How Naked Insurance is helping clients – reducing CoverPause premiums

It’s been a crazy, overwhelming few days as we face up to the reality of Covid-19, and prepare for the lockdown announced by President Ramaphosa. It is also an opportunity for us to stand together as a community, and we at Naked are working hard to play our part. The whole country will be facing tough economic times in the months ahead, and looking for ways to save money. Inspired by our president’s speech on Monday, we knew we needed to find a way to help.

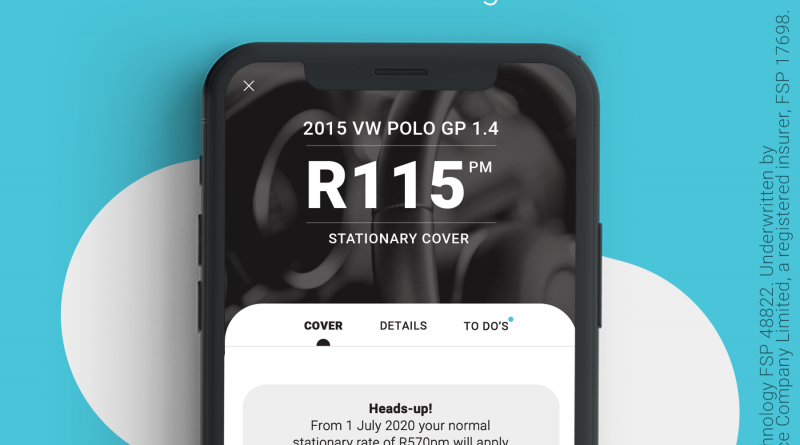

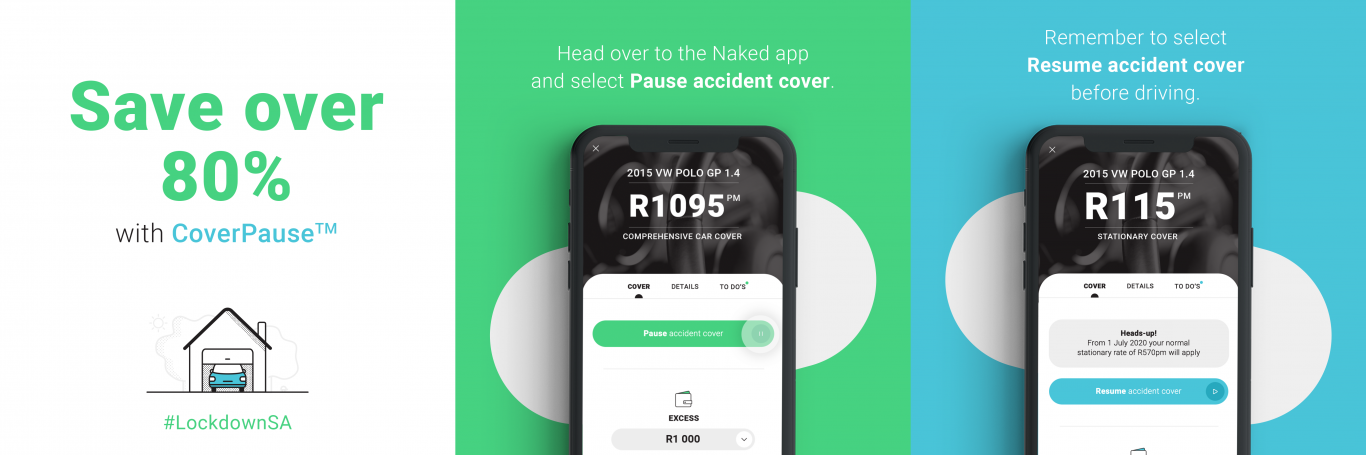

So from today, when you are on CoverPause™ you will only pay roughly 10% of your normal comprehensive premium. This should help ease the financial burden for many of us while our cars are not being driven.

We can do this because our actuaries have been taking a close look at how the severe restrictions placed on mobility affect a car’s exposure to theft and Mother Nature. They have concluded that the risk is considerably lower, and that during this period we can significantly reduce premiums on CoverPause™.

The plan is to return premiums back to normal by 1 July 2020 as we hope most cars will be back on the road by then. But we’ll keep you in the loop should anything change.

Heads-up… When you are on CoverPause™ your car will be fully covered for things that could go wrong while it is parked – but there’s no cover if it’s being driven. If your accident cover is paused, you should not drive at all. If you need to drive to get supplies just pop back onto the app and unpause your cover for that day.

Please just shout if you have any questions. Remember, we are online and ready to help. We hope you and your family stay safe.

Team Naked

#StrongerTogetherButApart

P.S. To activate CoverPause™ just pop onto the app, click on your car on the home page and press the ‘pause’ button. If you are already using CoverPause™, the premium reduction will be activated automatically.

Some questions you might have about CoverPause™

What is CoverPause™ and what am I covered for?

The Naked app allows you to pause the accident portion of your cover and downgrade to stationary cover on the days that you’re not driving. You can usually save up to 50% on your premium and still be covered for theft, fire, Mother Nature or anything else that can happen to your car while it is parked. Heads-up: if you have paused, you have no cover if you’re driving the car.

Simply unpause your cover when you want to start driving again. Click ‘resume accident cover’ and reactivate your comprehensive cover instantly. The billing and refunds happen in real time through your credit or debit card.

How much can I save under normal circumstances?

Under normal circumstances, the average saving is 45% on your monthly premium. Therefore, the premium you pay when you CoverPause™ is usually about 55% of your comprehensive monthly premium. The exact saving depends on your individual risk profile.

Example: John’s comprehensive premium is R1,000 per month. His CoverPause™ premium is R520. Under normal circumstances, for every day that Johan’s car is parked at home, he saves 48% on his comprehensive premium. This saving is applied pro rata to his monthly premium, for the number of days that he uses CoverPause™.

How much can I save during the COVID-19 pandemic?

From the 27th of March 2020 until at least 30 June 2020 we are reducing the premium you would normally pay for CoverPause™ by 80%. This means your car will still be covered while it is parked, but it will only cost you roughly 10% of your usual comprehensive car insurance premium.

Example continued: For days that John is not driving, his new monthly premium will be R104 applied pro rata. John is effectively paying 10.4% of his normal premium.

Why the increased saving during the Covid-19 pandemic?

Under normal circumstances, when you use CoverPause™, you will park your car and go on holiday or to work. This leaves your car exposed to significant risk of theft and Mother Nature, because you can’t move the car if there’s emerging danger. However, during the Covid-19 pandemic, most people who will use CoverPause™ will do so at their own home where you or your neighbours will be keeping an eye on it, which makes the average risk much lower. The chances of someone stealing your car, or the car being damaged by a flood or hail without you moving it, is much lower.

What if I need to stock-up on supplies?

No problem! If you pop out to the shops to stock up on groceries, just click the “resume accident cover” button on the app. Your comprehensive cover will then be activated immediately. Heads-up! 5 You will pay your comprehensive premium for that day, but only for that day. And remember to press the “pause” button again before midnight, because our billing cycle runs from midnight to midnight.

How much premium will you collect at the start of the month?

When our system collects your premium on your chosen collection date, it assumes your current level of cover (i.e. comprehensive or paused) will apply for the coming month. As such, if your cover is not paused on the collection date, we will collect the normal comprehensive premium and refund you when you pause your accident cover, during the month.

If your cover is paused on the day of your monthly collection, we will collect your paused premium for the full month. When you drive and click “resume accident cover,” our system will bill you for the rest of the month at normal rates. If you then pause again, you will get a refund for the remaining days, and so on.

How long will these reduced rates apply?

The reduced CoverPause™ rates will apply from 27 March 2020 to 30 June 2020 (or longer if the Covid-19 pandemic results in significant changes to how often people drive, and our actuaries’ calculations determine that we can afford to offer the lower rates). Once things start going back to normal, we will give you a 31-day heads-up before the prices go back to normal.

Is this like a payment holiday?

A payment holiday on a loan is simply an extension to make the loan longer. During the ‘holiday month’, you don’t have to pay an installment, but you are a still charged interest which you will eventually need to pay. Our Covid-19 CoverPause™ adjustment is not a delay or a payment holiday, it is a full discount during this period. You won’t have to pay it back later.

Safety and Roadworthiness of Vehicles in Long-Term Parking or Lockdown https://t.co/kIsNU6m4DN #ArriveAlive #VehicleMaintenance #Lockdown #ParkedCars pic.twitter.com/YeaxUP6uY6

— Arrive Alive (@_ArriveAlive) April 17, 2020