Sydney Soundy, Head of Vehicle Finance at Standard Bank comments on March 2013 Naamsa Sales numbers

General comments on March 2013 Naamsa Sales numbers:

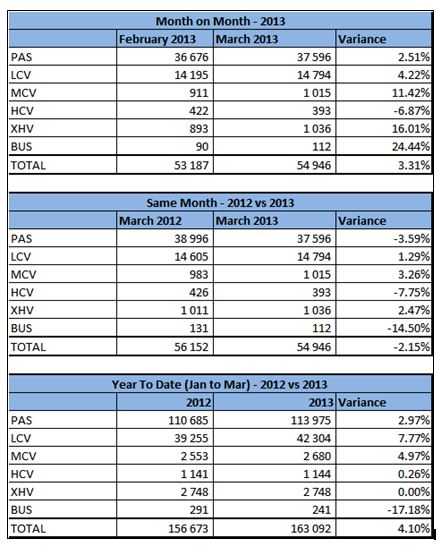

· The industry experienced increase in sales volumes in March 2013 compared to February 2013 (3.31%). The main contributors to this increase were Passenger & Light Commercial Vehicles in volumes. Extra Heavy, Medium Commercial and Busses all contributed above 10% growth Month on Month. Only Heavy Commercial Vehicles had negative growth but this was in small volumes.

· However Year on Year (March 2012 versus March 2013) sales declined by -2.15%, equating to 1206 fewer vehicles compared to the same time last year. Importantly the average sales per day march 2013 outsold 2012 by 2,892 to 2,674.

· For the past three years the month of March has on average been around the 2nd best performing month in terms of sales volumes. However with Easter falling in March the number of business days in the month have decreased. When looking at previous years (as far back as 2002) where Easter has fallen in March. The month has ranked in between 9th and 10th (2008 excluded as this was the beginning of the economic downturn). In 2002 and 2005 sales dropped by 12% due to Easter being in March with April recovering March’s losses. Thus the performance this month should not come as a surprise taking historical trends into consideration

· If the past is to go by and one takes into account March 2010 and 2011, this month’s volumes were above those two year, thus this would auger well for sales growth in 2013.

o Vehicle sales volumes may be boosted by the following factors if these trends continue:

§ Total Transport Cost (TCPI) Inflation has risen at lower rates than that of the CPI. TCPI has risen month on month by 0.8% but this is still at a lower rate than CPI.

§ The rand has been under pressure against all major currencies, this economical will has a negative knock-on effect on vehicle prices. However this has not been the case over the last year. The Vehicle Price Index has reflected that prices have risen at the low level 2.2% year on year as at Q4 of 2012. Potentially this could be due to an oversupply in the industry.

§ Vehicle Operating Costs seem to be lower than they were year on year February.

o However, the following factors are expected to provide subduing effects on vehicle sales numbers:

§ 2012 year on year Real GDP figure was 2.5%. Economic growth for 2013 is expected to be flat to 2.7%.

§ Increases in food prices, energy (fuel and electricity hikes) and transport costs (including toll fees) will impact on consumer disposable income.

§ The inflation of operating a vehicle has increased to 10.3% due to the petrol price rise in both January and February 2013.

§ The Prime Interest Rate remains at its lowest for over thirty years.

§ Household Debt to Disposal Income remains high at 75.8% (Q4 of 2012).

§ Carbon Emissions tax set to rise from April 2013.

General Macro and Industry Comments:

§ The Monetary Policy Committee (MPC) has revised their GDP forecast for 2013 to 2.7%, an increase of 0.1%.

§ The Prime Interest Rate remains at its lowest for over thirty years, and has and will play a major part maintaining the South African consumer’s appetite for debt. However the MPC has raised their inflationary forecasts by 0.1% to 5.8% for 2013.

§ Inflation is expected to breach the inflationary target in Q3 2013 at 6.3% and regress in Q4.

§ This inflationary deterioration can largely be attributed to the depreciation of the Rand and higher fuel prices. The Rand is likely to remain sensitive to both domestic and global developments. The exchange rate is expected to remain volatile and subject to overshooting. Standard Bank Research unit predicts that the rand will remain moderately more bearish than consensus at 9.00 by mid-year and 8.75 by year end.

§ Consumers are still under pressure despite a low-interest rate environment, deleveraging of household debt has been minimal, with the household indebtedness ratio having improved to 75.8% in Q4 2012 from 76.2% in Q3 2012. However household balance sheet pressures are still continuing.

§ Consumers seem to be taking advantage of the low interest rate environment and still have an appetite for secured credit. This was especially so in relation to vehicles, where there was a rise of 7.27% in volumes quarter 3 to 4 of 2012.

Other Observations:

Locally manufactured vehicles sold domestically:

§ In 2012, 530,332 vehicles were manufactured locally in South Africa. 252,439 of these vehicles were sold locally (47.6%).

§ Passenger and Light Commercial vehicles make up 92.6% of locally produced and sold vehicles

§ The South African consumer’s appetite for locally produced vehicles varies among 13 manufacturers. However Toyota and VW contribute 50% of the 47.6% of the vehicles produced and sold locally.

§ VW’s Polo has 24% of the market share, and is followed by Toyota’s Hilux which has 17% of the market share.

Labour:

· Stats SA has reported that there has been a decline in the unemployment rate to 24.9% in Q4:13 from Q3 of 25.5%. However this being said the actual number of persons in employment decreased by 235 000.

· At its conference in Boksburg on the 15th March 2013, COSATU tabled the following demands amongst others: State intervention in strategic sectors including through nationalization; protection of centralized bargaining; banning of labour broking; Ownership and control of the economy; on transforming the financial sector. The conference comes on the back of some labour unrest.

· On the back of these strikes, union demands and problems in the mining sector are adding to the difficulty in attracting skilled professionals.

· Labour disruptions are expected to have a significant impact on vehicle sales in 2013.

OEM’s Global Investment Appetite:

The world top 200 automotive executives believe that the BRICS’s share of the motor industry will sneak towards 50% of the world’s vehicle sales by 2018.

China is seen as the most attractive destination for investment for global automakers followed by India, Russia and Brazil. However South Africa is seen as the most attractive destination for investment in the motor industry outside the other BRICS’s nation by world executives who are looking to invest in developing markets.

Consumer Trends:

§ With developed country’s markets reaching mature levels, industry growth will naturally be driven by the developing nations. Innovation will have a major influence in the future of the motor industry with the following development trends expected:

o Battery electric/Fuel cell electric mobility

o Optimizing and downsizing of internal combustion engines

o Innovative urban design concepts

o Connected car technology

§ Current market share and sales volumes are influenced by the following factors that consumer’s value:

o Fuel efficiency

o Safety innovation

o Comfort

o Environmental impact

o Style of the vehicle

o Technological innovation

Some Standard Bank VAF Stats to Note:

§ The percentage of applications received with deposits for 2013 has been 40.5%.

§ The percentage of applications received with Residual Values is at 12.9%.

§ The average contract term of all applications received currently sits at 65.5 months.