and commercial products. This is covered under the OUT-AND-ABOUT section for personal lines clients and the OUT-OF-THE-OFFICE section for commercial clients. This is also known as “all-risks” insurance in the Industry.

What is insured?

It’s more than a simple matter of a camera with a few lenses. The equipment may include other electronic and computer equipment (portable or fixed), licensed software, portable audio/video equipment and electronic testing equipment.

When the items are covered under the OUT-AND-ABOUT or the OUT-OF-THE-OFFICE section

• The cover is on an “all-risks” basis

• Loss and damage to the items will be covered

• Accidental damage will also be covered

• The items are covered anywhere in the world

It is important to know the terms and conditions of the camera insurance policy – and to recognize that insurance does not exclude the basic requirement of care. There are some important aspects to remember if you do not wish to limit your cover. These would include:

- The need to conceal items that are locked in a vehicle.

- For example, there is a requirement that the items must be concealed in the enclosed storage areas such as the cubby-hole, boot or under retractable or removable boot covers.

- Goods left in the open are not covered.

- There must also be visible signs that the vehicle was broken into.

- There may be limits to the storage of the items in the loading areas of LDVs or inside canopies.

Take the time and make the effort to consult with your insurance company about your needs and what you require.

I would also recommend that you consult with professional photographers to better understand the perils you need to be insured against. Let them share their experience on the fine print in policy contracts to look at!

Also remember to review your insurance policy as you upgrade your photographic equipment and specify any new items.

Check these requirements with the insurance company so you can focus through the lense and not at an insurance dispute!

Also view:

Smile – but only if your camera and equipment are insured!!