Discovery Health clarifies legal position on motor vehicle accidents in claims against the Road Accident Fund

Discovery Health statement relating to Ronald Bobroff & Partners

Discovery – Oct 26, 2014 09:02 GMT

- Cover for motor vehicle accidents in claims against the Road Accident Fund

Discovery’s position on Road Accident Fund (“RAF”) claims is in accordance with the attached press release from the Council of Medical Schemes (Annexure A) and is summarised below:

- Discovery Health Medical Scheme (“the Scheme”) does not differentiate between medical claims resulting from a motor vehicle accident and claims resulting from any other accident or illness.

- The Scheme always pays for the treatment of any member or dependant injured in a motor vehicle accident in accordance with the member’s specific plan type, no questions asked.

- If a member or dependant subsequently becomes entitled to any benefit from the RAF, the member or dependant may submit a claim to the RAF for compensation and reimbursement of related medical expenses. The Scheme does not force members to claim from the RAF.

- If a member or dependant receives compensation from the RAF for medical expenses, the member must then refund those amounts previously paid by the Scheme for the member’s medical expenses. This is to avoid the member being unjustly enriched at the expense of the Scheme by receiving double compensation for the same health event.

- If the member does not receive any compensation from the Road Accident Fund, the Scheme will remain liable for the costs of the treatment subject to the chosen plan type of the member, and will never require that the member repay these funds to the Scheme.

- Members can be assured that they will always have access to the necessary treatment in the event of a motor vehicle accident and that the Scheme’s treatment of RAF claims is consistent with the provisions of the Medical Schemes Act.

- Overreaching and other charges against Mr Bobroff

Recently, numerous court orders including some by the Supreme Court of Appeal and the Constitutional Court, have been made against Ronald Bobroff and Partners in respect of its excessive and unlawful fees charged to its clients. The impact of these unlawful fees has created severe repercussions for clients who have typically suffered significant injuries from motor vehicle accidents.

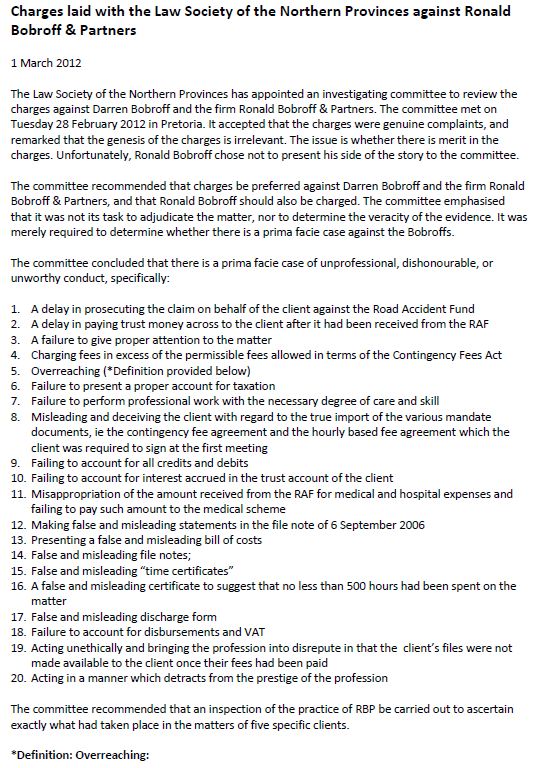

In addition to these court orders, Ronald Bobroff and Partners has also been charged with approximately 20 counts of unprofessional conduct and breaches of ethical duties by the Law Society of the Northern Provinces (Annexure B). Flowing from these charges, the Supreme Court of Appeal last week ordered an inspection of Ronald Bobroff and Partners business and trust accounts to determine the extent of its unlawful overcharging of clients.

Discovery Health has supported these cases against Ronald Bobroff and Partners because we believe that we have an obligation to assist and protect our members, particularly those that find themselves in a vulnerable position. We also believe that we have a duty to defend the integrity of the broader structures of our society, in this case the Road Accident Fund.

- Unfounded claims from Mr Ronald Bobroff

In order to deflect attention from the numerous charges and court orders against him, Ronald Bobroff has made a number of unfounded claims including that:

- The Scheme does not adequately inform members of the Scheme rules and, as a result, has no right to be refunded RAF claims in respect of medical costs incurred by the Scheme on behalf of the member.

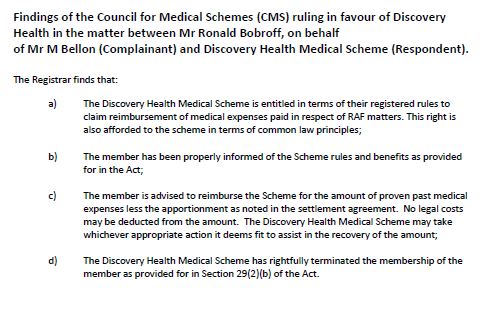

The Council for Medical Schemes has ruled unequivocally on this issue in favour of the Scheme, concluding: the Scheme is entitled to claim reimbursement of medical expenses paid in respect of RAF matters in terms of its rules and in terms of common law principles. The Council also confirmed that Discovery adequately informs its members of these rules and obligations in terms of the Medical Schemes Act (Annexure C).

- Discovery Health members and their families are approached while in hospital and forced to sign undertakings to refund the Scheme in respect of RAF reimbursements.

No Discovery Health employee has ever approached a member in hospital in this regard. All Discovery Health members are guaranteed coverage in respect of their medical costs incurred as a result of a motor vehicle accident (as with all other benefits) in line with their plan choice and in terms of the Prescribed Minimum Benefits which all medical schemes cover. The Scheme has never failed to pay claims for medical expenses after a motor vehicle accident.

Annexure A

Annexure C