Hollard Life Launches New Disability and Impairment Benefits Range

Hollard Life has launched its new range of income protection benefits, coinciding with the changes in tax legislation. Hollard’s new comprehensive range of disability and impairment benefits provide flexible and cost effective solutions to virtually all occupational scenarios clients could find themselves in.

“The changes in legislation regarding the taxation of income protection policies means that from March premiums will no longer be tax deductible, but benefit payments will be tax free. This also means that financial advisors should review their clients’ portfolios as clients may now be unnecessarily over-insured and no longer receiving the tax relief on their premiums. This provides us with an opportune time to introduce our new income protection benefits, which now offer improvements in the type and number of income benefits available, as well as highly competitive premium rates. In particular we have looked at harmonising the lump sum and income benefit offering – for example consistency in claim event definitions with the option of income or lump sum benefit payments,” explains Ryan Chegwidden, Head Product & Technical, Hollard Life.

Flexible disability and impairment cover options

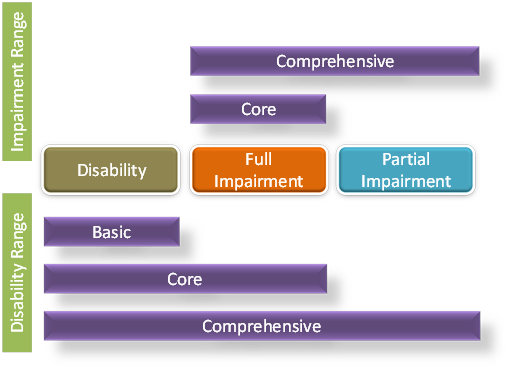

To cater for the diverse needs of clients, Hollard Life introduced a new continuum structure offering a variety of benefits ranging from very elementary accident cover, right up to fully comprehensive benefits including extensive cover for both disability and impairment.

The disability benefit range is constructed from 3 building blocks:

- Disability: The client’s inability to perform an occupation.

- Total Impairment: Specified impairment events of a total and permanent nature where 100% of the benefit amount is paid out

- Partial Impairment: Specified impairment events of a permanent nature, but not total, where less than 100% of the benefit amount is paid out.

The Hollard Impairment and Disability range

These five benefits are available on both an income and lump sum benefit payment basis to suit clients’ financial needs. The income benefits include cover for conditions of a temporary nature. In addition the popular Disability Plus remains available to cover both temporary income needs and permanent lump sum needs in one benefit.

Accident only versions of the Basic Disability and Core Impairment are available.

Various options are available on the all the benefits to allow the advisor to tailor specific cover to meet the specific need of a particular client.

What’s the difference between disability and impairment?

An aspect that many clients have difficulty in understanding is the importance of having both disability and impairment cover. It’s an important distinction to make for your clients and to ensure that they understand the different roles of the benefits.

“Disability benefits aim to compensate for the future loss of income and costs associated with being disabled and unable to perform an occupation. Impairment benefits provide cover in the event that your client suffers a permanent impairment and need not affect their ability to continue working. The claim event is assessed against a list of conditions stipulated in the policy, and is equally important as disability cover as it provides cover against unexpected expenses when it is needed most,” explains Ryan.

Hollard Life’s new income protection benefits mean that advisors can now cater for virtually every potential scenario that a client could face when it comes to disability and impairment, even for clients who did not previously qualify for occupation-based disability.

“Our entire approach and philosophy is about adopting a holistic approach to managing risk, which has resulted in Hollard Life being one of the most dynamic insurers in terms of product development. The new income protection benefits are further enhancements in our quest to deliver holistic insurance solutions where the traditional insurance products are unable to meet the needs of a diverse client base.

“There are many potential scenarios that probably worry your clients and keep them up at night. But it’s important to remind them that with sound financial planning in place and benefits designed to wrap around their specific needs, there is a whole lot more that can go right for them, even if life throws them a curve ball,” concludes Ryan.