Climate change threatens the agriculture sector

Climate change threatens the agriculture sector

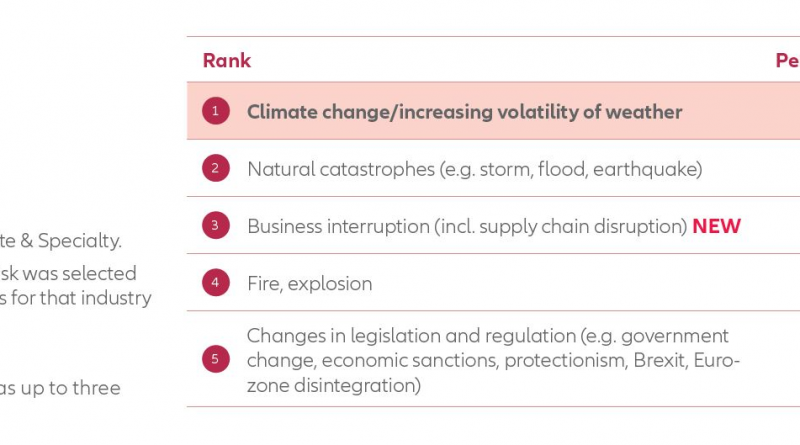

Climate change is the biggest concern in the agriculture sector

Business interruption is a new emerging risk for the sector

Natural catastrophe risks, although in second place have increased from 24% to 30%

Fire, explosion, and changes in legislation and regulation have declined as risks.

Johannesburg – March 15, 2018 – The Allianz Risk Barometer 2018 reveals that climate change or increasing volatility of weather is a top concern for agribusinesses with 60% of responses. Natural catastrophes at 46% are in at #2, down from #1 in 2017. Business interruption is a new emerging threat at #3 with 29%. Fire, explosion is #4 while changes in legislation and regulation is #5 at 21% – both threats have moved down from #3 in 2017. The report is published annually by Allianz Global Corporate & Specialty (AGCS), and is based on the insight of a record 1,911 risk experts from 80 countries.

Climate change or increasing volatility, natural catastrophes and fire, explosion are all risks that may result in business interruption, which is a major risk on its own. When a farm’s operation has been halted, often the complexity of ‘getting back to business’ is underestimated and can have bottlenecks in their emergency plans, particularly with regards to alternative suppliers. Changes in legislation and regulation such as the adopted motion for a constitutional review allowing for the expropriation of land without compensation may cause uncertainty for farmers in South Africa.

The report also pointed out that approximately USD330bn was lost from natural catastrophes, globally. Climate disruptions are increasing in volatility throughout the world, impacting many sectors and industries – agribusiness being – one of the hardest hit.

“The impact of natural catastrophes goes far beyond physical damage to structures in the affected areas. Natural disasters disrupt the normal dynamics of societal and industrial operations in the immediate regions affected and beyond, impacting a large variety of industries that might not seem affected at first glance,” says Ali Shahkarami, Head of Catastrophe Risk Research at AGCS.

When the statistics are narrowed to South Africa, the imminent losses are greater for small-scale farmers. Farming is a high-risk industry faced with uncontrollable threats like hailstorms, floods, disease outbreaks and drought. The risks in agriculture threaten the profitability and sustainability of the entire sector. Due to the drought, Western Cape wineries, which depend on stable soils and some level of climatological consistency to deliver a viable product, are faced with tough decisions around production and revenue. Moreover the drought has dramatically increased fire risks as seen with recent Knysna fires.

The severity of the drought is a nationwide threat on the entire value chain of agribusiness. Low rainfall in the Free State and the North West in the current season is presenting the country with potential maize shortages, which could increase the price of maize. The good news though is that the previous season produced a bumper harvest and as such the stocks of maize are expected to provide a buffer to the forecasted maize shortages. Other crops such as wheat, barley, soybeans and horticultural crops will also reduce in supply, which may force prices to go up and increase the impetus of price risk in the agricultural sector.

In order to keep up with rapidly-changing risk concentration, farmers can use a variety of new catastrophe management tools and insurance solutions to monitor storms and assess natural catastrophe damages from events such as those anticipated in 2018. Farmers can benefit from outdoor tools used to assess roof wind damages and inaccessible locations. Indoor tools can also be used to assess water damage in large facilities while satellite technology and 3D imagery is used to locate risks more quickly and more precisely.