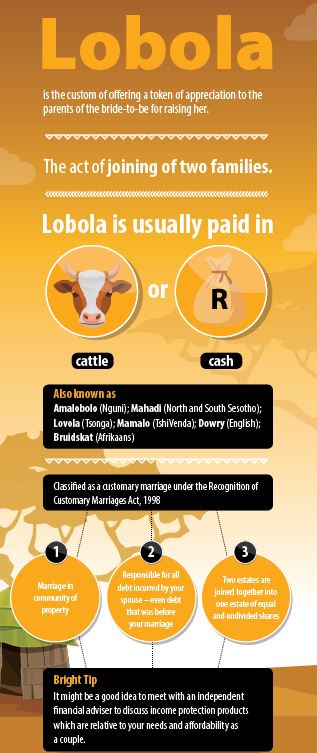

A few cows later … and now you’re married

The beginning of lobola negotiations is a time for the celebration of a matrimonial coupling, a time to focus on love and family. But when the excitement of the celebrations has worn off, you’ll want to start planning for your and your partner’s future. Once the traditional lobola processes have all been followed, you can consider yourself married – not just in the community’s eyes, but in the eyes of the law. Lobola means that you and your partner have entered into a customary marriage, automatically considered to be in community of property. This means that you and your partner have an equal share in the assets, money and property that you both own. It also means that you’re liable for each other’s debts. Here are a few things to consider:

- Being honest about needs and responsibilities

Having an honest money conversation with your significant other can be difficult but it’s vital. In the current recessionary environment, more and more couples are finding themselves financially stretched. So you’ll need to lay all of the facts about your mutual finances on the table – how much you own, how much you owe and what your current and future financial concerns are. Your insurance needs are an equally important topic to cover. As grim as it might be, it’s a good idea to discuss your financial needs and responsibilities in the event of you or your spouse suffering a debilitating illness, injury or dying. This will enable you to ensure that your needs are covered in the event of any unforeseen or unexpected life-changing events.

- Coupling up, moving in and accrual of assets

At the start of your lives together, your insurance should cover income-related needs – debt, household expenses and healthcare costs. Although you might both be working full time, your both earning incomes that cover the household which might be split between covering car finance or the bond on a new house. There might even be debts, like paying off the cost of your wedding reception or study loans. That’s why you need to consider a policy covering the loss of income, as well as considering additional cover to settle these debts with a lump-sum payment.

When insuring yourselves against this risk, you could look into various scenarios, such as cover for the period that you can “self-insure” as a couple, and if you can afford to cover the full income, or plan to reduce expenditure in the event of an illness or injury.

Remember, the need to provide for basic household expenses and healthcare costs is a life-long one. The decision whether to protect income until retirement age or death will therefore depend on how much you’ve provided for your retirement.

- Your lives will change, so should your insurance

It’s important that a young couple understands that they’re likely to have many more financial obligations in the future. On average, salaried South Africans finance a new car every three years to five years and many new parents will upgrade to a family home once children arrive. So it’s important to check that your insurance policy is flexible and able to change as your life changes.

- Sustainable affordability

Given the high levels of debt and growing financial assets at the newlywed-stage of marriage, affordability of cover is an important consideration too. While cheaper premiums upfront may be attractive, you need to be sure that they’ve not been achieved at the expense of future sustainability. If you’re jointly repaying a bond, you might need to ensure that you have cover on both lives, because your combined debt could be called in on either partner’s death.

- Safeguarding your family’s future

If you have people who depend on you financially, it’s important to determine which partner is primarily responsible for providing for your children and any other dependants, ensuring that you’ve made enough provision should either partner suffer a loss of income.

The traditions of lobola are beautiful and represent the first of many big change moments you’ll share during your life together. Your life cover should be able to adjust and change as your financial responsibilities change. So make a date to talk money and ask your financial adviser for protection that meets your needs today, and can change with you over the years.

Advice on Preventing crashes into Animals On The Road https://t.co/pemfxyM3Ga #ArriveAlive #Animals #Wildlife@TheEWT @SANParks pic.twitter.com/ynyCqN2EQ1

— Arrive Alive (@_ArriveAlive) July 30, 2019