New smartphone driving app set to rev up driving standards in South Africa

With the aim to create a nation of great drivers, Discovery Insure has released a new smartphone application that scientifically measures and incentivises driving behaviour. The Discovery Insure app is a global first in combining mobile technology and behavioural economics to create better drivers and improve road safety. It is available as a free download from the App Store or Google Play Store – for both Discovery Insure and non-Discovery Insure clients.

With the aim to create a nation of great drivers, Discovery Insure has released a new smartphone application that scientifically measures and incentivises driving behaviour. The Discovery Insure app is a global first in combining mobile technology and behavioural economics to create better drivers and improve road safety. It is available as a free download from the App Store or Google Play Store – for both Discovery Insure and non-Discovery Insure clients.

“When people think of the relationship between smartphones and driving, their first thought is often negative. We want to change this perception by demonstrating that smartphone telematics can be a powerful tool to improve driver behaviour and road safety,” says Anton Ossip, Chief Executive Officer of Discovery Insure.

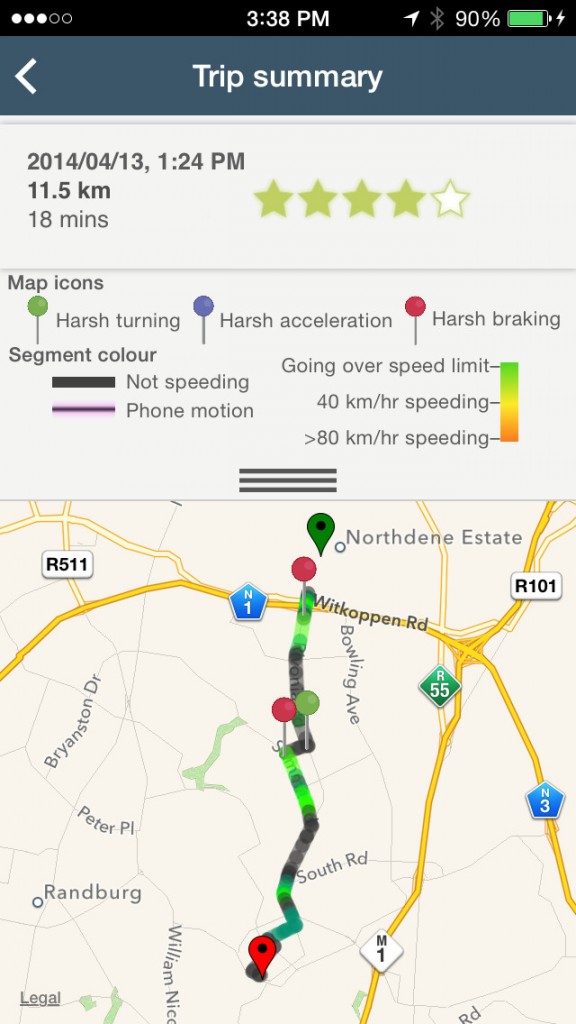

The Discovery Insure app uses a smartphone’s accelerometer and GPS to provide a driver with detailed driving information including harsh braking and cornering, distracted driving, speeding, personalised driving tips, and a leaderboard function that ranks a driver’s score against that of their friends as well as other drivers in South Africa.

The Discovery Insure smartphone app was designed in collaboration with experts in the field of mobile sensory analytics as well as Rory Byrne,Special Engineering Adviser to Discovery Insure and F1 Legend. With his extensive background in Formula 1 car design, Rory believes the strength of the smartphone app is its real-time analysis of driving patterns.

“In Formula 1 racing, immediate telematics data is crucial to both driver and team to enable real-time driving improvement as the car moves around the track. Similarly, the Discovery Insure smartphone app will provide the trip details while they are still fresh in the user’s mind, making it more likely for them to recall their risky driver behaviours and change them. In addition, we are also tapping into our competitive nature – it is not only F1 drivers that are competitive and we think the leaderboards will play a positive role in changing driver behaviour positively.”

Discovery Insure has also launched the Discovery Insure Driver Challenge – a challenge to South Africans to promote safer driving on our roads. The competition will run from 1 June 2014 until 31 August 2014. There are weekly draws for a share of a R1 million Rand in BP petrol vouchers and a once-in-a-lifetime trip for four to the Monaco Grand Prix.

In line with the UN General Assembly’s resolution to improve global road safety by 2020 and our national objective to turn the tide of over 13 000 deaths on South African roads each year, the Discovery Insure Driver Challenge offers an innovative means of encouraging better driving behaviour.

“Research shows that the main cause of car accidents and motor vehicle fatalities is driver behaviour with over 90% of accidents being caused by the driver. We encourage members of the public to download the app, drive well, and challenge their friends and family to take part in our Driver Challenge,” concludes Ossip.

For more on Car insurance and Insurance Telematics, also view the following:

Insurance Telematics and Road Safety

Insurance Telematics and Driver Behaviour Measurement with Ctrack

What is Insurance Telematics and how will it impact on car insurance?

Discovery information

About Discovery Limited

Discovery Limited is a South African-founded financial services organisation that operates in the healthcare, life assurance, short-term insurance, savings and investment products and wellness markets. Founded in 1992 by the current Group Chief Executive Officer Adrian Gore, Discovery was guided by a clear core purpose – to make people healthier and to enhance and protect their lives. Underpinning this core purpose is the belief that through innovation Discovery can be a powerful market disruptor.

The company, with headquarters in Johannesburg, South Africa, has expanded its operations globally and currently serves over seven million clients across South Africa, the United Kingdom, the United States, China and Singapore. Vitality, Discovery’s wellness programme, is the world’s largest scientific, incentive-based wellness solution for individuals and corporates. The global Vitality membership base now exceeds 5.5 million lives in five markets.

Discovery is an authorised financial services provider. It trades on the Johannesburg Securities Exchange under the code “DSY”.

Follow us on Twitter @Discovery_SA

Discovery Insure

Discovery Insure was launched in May 2011.

·This pioneering product was created by leveraging the behavioural expertise developed in the Vitality programme with the latest telematics technology.

·The unique Vitalitydrive programme encourages and rewards better driving behaviour and ensuring that vehicles are roadworthy.

·At the heart of Vitalitydrive is the DQ-Track telematics device that measures and reports crucial aspects of driving behaviour.

·Drivers on the higher driver status have 34% fewer claims than average or poor drivers (as measured by Vitalitydrive).

·Vitalitydrive provides up to 50% fuel rewards on clients’ monthly BP fuel spend.

·Young adults between 18 and 25 can receive further discounts of up to 25% on their motor premiums.

·Discovery Insure offers comprehensive vehicle, personal and household cover.

·Discovery Insure was voted second in the Short-term Insurance (Consumer Category) at the 2013 Sunday Times Top Brands Awards.