Survey shows COVID-19 inspiring innovation in South African short-term insurance sector

Results of a survey conducted amongst 1200 Old Mutual Insure (OMI) and Elite brokers provides rich data on just how significantly the COVID-19 crisis and, especially, the national lockdown has impacted the short-term insurance industry.

Of interest is a range of positive innovations that brokers believe lockdown is likely to leave in its wake. “These unexpected learnings are likely to benefit the industry long after lockdown is lifted,” said Christelle Colman, Managing Director of Elite Risk Acceptances.

Significantly, COVID-19 lockdown has bought home, now more than ever, the need to save. Black swan events like the current global pandemic illustrate, “that nothing can be taken for granted. The unforeseen is ever present. And the best preparation for the unforeseen is savings,” said Colman.

Survey results also indicate how COVID-19 lockdown has highlighted the need for both individuals and businesses to embrace change, especially technological change. Lockdown has forced many brokers and their clients to, “rapidly introduce technology and new ways-of-working that they had previously been dragging their feet on,” reported Colman.

Many of these rushed changes have improved efficiency and productivity.

“Utilising digital platforms saves time. Working from home has also reduced overheads in many instances,” reported Colman. Interestingly, only 13% of brokers faced challenges ‘keeping staff motivated and focused.’ In fact, much of the qualitative data pointed to staff preferring to work from home where they believed they were much more motivated and productive. This points to the, “possibility of remote working arrangements becoming more permanent – even after lockdown is lifted,” predicted Colman.

That said, 33% of brokers surveyed reported that ‘speed of doing business’ was a challenge in lockdown. 32% reported that ‘staying connected with clients or staff’ presented difficulties. 22% of brokers reported that they were struggling with claims response times.

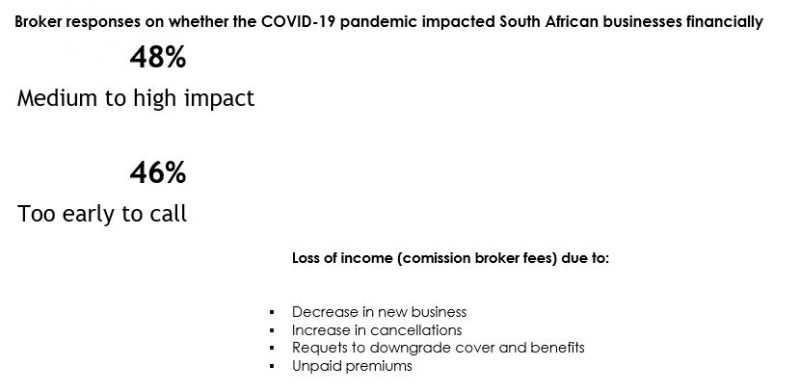

Nearly half of brokers polled (48%) reported that lockdown had had a medium to high negative financial impact on their business. Slightly less than half (46%), however, believed that it was too soon to tell how large a negative financial impact lockdown was having. Many brokers believed that the full impact of the crisis would only be visible once June collections were in. Most brokers, however, had already experienced various degrees of unpaid premiums and policy cancellations.

Brokers were, however, appreciative of the payment relief options provided by insurance companies like OMI and Elite. These relief measures appear to have been a great help to brokers and their clients.

The most common client concerns reported by brokers included: getting discounts on premiums, payment holidays, applicability of existing covers in lockdown, the impact of lockdown on the market, eroded investment values, and temporary policy cancellations. Brokers also reported that clients were anxious about when they would be able to meet with

their brokers as well as how long lockdown would continue before things returned to normal. There had also been a lot of requests for reduced covers.

Looking ahead

Looking ahead

Looking to the future, brokers were generally of the belief that the long-term impacts of COVID-19 lockdown would prove to be a mixed bag of positive and negative impacts.

On the positive front, brokers generally believed that the current crisis has led to the acceptance of doing business differently, normalised remote work, reduced the need for and cost of office space, increased the use and efficiency of virtual meetings, and promoted the use of digital platforms and social media. Lockdown has also assisted many businesses, “prioritise marketing, improve competitivity and shift focus much more squarely onto retaining existing business while exploring new business opportunities,” added Colman.

Less positively, brokers either report or predict loss of income and commissions as the economic impact of COVID-19 lockdown reduces customer’s ability to afford insurance. Clients are also a lot more price sensitive. This means that in future policies will, inevitably, “cover less and exclude additional benefits,” predicted Colman.

Despite the challenges and the disruption, however, broker responses also revealed some surprising positive human impacts of lockdown. In addition to learning news ways of working many brokers they felt lockdown had, “bought them closer to their families, providing more quality time with loved ones,” said Colman. There was also a general sentiment that lockdown had bought communities and the nation closer together, “made civil society stronger and also revealed new business opportunities,” she added.

The most encouraging aspect of these results, however, has been the overall sense of a dynamic and innovative industry operating amongst a resilient and highly adaptive customer set. Both brokers and customers have, “quickly and ably responded to an unforeseen crisis in a calm, creative and effective manner,” said Colman. This bodes well for the future of the South African insurance industry in general and the short-term sector in particular as, “we continue to confront and manage the long-term impact of this ongoing crisis together,” concluded Colman.