Your family’s health history: The legacy no one talks about

When we think about heritage: culture, traditions and values often come to mind. Something that is considered less frequently in this context, but is equally important, is your family’s health history. If there are potential problems, you should be aware of them and as far as possible make appropriate lifestyle changes to mitigate the risk to yourself. The good news is that having an adverse family health history doesn’t mean your future is predetermined. Your lifestyle, choices, and access to medical care all play an important role.

This is also an important aspect that should be disclosed when considering life insurance. Even though many people assume that a family history of illness makes life insurance unattainable or unaffordable, it is a myth, says Joretha Bothma, Head of Product Development, Underwriting and Claims at Momentum Life Insurance.

Insurers look at several factors when assessing your application, and family health history is just one of them. Here’s how it may influence cover:

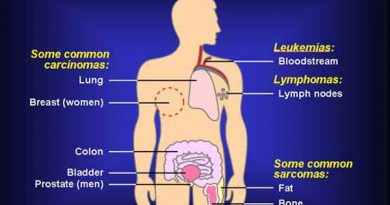

• Family patterns: If close relatives such as parents or siblings have experienced illnesses such as heart disease, cancer, or diabetes, insurers may view this as a higher risk indicator.

• Cost of cover: A family history of certain illnesses might affect monthly premiums, but it rarely prevents access to cover.

• Policy conditions: In some cases, exclusions may apply for conditions with a strong hereditary link.

• Timing of illness: If family members were diagnosed later in life (for example, after age 65), it usually carries less weight than if the illness appeared earlier.

• Your lifestyle: Healthy habits eating well, exercising, avoiding smoking, and going for health check-ups count strongly in your favour.

Life insurance is designed to provide financial security for your loved ones when you can no longer do so yourself. Being open about your family’s health history is crucial: transparency ensures your policy remains valid and prevents complications during a claim.

Importantly, lifestyle choices can offset many risks. A balanced diet, regular exercise and early health screenings can help you stay in control, regardless of your family history.

Just as we protect cultural traditions, we should safeguard our financial legacy for our families. Life insurance is more than a policy it’s a way to ensure your loved ones’ future remains secure, whether that means funding education, paying off a home loan, or simply providing financial stability in difficult times.

Why timing matters

Many hereditary conditions only reveal themselves later in life. By then, it may be more difficult, expensive or even impossible to obtain life insurance cover. Having a family history of illnesses like diabetes, hypertension, cancer or heart disease already places you at a higher risk than the general population, which insurers take into account. The best time to secure cover is while you’re still young, healthy and insurable long before health concerns become a barrier. Acting early gives you more options, greater peace of mind, and ensures your loved ones remain protected.

This Heritage Month, take time to talk to your family about their health history. Use that knowledge as a foundation for a healthier, more financially secure future. By turning understanding into action, you can protect generations to come and honour your heritage in the most meaningful way.

Your family’s health history is just one piece of the puzzle. Your lifestyle and wellbeing are equally powerful in shaping your future and your life insurance cover.