NAAMSA New Vehicle Sales Report August 2013 : Several challenges remain in the automotive industry

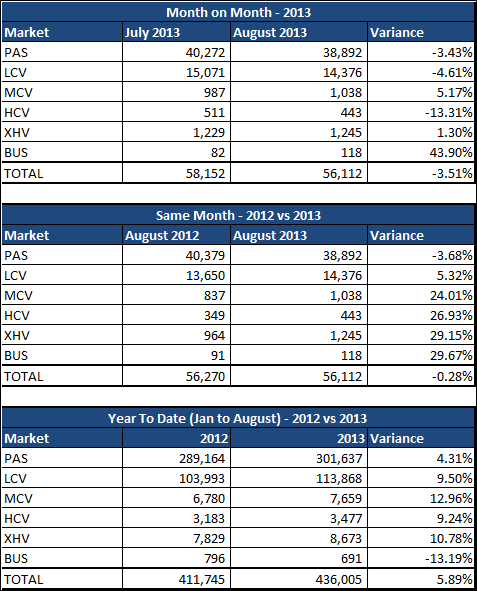

Sales Performance Summary – Total by Market Segment (NAAMSA flash includes Namibia, Lesotho, Swaziland & Botswana):

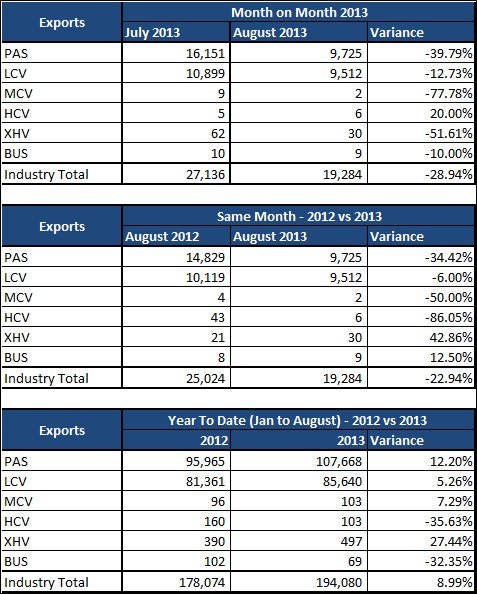

Sales Performance Summary – Exports:

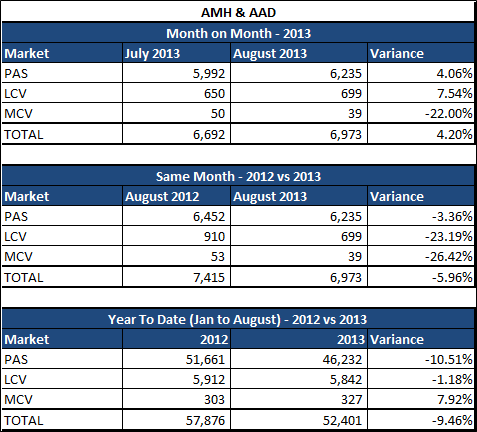

Sales Performance Summary – AMH:

General Comments on August 2013 NAAMSA sales:

- The month of August 2013 experienced -3.51% less sales than July 2013.

- Month on Month Passenger and Light Commercial Vehicles experienced negative growth of -3.43% and -4.61% respectively.

- Year on Year comparison shows a decrease of -0.28% in August 2013 compared to August of 2012. The average sales per day in August 2013 were less than August 2012 by 2,158 to 2,164.

- Year to Date (January – August 2013) comparison indicates a growth of 5.89% in 2013 compared to the same period last year. This equates to 24,260 more vehicles sold for the eight months (8 months) of 2013 compared to 2012.

- The main contributors to this year’s growth were Light Commercial, Medium Commercial and Extra Heavy Commercial Vehicles, with growth of 9.50%, 12.96% and 10.78% respectively. Year to Date growth for Passenger was 4.31% and Heavy Commercial Vehicles was 9.24% up. Only Busses had negative growth but this was in small volumes.

- The average number of sales for August since 2010 has been 51,324 (excl August 2013) and on average August has ranked as the 2nd best month since 2007. August 2013 has in fact surpassed the average number of sales, (56,112 to 51,324), and has ranked the 2nd best month this year, and 7th best out the last 80 months (January 2007 to August 2013).

General Macro and Industry Comments:

- The country’s Q2:13 Gross Domestic Product numbers came in at 3% q/q growth. This was on the back of a poor 0.9% q/q growth for Q1:13.

- The headline CPI (for all urban areas) annual inflation rate in July 2013 was 6.3%. This means that inflation has breached the upper limit of the Reserve Banks inflationary target band (between 3% to 6%). During the July MPC meeting there was a further revision in the inflationary outlook to 5.9% for 2013. Inflation is expected to peak at 6.1% in Q3:13 and average 5.9% through 2013 (Standard Bank Research).

- The transport index increased by 2.5% between June and July 2013, mainly due to an 84c/litre increase in the price of petrol. The annual rate increased to 8.2% in July from 3.7% in June 2013. With transport’s contribution to CPI being 16.43% it has the 2nd largest impact on the measure of inflation.

- Fuel prices have risen by 27.7% in petrol (inland) and risen by 21.5% in diesel (inland) since Jan 2012 to August 2013. Further, the price of fuel in the country has gone up by 252.4% in petrol and up by 272.2% in diesel since Jan 2004.

- The Rand has been depreciating against major currencies for some time but has come under immense pressure in July/August, with the Rand experiencing a new 4 year low against the Dollar.

- The rand will remain on the back-foot until global prospects brighten and commodity prices turn. It remains vulnerable as well to any flare-up in anxieties around any risks of labour unrest and electrical supply concerns.

- Standard Bank Research is of the opinion that the Rand will average R10 to the Dollar in Q3:13 and appreciate in Q4:13 to average R9.75.

- The unemployment rate increased to 25.6% in Q2:13 from 25.2% in Q1:13. The highest unemployment rate was recorded in Q2:11, at 25.7%.

Comments on Vehicle Sales Outlook:

- Vehicle sales volumes may still be boosted by the following factors:

- The Prime Interest Rate remains at its lowest for over three decades, and continues to play a major part maintaining the South African consumer’s appetite for debt.

- Vehicle Price Inflation for Q2:2013 has so far remained below CPI.

- However, the Rand has been under pressure against all major currencies, and this will have a negative knock-on effect on Vehicle Price Inflation (VPI).

- VPI on New Cars has increased Quarter on Quarter to 3.0% compared to the 2.4% in Q1:13.

- In contrast VPI for Used Car prices has decreased to -2.5% from -1.4% in Q1 of 2013.

- The industry is currently still experiencing the impact of the replacement cycle. This refers to the vehicle purchasing cycle. The cycle is approximately 5 years. 2007 was a massive year in the industry with 623,850 new vehicles financed.

- At the end of a 5 year term most maintenance/service plans have come to an end and consumers risk large cash outlays in the event of damage to their cars. Thus in light of that, and with intentions of recouping some value from a depreciating asset consumers tend to purchase newer more cost effective vehicles.

- 2013 is the proverbial end of cycle and we are currently seeing the market grow but this will slow down towards the end of the second half of the year.

- The following factors are expected to provide subduing effects on vehicle sales numbers:

- The expected low GDP growth. On 18 July 2013 the Monetary Policy Committee (MPC) revised down its annual GDP growth forecast for 2013 from 2.4% to 2.0%.

- The labour disputes that have halted production in the motor industry will have an impact on stock levels in months to come, both for local consumption and exports.

- Potential labour disputes in the retail motor industry which may impact sales activity directly.

- The volatility in the exchange rate will increases food, energy and transport costs and will have a negative impact on consumer disposable income.

- Household Debt to Disposal Income remains high at 75.8% (Q4 of 2012 latest available update).

- The number of consumers with impaired records increased by 189,000 to 9.53 mil leaving only 52,5% consumers in good standing.

- On the commercial front we note the pressure that the mining sector and construction industry are facing.

- Mining production which accounts for 4.9% of GDP saw growth fall by -5.6% q/q in Q2:13 from positive 14.6% q/q growth in Q1:13.

- With the expected strikes set to get underway from the beginning of September, the softer pricing of commodities and increases in electricity costs could constrain the mining industry for the rest of 2013.

- The mining sector, which carried the sales of yellow metal, has been under stress since mid-2012. Three out of the last four quarters have provided negative growth in this industry (-12.7% Q3:12; -9.3% Q4:12; 14.6% Q1:13).

- The construction industry saw meager growth q/q at 1.2% Q2:13, this was up from Q1:13’s 0.9%. With the government‘s R800bn infrastructural development plans not being implemented with any vigor the industry will have limited room to grow.

Standard Bank Application Stats:

- For the period January to July 2013 Standard Bank experienced positive growth of 20.8% in applications compared to the same period in 2012.

- The average contract term has increased for 4 consecutive years (including 2013). This has occurred at a time when interest rates are a four decade low. The current average contract term is 56 months.

- The consumer’s average monthly financed amount has increased at an average by 14.7% in 2013, when compared to 2007’s average monthly instalment. This has been driven by the average ticket price (deal size) increasing by 19.1% since 2007.

- Applications with RVs requested remained flat month on month June to July 2013 at 14.6%. With consecutive month on month growth achieved from January 2013 to June 2013.

- Applications with deposits requested represent 29.7% of all applications. This figure has been dropping since April 2013.

[ Comments from Sydney Soundy, Head of Vehicle and Asset Finance at Standard Bank]