Online fleet card transaction authorisation brings significant savings for fleet operators, says Standard Bank

December is a time when major road routes across the country usually are at their busiest, and historically creating opportunities for potential abuse of fleet cards. But, thanks to technology, the chances for illicit transacting are being successfully whittled away, says Standard Bank.

Dr David Molapo, head of fleet management at Standard Bank, says that in December 2013, Standard Bank fleet customers were saved an estimated R17.0 million in potential losses through the bank’s online authorisation system, which scanned and declined questionable transactions at filling stations and outlets across the nation.

“During this holiday period, traditionally people use the cover of increased activity on holiday routes and at crowded facilities to mask dubious forecourt transactions,” explains Dr Molapo.

”Last December marked a significant change in this trend. Prevention of irregular and unlawful card use during the month were the fifth lowest month recorded by the Standard Bank Fleet system during 2013.”

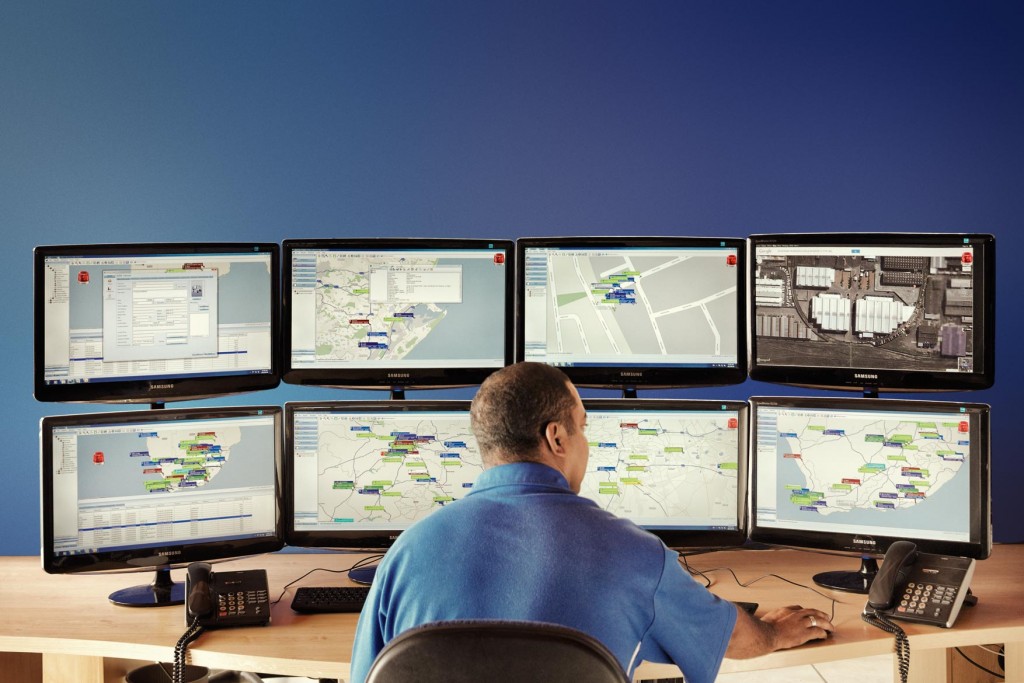

The key technology introduction that reduced potential losses is Standard Bank’s real time authorisation system that enables each card transaction to be validated and authorised at point of sale at all forecourts or workshop premises. This, coupled with electronic tools such as online access to the transaction authorisations system that is updated every minute and enables fleet operators to view all fleet transactions online.

“Where transactions appear to be out of the ordinary, fleet operators are phoned and alerted. They can then check the circumstances surrounding the transaction and either approve or decline it,” says Dr Molapo.

In 2012, transactions amounting to R257.6 million were blocked, often before fleet owners were even aware that attempts to use accounts illegally had been made. For 2013, this figure increased to R273.2 million of transactions were blocked. On consultation with clients on the blocked transactions, approval was only given for legitimate transactions amounting to some R41.0 million.

The remainder of the transactions was declined. Interestingly, this was mainly due to the improper use of fleet cards, with actual fraud (cloned or stolen cards) amounting to a mere 1.50% of the blocked transactions.

“Aberrations that were detected and ultimately declined included same day fill-ups within very short timeframes, exceeding the tank capacity of vehicles, and illicit use of lost or discontinued cards,” says Dr Molapo.

“For December 2013 specifically, of the total R17.0 million in transactions that were declined, only 2.06% were actually fraudulent. This was mainly due to cloned cards,” Dr Molapo says.

He says that opportunities for using cloned cards to make any sort of transaction are also being progressively shut down.

“A transaction will automatically be rejected if the card user is attempting to process a purchase that is not aligned with certain of the vehicle’s particulars recorded on our system. For example, if a driver is attempting to make tyre purchases with a card valid for fuel, oil and tolls only, the purchase will be declined.”

The benefits of increased technical vigilance have made fleet operators more aware of the challenges they face. It has seen control measures being introduced within companies, contributing further to increased security for fleet cards. “Drivers are more conscious of the manner in which they use the cards, reducing improper use and fraud levels even further,” says Dr Molapo.

“Additional improvements to the approval system are being introduced by Standard Bank Fleet Management to further enhance fleet management and security during 2014,” he concludes.