Energy Drinks enjoy increasing popularity among young South Africans

- Who is the target market for companies manufacturing sports drinks? Is it necessarily those who actively participate in sport? We have given attention to the benefits of energy drinks on the Arrive Alive website and have long believed that the targeted consumer is not necessarily only our sportsmen and women. A rather interesting study reveals that this is in fact true:

- As the name implies, sports drinks are generally intended for active people, yet a high percentage of South African sports drink consumers in fact do not participate in sport activities at all.

- There are currently 8.5 million (25%) sports drink consumers in South Africa (adult population +15 years) according to the latest AMPS 2011A data i.e. people who had personally consumed in the past 7 days. The number of sports drink consumers had increased from 7.8 million (24% of adults) in 2009 to 8.5 million (25% of adults) in 2011.

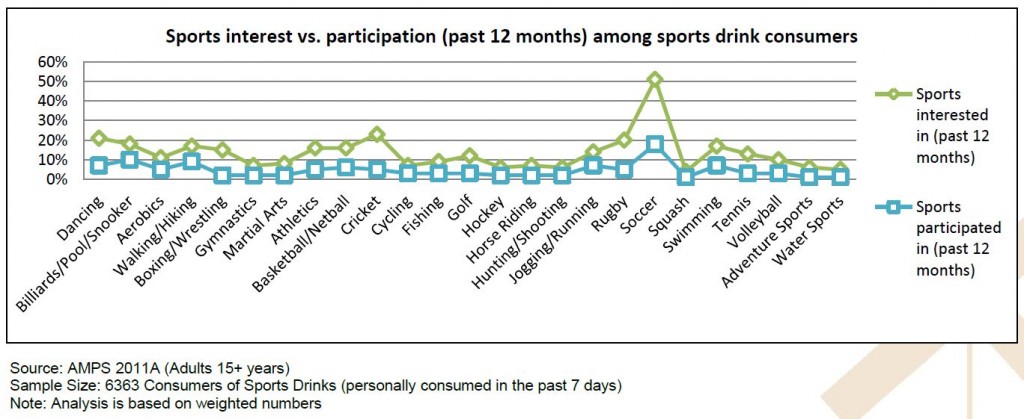

- By taking a closer look at the lifestyle and sport interests of South African sports drink consumers, the report shows that there is a strong interest in sports especially for Soccer (51%), Cricket (23%) and Rugby (20%). But, when it comes to an active participation in sport activities, the percentages are very low. While 89% of sports drink consumers stated that they are interested in sports, only 53% had been actively involved in sport activities in the past 12 months.

- The most popular sports that consumers had participated in the past 12 months were Soccer (18%), Billiards/Pool/Snooker (10%), Walking/Hiking (9%), Swimming (7%) and Jogging/Running (7%).

Energy Drinks enjoy increasing popularity among young South Africans (Source: AMPS 2011A, Adults 15+ years):

- In line with the international trend, energy drinks are enjoying increasing popularity among South Africans, just over 6 million South African adults (15+ years) had consumed an energy drink in the past 7 days.

- Energy drinks definitely appeal to the younger consumer segments. Approximately 72% of its drinkers are between the ages of 15 and 39 years old, more than 4.4 million consumers, with males comprising 52% of the market.

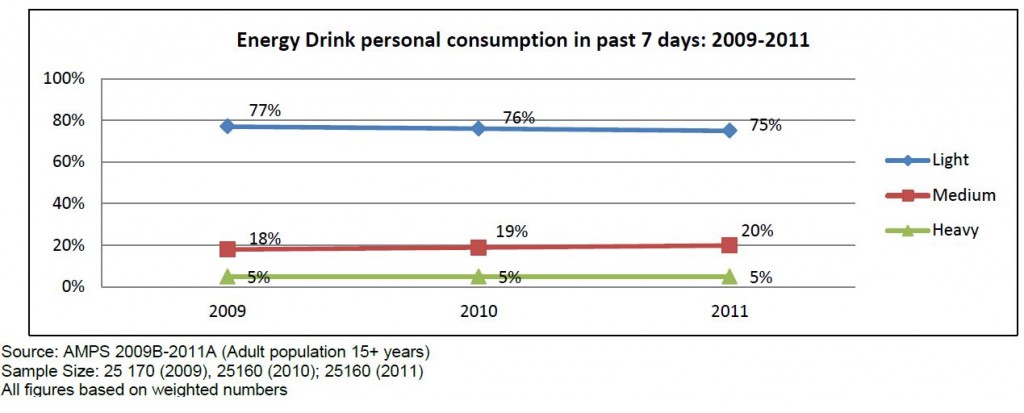

- Results of the Analytix BI report highlight a trend of increasing energy drink consumption in the past 7 days. Between 2009 and 2011, the proportion of consumers that were classified as “Medium” consumers of energy drinks (drank 3-5 cans/bottles in the past 7 days) had increased from 18% to 20% and the proportion of “Light” energy drink consumers (drank 1-2 cans/bottles in the past 7 days) had subsequently declined from 77% in 2009 to 75% in 2011.

[Information with credit to Analytix BI]

ABOUT ANALYTIX BI:

Analytix Business Intelligence is a Proudly South African market research company that conducts integrated quantitative and qualitative research to deliver holistic consumer-centric insights, customer value propositions and marketing strategy. Our strength in quantitative surveys and analysis is enriched by significant expertise in gaining qualitative insights from ethnographic-style, in-home research to provide a 360-degree understanding of the consumer. We ensure you have the right information-based foundation to create successful marketing and communication strategies. In addition to a comprehensive desk research service, we have more than 50 affordable, pre-packaged consumer intelligence reports that are created by expert analysts – saving your valuable time and resources.

On Driver Tiredness , Fatigue and Drowsiness also view:

- Energy Drinks, Driver Alertness/ Tiredness and Safe Driving

- Study on Energy Drinks and Driver Tiredness

- Driver Fatigue and Road Safety

- Road Safety & Health – Page on Fatigue

- Driver Tiredness

- Facts about drowsy driving internationally

- Sleep Apnoea and Road Safety