NAAMSA New Vehicle Sales Report for October 2012 – All you need to know!

We would like to share some important insights and comments on the NAAMSA New Vehicle Sales Report for October 2012 as prepared by Sydney Soundy, Head of Vehicle and Asset Finance at Standard Bank:

General Macro and Industry comments:

- The year to date inflation is at 5.5%. Standard Bank’s economic desk forecast the inflation rate to stay flat through 2013.

- GDP growth for Q2 2012 was 3.2%.

- New vehicle prices have grown at lower level than real income growth.

- The 50 basis points repo rate reduction in July 2012 was meant to provide a boost to the South African economy. The prime rate is at its lowest for over thirty years, and has played a major part in increased take up of debt by consumers.

- Household debt to disposable income ratio has increased to around 76.3% in Q2.

- The number of consumers with impaired credit records remains relatively very high, making up 47% of the total credit active consumer base.

- The increased fuel prices have impacted on the running costs of vehicles. Fuel prices have risen by 42.2% in petrol (inland) and 44.5% in diesel (inland) since Jan 2011 (Jan 2011 to Oct 2012). Further, the price of fuel in the country has gone up 63.3% in petrol (inland) and 56.2% diesel (inland) since 2008. (Reference: Statistics from the Department of Energy).

General comments from NAAMSA:

- Despite a lower economic growth environment, there are a number of factors that continued to support domestic sales. These include historically low interest rates, ongoing improvement in vehicle affordability in real terms and higher demand for credit by households.

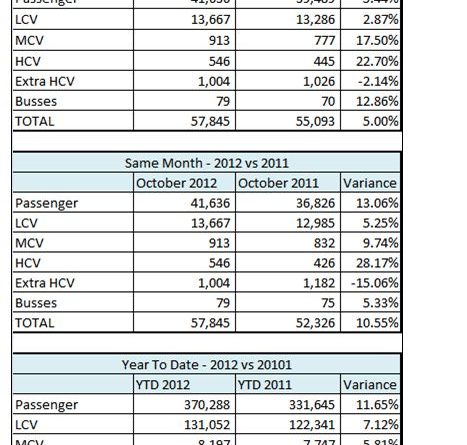

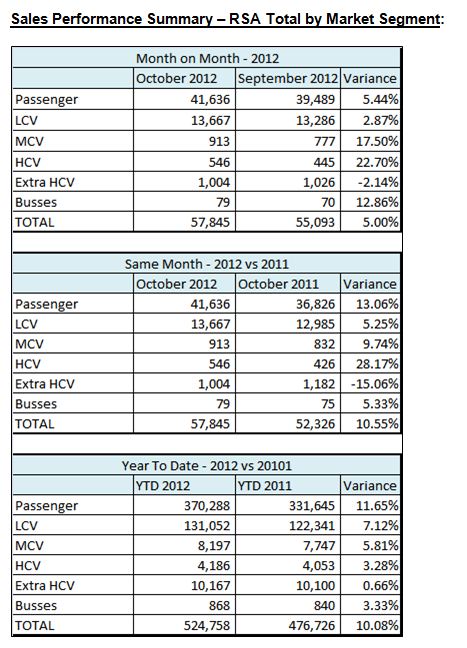

- The year to date growth in total vehicle sales of 10.1% is in line with growth expectations for 2012. Passenger and Light Commercial Vehicles are the main volume drivers of growth, at 11.65% and 7.12% respectively.

- The increased sales volumes in October compared to September (of 5%) were driven by higher percentage growth in the Medium and Heavy Commercial Vehicle categories, at 17.5% and 22.7% respectively.

- Comparing growth in Diesel, Hybrid Petrol and Petrol vehicles sold up to September 2012, there has been significant percentage growth in the first two categories of 11.4% deals and 19.7% respectively, while Petrol has grown by 7%.

- There are no significant differences in growth between vehicles of different engine sizes. However, a shift towards affordable vehicles is evident based on sales volumes in different price categories.

-

- There are competitively priced, high specification and quality vehicles available to the buyer in certain categories – this can be one of the factors that are driving the growth in all engine sizes.

Comments on Standard Bank, Market Share and general Retail Vehicle Finance sales, and related trends:

- The ratio of Used to New vehicles financed by SBSA is lower than the general market – a reflection of the recent historical focus of the bank on the existing Standard Bank customers, as well as greater focus on the franchised dealer network.

- The average contract term increased from approximately 57.5 months in October 2011 to 58.5 months in October 2012. The passenger category showed growth from approximately 61 months to 62 months for the same period.

- The average loan (financed amount) per deal increased to R313,124 from R288,585 last year.

Some statistics on applications for YTD September:

- Longer term periods (>60 months) remain very popular, particularly from personal/individual consumers.

- There is a small increase in the percentage of customers that request residual values. The demand for residual values remains at a fairly low level.

- In September Standard Banks ratio of New to Used vehicle application sat at 0.63 new to 1 used.

- Standard Bank stats for September 2012:

- Applications received and scored with Finance term > 60 months = 49.5% (August was 49%).

- Applications received and scored with No Deposit = 65% (August was 64.1%).

- Applications received and scored with Residual Value requested = 12.3% (August was 12%).

Census 2011 Motor Car Statistics

The 2011 Census statistics have been released by Stats SA and have provided some interesting facts relating to vehicle ownership.

Although Africans make up 79.2% of the population African households make up 49.5% of all households that own motor cars. Whites on the other hand make up 8.9% of the population but contribute 34.4% of households with cars.

Prepared by: Sydney Soundy