BlackRock’s Weekly Market Commentary: Three key dates for markets this quarter

Key points

- We highlight three key events: the January Federal Reserve meeting, a potential end to the U.S.-China trade war truce, and looming Brexit.

- Risk assets rallied on strong U.S. job market data, Fed Chairman Jerome Powell’s perceived dovish comments and China’s bank reserve ratio cuts.

- Any downside surprise in this week’s U.S. consumer price index (CPI) inflation data could further weigh on U.S. government bond yields.

Three key dates for markets this quarter

Will the Fed take a breather from its quarterly pace of rate hikes? The policymakers’ Jan. 29-30 meeting will be a key event in the first quarter, as the U.S. economy nears late cycle and financial conditions tighten. Both Fed policymakers and the markets will be laser-focused on economic data for clues about the health of the global economy.

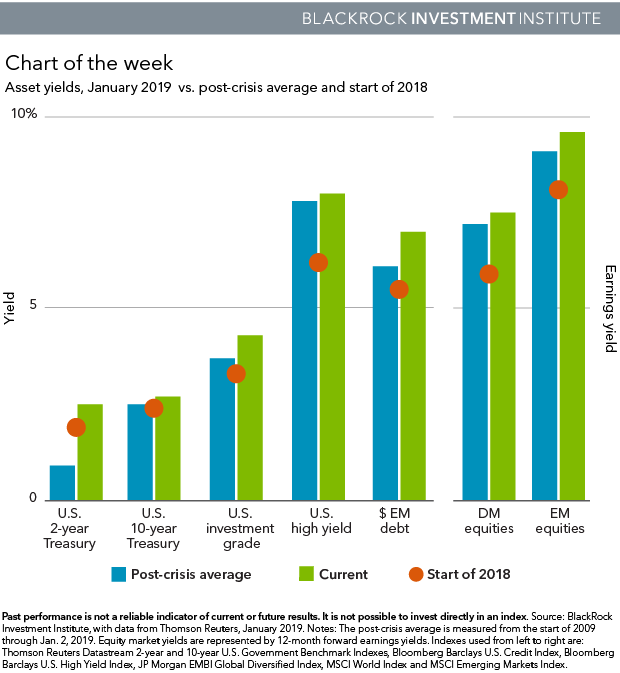

Chart of the week

Asset yields, January 2019 vs. post-crisis average and start of 2018

Asset valuations cheapened significantly in 2018 – as uncertainty increased and the Fed raised rates. Equity valuations are back in line with post-crisis averages, as gauged by earnings yields. See the chart above. We enter 2019 with less-demanding valuations and risks better reflected in many asset prices. Yet fears over an economic slowdown and trade conflicts loom large. U.S. stocks in December posted their worst month since February 2009, while perceived “safe havens” such as gold, the Japanese yen and U.S. government bonds garnered more interest. Ten-year U.S. Treasury yields fell to the lowest levels since early 2018 (as prices rallied), underscoring government bonds’ diversification benefits during risk-off events. Our 2019 Global investment outlook offers further details on how to balance risk and reward in today’s environment.

The Fed, trade and Brexit

We see the Fed becoming more cautious as U.S. interest rates near neutral – the level at which monetary policy neither stimulates nor restricts growth. The Fed reiterated its tightening bias in December, citing a still robust growth backdrop. But the policymakers’ median rate expectations for 2019 dropped to two hikes from three, the latest “dot plot” projection shows – in line with our base case. The impetus: a softer growth and inflation outlook. The January meeting could provide clues to the Fed’s future path. We see a pause in March looking increasingly likely, as the Fed weighs the impact of tightening financial conditions and economic fundamentals.

A second key date: the potential end of the 90-day trade war truce between the U.S. and China on March 1. A lack of clarity as to what was agreed between U.S. President Donald Trump and China’s President Xi Jinping on Dec. 1 highlights the fragility of the truce. Recent steps taken by China to increase its purchases of U.S. goods, protect intellectual property and further open its economy could lead to an extension of the truce, but we expect structural tensions related to China’s industrial policy and competition for global technology leadership to persist. Negotiations between the two sides are set to resume this week.

The third key date: March 29, when the UK is scheduled to leave the European Union (EU). The UK needs to agree on a withdrawal deal with the EU to avoid a messy exit. Yet the odds of the parliament passing Prime Minister Theresa May’s current deal with the EU look very low given deep domestic political division. A change of path is likely necessary, but we don’t see a clear direction. We still put a low probability on a “no-deal” Brexit, though the valuation of the British pound appears to reflect significant fears of a disruptive exit.

Bottom line: Uncertainty around key events is likely to stoke volatility, arguing for greater portfolio resilience in 2019. We prefer a barbell approach: exposures to government debt as a portfolio buffer on one side and allocations to assets offering attractive risk/return prospects such as quality and EM stocks on the other. This includes steering away from assets with more downside than upside potential, such as European equities and European sovereign bonds.

Week in Review

- A strong U.S. job market report eased worries about weakening growth that had driven risk assets to deep losses since early December. China’s central bank cut bank reserve requirements to shore up lending and growth. Fed Chairman Powell pledged that the central bank is sensitive to risks and will be patient with its monetary policy in 2019, and expressed confidence in solid U.S. economic momentum.

- Global stocks rallied with other risk assets late in the week, reversing earlier declines. U.S. Treasury yields rose. Equity and credit market liquidity started to normalize after some tightness in late December. Saudi Arabia’s lower crude exports helped drive oil up.

- Global manufacturing data were lackluster. U.S. manufacturing activity fell to a two-year low, according to Institute for Supply Management (ISM) data. China’s factory activity shrank for the first time in over two years, Purchasing Managers’ Index (PMI) data show. Eurozone’s activity slowed to the lowest since early 2016 – though still in the expansionary territory.

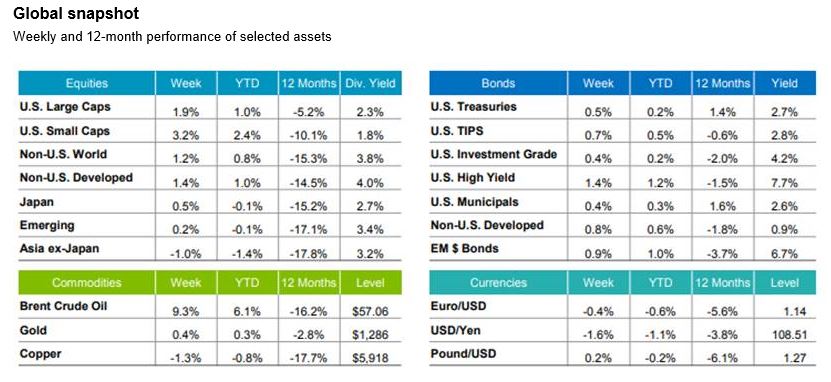

Global snapshot

Week Ahead

| Date: | Event |

| Jan. 7-8 | The U.S. and China hold trade talks in Beijing |

| Jan. 9 | Federal Open Market Committee Dec. 2018 meeting minutes; Eurozone unemployment rate |

| Jan. 10 | China CPI and producer price index (PPI) |

| Jan. 11 | U.S. CPI |

U.S. CPI data are in focus this week – especially as falling inflation expectations have been a primary driver behind the recent sharp decline in U.S. government bond yields. Consensus estimates point to a December core CPI reading of 2.2% year-on-year, the same as the previous month. A lower-than-expected number could put further downward pressure on Treasury yields. Our BlackRock Inflation GPS suggests the U.S. core CPI reading should remain slightly above the Fed’s 2% target over the next six months.