Yalu offers free media space to its rivals

A local financial services brand is giving free media space to its rivals, all in the name of consumer education and awareness…

Media space is a precious commodity, and most brands treasure it highly. It comes as a shock, then, to hear that financial services challenger brand Yalu is offering free media space to other Credit Life Insurance providers – despite the start-up’s limited marketing budget. To make matters even more intriguing, Yalu is offering the space to its direct rivals… South Africa’s banks.

“Yes, it is a bit shocking, but we have good reasons,’’ says Nkazi Sokhulu, co-founder and Chief Executive Officer at Yalu. “Yalu as a brand is really pushing transparency and consumer awareness in the Credit Life Insurance category, which has, up until very recently, been unknown in the market. This offering is an extension of that effort.”

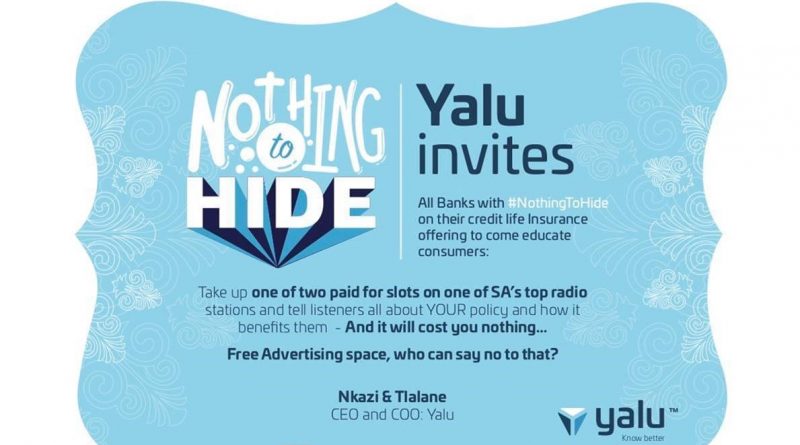

Yalu’s recent #NothingToHide campaign has sent a clear message to the market that it is time financial service providers were completely transparent about their product structures and pricing. The campaign has already got industry tongues wagging – and the free media space offer is bound to add to the buzz.

“There is a small element of buzz, of course, but Yalu’s big drive is consumer education and awareness,” says Sokhulu. “Our intention is to open up the transparency conversation across South Africa. Offering financial services brands a platform to discuss their offerings and approach to pricing, especially when it comes to obscure products like Credit Life Insurance, is a great way to do this.”

Credit Life Insurance covers borrowers against their debt in the case of retrenchment, death or disability. This type of insurance is often (but not always) legally required for certain types of debt and is generally provided by the same financial institution offering the loan. Every South African has the right to choose their Credit Life Insurance provider, and the fees charged for these policies can vary dramatically. Very often, however, consumers are unaware they even have the product, which puts them at risk of paying the maximum possible amount in monthly fees.

Yalu offers a seamless five-minute online process that allows consumers to consolidate their different Credit Life Insurance policies, saving considerably on monthly payments. The brand entered the market in 2018 and made an immediate impact.

Yalu offers a seamless five-minute online process that allows consumers to consolidate their different Credit Life Insurance policies, saving considerably on monthly payments. The brand entered the market in 2018 and made an immediate impact.

“Our progress has shown there’s a strong business model in giving consumers the chance to optimise their monthly payments in these kinds of areas,” says Sokhulu. “But since our launch it has also become very clear that far too many South Africans are oblivious to the fine details of their loan packages. We believe it’s the responsibility of all brands operating in this sector to improve awareness and education levels. If we get it right as a sector, the whole country will benefit.”

Yalu’s offer of its media space to rivals has no conditions, other than that the participating brands must focus their use of the space on Credit Life Insurance. The media space is in the form of a 3 – 5 minute conversation on one of South Africa’s prominent radio stations; the date and time contingent on when financial services brands respond to the offer.

“We’re looking forward to getting going,” concludes Sokhulu. “It will be fascinating to see which of South Africa’s well entrenched financial services brands are willing to take up the transparency challenge!’’