Growing cost of cancer treatment makes a well-rounded financial plan essential

The risk of developing a serious illness like cancer has increased with the rise in stress, obesity, inactive lifestyles and pollution, among other contributing factors.

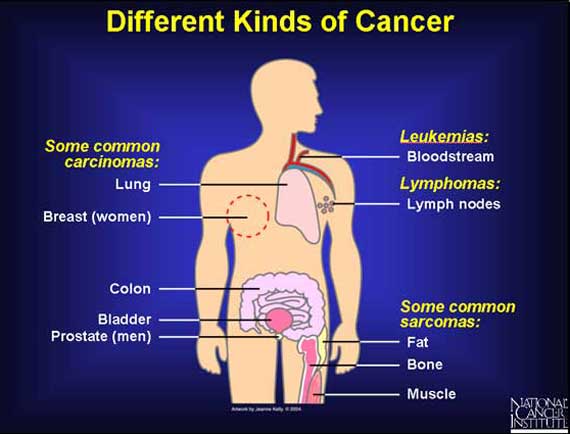

According to National Health Laboratory statistics, Breast cancer will affect 1 in 29 South African women in their lifetimes. This figure is even higher in urban communities in South Africa, where the incidence of breast cancer is as high as 1 in 8. Prostate cancer is the most commonly diagnosed cancer in men with 1 in 23 men being diagnosed in their lifetime. On average, five men will die from prostate cancer in SA every day, despite it being one of the more curable cancers if diagnosed and treated early.

With the focus on breast cancer and prostate cancer during October and November, Hollard Life stresses the importance of having the right insurance in place to protect your financial, physical and emotional security if you were to face a cancer diagnosis.

One of the scariest things about cancer is that it often develops without any noticeable symptoms in the early stages. “It’s one of the reasons why there is such an emphasis on pre-emptive screening and routine health checks – whether you have symptoms or not – in order to stay healthy and beat cancer,” says Hayley Taylor, head of underwriting at Hollard Life.

“Being diagnosed with cancer is devastating but the good news is with early detection and treatment, more and more people are surviving. In the life insurance industry, cancer accounts for the majority of critical illness claims. Surviving cancer is no less harrowing than it was years ago, however the cost of cancer treatment has grown considerably. The importance of pre-emptive screening as well as early diagnosis and treatment can’t be emphasised enough in the fight against cancer. But this has to be backed up by a solid financial plan that goes beyond medical aid to protect your income while allowing you to prepare for any lifestyle changes and afford the best possible treatment. Beating cancer comes at a huge cost – emotionally, physically and most definitely financially,” explains Hayley.

What does cancer really cost?

Cancer remains a highly emotive illness that has far reaching implications for both patient and family. Those fighting the disease can often face punishing treatment that makes it difficult or even impossible to work and earn an income. Added to this, the cost of cancer treatment can be enormous and medical aid alone simply isn’t enough anymore.

In an article published in Daily Maverick (June 2016), Dr Ernst Marais, Chief Operating Officer of ISIMO, an umbrella organisation that oversees the Independent Clinical Oncology Network (ICON), says that because of its high incidence, breast cancer treatment carries the biggest price ticket in South Africa at the moment. Costs are determined by the incidence of a specific cancer as well as the treatment used and can vary from a few thousand Rand to R800k per case. Certain blood, skin and kidney cancers can cost upwards of R1million to treat. Herceptin, the treatment of choice of certain aggressive breast cancers is a biological and costs up to R25k per dose, with some patients requiring up to 16 treatments amounting to R400k.

In the face of the spiralling cost of treatment for illnesses like cancer, many medical schemes place limits on oncology benefits and exclude expensive, advanced treatments such as biologicals. This means that a lot of people that are diagnosed with cancer suddenly find themselves having to self-fund some of their treatment, not to mention the other unexpected costs of recovery.

“The cost of rehabilitation during remission goes far beyond medical treatment. There’s also the loss of income while you’re unable to work, shortfalls between medical aid rates and specialist fees as well as any lifestyle changes you need to make as a result. What happens if you’re not in the all clear after your treatment is complete and you’ve reached the limit of your medical aid’s oncology benefits? What happens if you don’t respond to traditional radiation and chemotherapies and need biological treatment that isn’t covered by medical aid?” asks Hayley.

“The cost of rehabilitation during remission goes far beyond medical treatment. There’s also the loss of income while you’re unable to work, shortfalls between medical aid rates and specialist fees as well as any lifestyle changes you need to make as a result. What happens if you’re not in the all clear after your treatment is complete and you’ve reached the limit of your medical aid’s oncology benefits? What happens if you don’t respond to traditional radiation and chemotherapies and need biological treatment that isn’t covered by medical aid?” asks Hayley.

According to Hollard Life, the implications of a cancer diagnosis and treatment are wide-reaching, which is why it’s often the case study used to demonstrate the important interplay between traditional medical aid and other kinds of insurance like critical illness, disability, income protection and gap cover.

It is important to remember that critical illness and disability cover are not replacements for medical aid; but complimentary benefits in a well-structured healthcare portfolio. It requires an experienced eye to get the balance of benefits right – a role best undertaken with the help of an experienced financial planner.

Talk to your financial advisor

Being diagnosed with a serious illness like cancer can knock you off your feet – and knock your finances at the same time, which is why everyone should consider the need for a well-rounded financial plan. Medical aid is vital but it is simply not enough.

Being well covered with medical aid, critical illness and disability cover means that you can emerge from your illness not only with your health intact, but your finances too. A good financial plan ensures that you can afford your preferred treatment, the best technology available and the best post treatment options.

You will also be in a position to sustain your standard of living even if you are unable to earn an income,” concludes Hayley.