Euler Hermes Global Insolvency Index: Insolvencies expected to rise by 4% in South Africa

- The upward trend in business insolvencies continued in 2019 for the third time in a row: +9% year on year, according to Euler Hermes Global Insolvency Index, which covers 44 countries that account for 87% of global GDP

- This year, business failures will rise again for the fourth consecutive year: +6% year on year

- Asia will be the key contributor to the rise in insolvencies, while Western Europe will see an increase in most countries. USA and Canada have shown increases for the first time in many years in 2019 and we expect +4% and +5% respectively in 2020

- Low growth in South Africa has driven a deterioration in payment behavior with business insolvencies up by +6% in 2019 and expected to increase by +4% in 2020

- Failures of large companies – those with over EUR50mn of turnover – remain at a persistent and worrying high level.

Johannesburg, Paris, February 5, 2020 – Global bankruptcies are still on the rise, implying higher export risks: this is the conclusion of the latest Global Insolvency Report by Euler Hermes, which covers 44 countries and 87% of global GDP and provides the latest update of its Global Insolvency Index. Business insolvencies increased by +9% in 2019, mainly due to a prolonged surge in China (+20%) and, to a lesser extent, a trend reversal in Western Europe (+2%) and North America (+3%).

Continuing economic weakness, political and social uncertainties

Euler Hermes’ experts believe this worrying trend is due to the combination of a low-for-longer pace of economic momentum, notably in advanced economies, in the industrial sector, and the lagging effects of trade disputes, political uncertainties and social tensions. In 2020, even if monetary policies should remain supportive, it will not be enough to counterbalance softer demand, tougher price competition and an increase in production costs, notably wages.

Export risks are on the rise almost everywhere

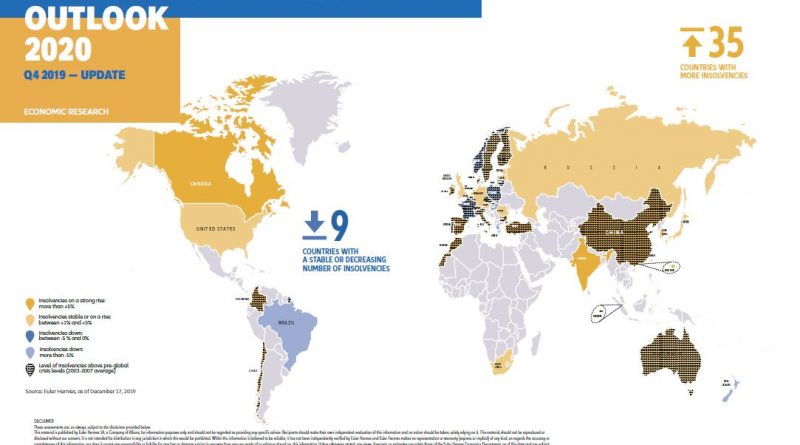

As a result, insolvencies should rise again by +6% globally this year for the fourth time in a row, with Asia still as the key contributor (+8% y/y) notably due to China (+10%) and India (+11%). In Western Europe, economic growth will remain below the historical threshold which usually stabilizes the number of insolvencies (+1.7%), leading to an increase in most countries. All in all, four out of five countries will post a rise in insolvencies in 2020, with Brazil (-3% y/y) and France (0%) as the key exceptions. In 2019, the overall increase was higher, but only two out of three countries were impacted by rising insolvencies. This means that export risks are on the rise almost everywhere: there is hardly a safe haven anymore.

Protracted growth slowdown in South Africa

South Africa is expected to experience a protracted growth slowdown (0% in 2020 and +0.7% in 2021). 2021 will mark the fourth consecutive year of below 1% real GDP growth. Domestic demand is unlikely to sustain growth, in a context of a high tax burden, a 30% rate of unemployment as well as downward pressures on wages. Low growth has driven a deterioration in payment behavior with business insolvencies up by +6% in 2019 and expected to increase by +4% in 2020.

Debt likely to increase to 62.5% of GDP

On the fiscal side, debt is likely to increase to 62.5% of GDP in 2020 with a current fiscal deficit of -5.9% in 2019, leaving limited room for maneuver for more fiscal stimulus. Opportunities for the economy could have emerged from the country’s rich assets in commodities but the lack of reforms is most likely to prevent the country from reaping the benefits of exportations in this sector. In addition, the lack of investments in structural infrastructural vulnerabilities, especially reflected by long-lasting electricity cuts happening this year, combined with increasing uncertainty on property rights, have led to investments outflows from the country.

Serious domino effects of major insolvencies

The number of major insolvencies from Q1 to Q3 2019 remained relatively stable year-on-year (249 major insolvencies) but their severity worsened in terms of cumulative turnover (+EUR39.1bn to EUR145.2bn), which could have serious domino effects on providers along supply chains. The greater the turnover of the bankruptcy candidates, the greater the damage to individual suppliers. The hot spots were construction in Asia, energy and retail in North America, and retail and services in Western Europe.

“Overall, this insolvency outlook calls for a close monitoring of trade disputes and other political and policy-related risks, as the level of economic volatility will be very high all along 2020. More selectivity and preventive credit management actions will be needed,” said Maxime Lemerle, Head of Sector and Insolvency Research at Euler Hermes.

Discover the full Global Insolvency Report here, and its corresponding map.

All data are also available in our Mind Your Receivables web application and our open data portal.