BrightRock announces strong 2018 business performance

BrightRock’s 2018 performance features strong growth and bright opportunities

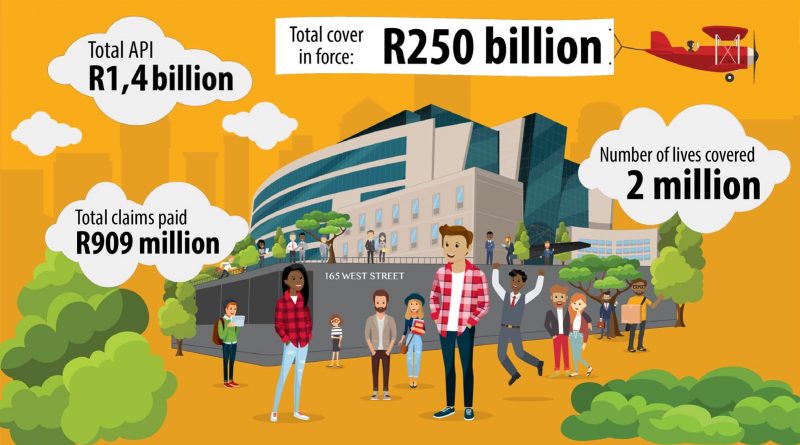

- BrightRock achieves strong new business growth, with total premium income increasing by 43% year on year

- Total cover in-force now exceeds R250 billion

- Total in-force annualised premium income grows to R1.4 billion, with activated annualised premium income for the year of R433 million

- Lives covered grows to over two million

- Total claims paid to date of R909 million

- Individual life business increases market share while group risk and life assistance offering

- gain traction

Following the recent annual results announcement by its majority shareholder, Sanlam, needs-matched life insurer BrightRock has released an update on its business performance across its multiple risk product lines. From a zero base at its product launch in March 2012, BrightRock has grown rapidly, increasing its market share to 12% of the market for large risk policies sold by independent financial advisers – making it the fourth largest provider in this market based on new business volumes.

During the 2018 financial year, BrightRock maintained its position as the fastest-growing provider in this segment, achieving strong organic growth. Total premium income across its businesses increased by 43% year on year and annualised premium income of R433 million was activated in 2018. This is despite tough market conditions – the category saw just a 12% increase in the number of risk policies sold between July 2017 and June 2018. With reporting season still underway, it is too early to provide definitive figures but indications are that many insurers have experienced single digit growth in risk policy sales and an increase in first-year risk policy lapses during 2018.

According to Schalk Malan, BrightRock CEO, a key driver of the company’s growth has been the increased uptake of its needs-matched offering by independent financial advisers (IFAs) operating in the upper income segment. The company currently has more than 4 200 accredited IFAs distributing its product nationwide. In particular, its permanent disability cover is making significant inroads in this market.

“We came to market just seven years ago with a fundamentally different product design that precisely matches client’s needs and adapts seamlessly to changes in their lives. It’s a client-centric

approach that creates a unique solution for each and every client.”

One of the major benefits of this structure, according to Malan, is its efficiency. “By shaping clients’ cover to match their changing needs over time, we are able to strip out unnecessary waste, which creates premium savings for clients. For example, when it comes to cover for their permanent expense needs, BrightRock clients get – on average – double the amount of disability cover for the same premium rand”, said Malan.

On the back of the growth of its individual life offering, 2018 saw the launch of BrightRock’s group risk offering. This was an important step – according to Malan – in the firm’s planned expansion into new markets. BrightRock currently operates in the individual life, life assistance, and group risk markets with ambitions to add new product lines to its offering in the medium to long term. The company’s recent move, necessitated by its rapid growth, from Parktown to its new head office in Sandton was another important step.

“Our ambition is to leverage the unique principles of our proprietary, needs-matched approach to build BrightRock into a financial services player of scale. Our new premises place us at the centre of South Africa’s financial district and offer us scalability and scope for growth”, said Malan. He also states that the business will be looking to grow its distribution footprint further in the near future, with the addition of new channels.

Besides growing traction in the SA market, BrightRock has garnered international attention in Germany, Australia and the USA. Most recently, in October, Malan was invited to speak at an international industry conference in New York, hosted by LIMRA, about how BrightRock has harnessed client-centric product design to innovate and create opportunity.

“It’s exciting to get that outsiders’ perspective. South Africa is hailed as the innovation leader in the international life insurance industry and BrightRock is gaining recognition as being at the forefront”, said Malan of his reception there.

Speaking of BrightRock’s growing presence in the financial services market, Malan also commented on the company’s positive relationship with its majority shareholder, Sanlam: “We’re privileged to have a great shareholder that supports our client-centric outlook and is supportive of our growth and future prospects.”

About BrightRock

BrightRock was established in 2011 with the goal of offering highly differentiated life insurance products to better meet clients’ and financial advisers’ needs. Since entering the South African intermediated individual risk market in April 2012 with its proprietary needs-matched offering, the company has become one of the fastest growing players in its category.

BrightRock’s needs-matched life insurance cover is uniquely structured to match client’s life insurance needs very precisely at the outset and change as their needs change over time. In 2017, Sanlam acquired a majority stake in BrightRock.

BrightRock is headquartered in Johannesburg and Port Elizabeth with regional hubs in the major centres of Johannesburg, Pretoria, Durban, Bloemfontein and Cape Town, and a national distribution footprint through more than 4 200 independent financial advisers. BrightRock Life is an authorised financial services provider and registered insurer. (FSP 11643, Company Registration No: 1996/014618/06).