Will your insurer cover you when travelling across the borders into Africa?

Do you plan for safety and potential response in worst case scenarios before you embark on a travel across the borders of South Africa?

Do you know what will happen to you and your vehicle when you get stranded across our borders? My brother alerted me to a story in the Die Burger Newspaper yesterday where a person shared his terrible ordeal.

The writer revealed that his bother struck a kudu near Keetmanshoop and had his vehicle and trailer towed to Cape Town at a cost of R19,000

The writer himself changed from insurer and now has the peace of mind that everything is covered – including towing costs of the vehicle, 2 days accommodation, personal loss for damage to the vehicle and trailer in a crash, fire and theft as well as provision for a replacement vehicle for 30 days without any ridiculously expensive premium..

I decided to approach OUTsurance, the leading South African direct insurer with a tailor made product for travelling into Africa with a request for more info on what would be covered by their insurance policy:

Out-in-Africa is an optional extension of cover for clients who intend to travel to neighboring countries or require additional repatriation cover in case of a breakdown or a claimable event.

This cover also extends the geographical areas that are covered and also offers additional benefits to normal OUTsurance cover.

Which counties are covered?

Any client covered comprehensively in South Africa will enjoy comprehensive cover in the following countries:

• Mozambique

• Malawi

• Lesotho

• Swaziland

• Namibia

• Botswana

• Zimbabwe

The normal comprehensive cover will be extended to the following countries in addition to the neighboring countries mentioned when OUT-in-Africa cover is selected:

• Zambia

• Tanzania

• Kenya

• Uganda

• Angola

There are additional benefits, not part of our standard cover, to taking OUT-in-Africa cover on your policy and these benefits also apply in South Africa or neighboring countries.

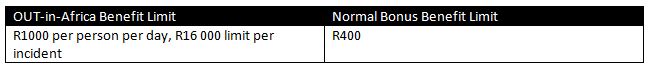

• Repatriation of vehicle and its occupants up to R65 000 per incident for which you can claim (not limited cover). Under normal Bonus benefits you only receive R400 for repatriation of you vehicle.

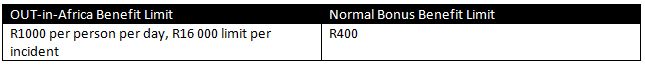

- Emergency accommodation following an incident you can claim for R1000 per person per day up to R16 000 per incident. Under normal cover you only receive R400

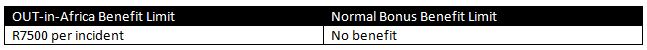

- Mechanical and electrical breakdown R7 500 per incident. This includes breakdown due to failure of anti theft devices and also airborne assistance. Note that spares are not covered. Under normal bonus benefits you only have tow-in costs to the nearest place of safe keeping

- Emergency repairs up to R7500 to get vehicle mobile after an accident

- Medical repatriation: Full costs up of transportation and inter hospital transfers. Full costs, but R2000 refundable hospital admission deposit is payable

Please note that this is for personal use only. No business use outside the normal territories will be covered.

The product can be added to any risk under the vehicle section – motorcars, motorcycles, caravan or trailer. This cover is not only for 4×4 vehicles and any vehicle traveling outside South Africa can enjoy the benefits of this product.

The minimum period of cover is one year, however the client will enjoy cover from the moment the product is added to his facility. The cover can only be removed after one year.

A single trip may not be longer than 3 consecutive months. All trips during the year may not exceed 6 months per year.

OUT-in-Africa is only for client’s with RSA ID numbers.

Conclusion:

Do not assume that you are covered! Contact your insurer or broker and confirm that you will be covered , where you will be covered and for what you will be covered!

Also view:

Guide to safety and driving on safari / driving in the nature reserve

4×4 Driving and Vehicle Insurance