Quitting your smoking habit is good news for your health and your pocket with Altrisk

People start smoking for many personal reasons, however they continue for just one – addiction to nicotine. Regardless of whether you are a light or heavy smoker, a social or closet smoker, there is no denying that nicotine is a powerful, addictive substance that damages your health and your finances.

If you are a smoker and have life insurance, you probably already know that you pay substantially more for life insurance because of the higher risk of a claim compared to a non-smoker, but did you know that not all smokers are the same? Through detailed research into the risk of smoking and how related diseases result in claims, long-term risk product provider Altrisk, has developed another industry first with a premium rating approach to better rate each individual client.

With Altrisk’s new Proactive Risk offering, if your smoking habits, health and lifestyle attributes are associated with a reduced risk of death or disability, you can now get the benefit of this in your premium rate. By considering your unique circumstances and smoking habits, Altrisk is able to provide you with a quote that more accurately reflects your personal risks and give you the benefit of a discount upfront.

How does it work?

Altrisk is offering smokers a reduced rate on your risk cover premiums for a period of two years, with the proviso that you intend to quit smoking during this period. Notify Altrisk at policy application stage of your intention to quit, and you will immediately qualify for a discount on the premiums for selected benefits.

If you are smoke-free for a period of six months, you will qualify for non-smoker rates. If you remain a non-smoker for a further six-month period – in other words 12 consecutive months as a non-smoker – your non-smoker premium rates are guaranteed. The financial benefits are significant when one considers that non-smoker rates are on average 40%-50% less than smoker rates.

Altrisk will also arm you with the tools and support you need to ‘quit the killer’ for good including an online app available on Google Play and Apple store, an Allen Carr discount voucher, and daily motivations via Facebook and Twitter to keep you on track.

“Smoking has a significant effect on risk insurance and the premiums that you will pay. The reality is that the health and financial burden of smoking is a lot more extensive than most people realise, and there’s growing evidence to show that the effects of smoking on health may soon mean that smokers will be paying even higher rates for cover compared to non-smokers in future.

“Smoking is proven to be the greatest avoidable cause of premature death and disability in the world. Stopping smoking, regardless of how long you have smoked for and how many, is one of the best things you can do for your health and finances,” says Ryan Chegwidden, Executive Head: Product and Technical at Altrisk.

Quitting the killer is a life-changing decision that almost every smoker wants to do. The categorisation of smoking as a ‘bad habit’ underplays the very powerful hold that nicotine addiction presents – no less than alcohol, heroin or cocaine – making it a difficult addiction to quit, but one that can be overcome with the right support and motivation.

“From a financial planning perspective, quitting smoking will put a lot more money back in your pocket to afford you better levels of insurance cover. You may only think about the money you save on your daily fix after quitting, but the financial considerations are far more significant,” adds Ryan.

Consider this illustrative model demonstrating current cost of cover for smokers versus Proactive Risk smokers:

For a female, age 40, with a three year tertiary qualification:

| Risk benefit | Benefit amount | Current Non-smoker Premium | Current Smoker Premium | Proactive Best Smoker Premium |

| Life cover | R1 000 000.00 | 204.82 | 414.29 | 316.93 |

| Disability (own occupation) | R1 000 000.00 | 171.99 | 273.76 | 229.75 |

| Total monthly premium | 376.81 | 688.05 | 546.68 | |

| Price difference: | Smoker pays 83% more per month for the same amount of cover | -141.37 |

Altrisk’s new Proactive Smoker offering in a nutshell:

- It gives you an immediate benefit of a discount on smoker rates purely on your intention to quit smoking.

- Provides you with access to tools to successfully quit smoking.

- It recognises the differences in risk of different smokers.

- The quit smoking discount is provided for two years from the commencement of the policy.

- Once you have quit smoking for 6 months you can benefit from non-smoker rates.

- Non-smoker rates are guaranteed once you have remained smoke free for a further consecutive six months. (i.e. guaranteed after 12 months of non-smoking).

- If you resume smoking after 6 months and before 12 months the premium will be increased from that of a non-smoker to smoker but you will retain any lifestyle adjustments provided on the policy.

- The discount for the intention to quit smoking is available only once per client.

- If you do not quit smoking before the 1st policy anniversary, half of the 10% quit smoking discount is forfeited.

- If you do not quit smoking before the 2nd policy anniversary, the remaining half of the 10% quit smoking discount is forfeited.

Some financial considerations you should consider:

- Smokers pay around 80% more than a non–smoker for the same amount of cover. Any other existing health conditions, family history and advancing age will elevate this loading even more.

- Smoking has a significant and direct impact on the affordability of insurance cover. As a direct result of the higher cost of risk insurance for smokers, they tend to under insure on their cover, which compromises their financial security and that of their loved ones too should anything happen to them. In other words, instead of being able to afford R5 million in life cover which would cost a non-smoker say R500, a smoker can only get R3 million of life cover for the same R500 premium.

- The higher cost of risk insurance for smokers and the impact on affordability applies across all forms of cover including life, critical illness, disability and income protection. So if you have benefits, the extra cost or lack of cover will be multiplied across all these policies which add up to a significant amount of money.

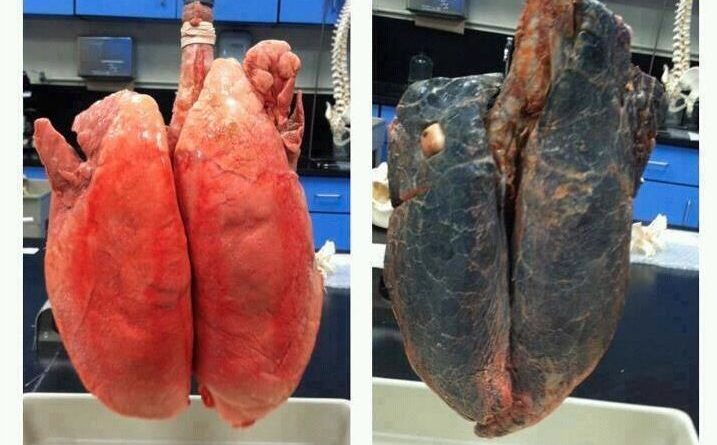

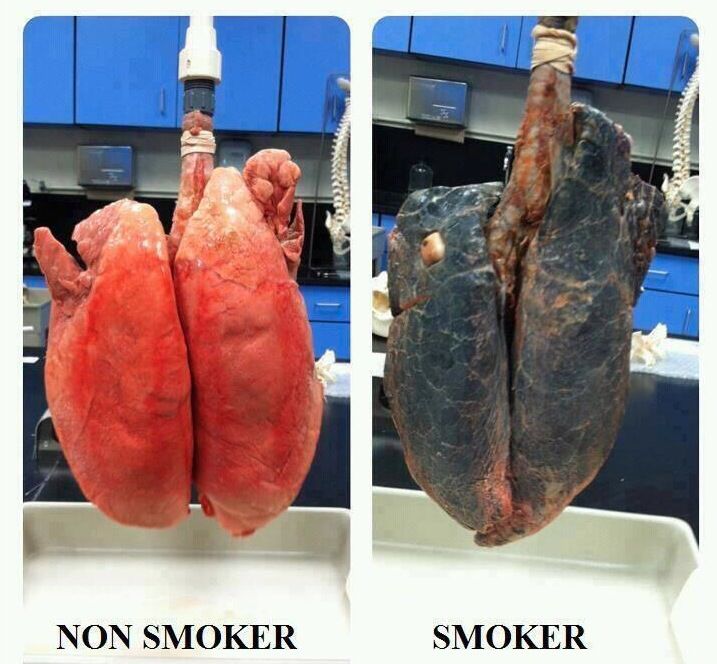

- Smokers do get sick more often and will die sooner than non-smokers, most often from specific smoking-related diseases such as cancer or cardio-vascular disease.

- The risks of smoking increase as you get older. This has implications for your financial planning and the cost of your cover in your older years, when your income is likely to be reducing. Cover for smokers will become less affordable as you age, which is the time that you need it most.

Interesting South African ‘smoker’ statistics:

- 44 000 people die from smoking each year in South Africa.

- In South Africa, around 30 million cigarettes are smoked each year by 7.7 million adults, of which men are the main consumers, although there is growing evidence of the increase in smoking among women and more alarmingly, younger children.

- Three men die for every one woman as a direct result of smoking.

- Every time you smoke a cigarette you inhale up to 4 000 different chemicals, all toxic substances that cause cancer and heart disease. One of the most toxic substances is the alkaloid produced to chemically defend the tobacco plant from insects.

- Quit before you’re 50 and halve your risk of dying prematurely

- After quitting for more than a year, your relative risk is exactly halved. After 10 years, your risks are virtually the same as someone who has never smoked.

- The health benefits of quitting begin immediately and the sooner you quit, the greater the health benefits and your life expectancy.

“Our analysis and understanding of smoker claims risk has allowed Altrisk to create a rating model for Smokers in the Proactive range. Smokers will potentially benefit from significantly lower premium rates from Altrisk after they quit smoking, smoking habits, health and lifestyle adjustments have been applied. If you kick your habit you get to enjoy non-smoker premium rates and the even greater benefits of your renewed health,” concludes Ryan.

Talk to your financial advisor about Altrisk’s Proactive Smoker benefit and for more information go to www.altrisk.co.za