NAAMSA: Comment on the December 2018 monthly sales, Calender 2018 New Vehicle Sales Statistics and Prospects for 2019

1. BRIEF COMMENT ON DECEMBER, 2018 SALES

Industry domestic sales ended 2018 on a weak note with aggregate industry new vehicle sales for December, 2018 at 39 984 units recording a decline of 767 vehicles or a fall of 1.9% compared to the total new vehicle sales of 40 751 units during the corresponding month of December, 2017.

The December, 2018 new passenger car market and light commercial vehicle market reflected year on year volume declines of 0.2% in the case of new cars and a substantial decrease in the case of light commercial vehicles of 7.0%. Sales of medium commercial vehicles had also been weak, declining by 10.1%. On the other hand, sales of heavy commercial vehicles had improved 13.8% year on year.

In contrast, export sales had recorded a massive improvement in December, 2018 and at 31 437 units reflected an increase of 11 330 vehicles or a remarkable gain of 56.3% compared to the 20 107 vehicles exported during December, 2017. The strong December industry export performance had contributed to a record annual export sales figure for the industry. Overall, out of the total reported Industry sales of 39 984 vehicles, an estimated 34 012 units or 85.0% represented dealer sales, an estimated 9.3% represented sales to the vehicle rental industry, 3.2% to government and 2.5% to industry corporate fleets.

2. COMMENT ON 2018 NEW VEHICLE SALES AND VEHICLE EXPORTS: A CHALLENGING YEAR CHARACTERISED BY SUBDUED DOMESTIC SALES OFFSET BY GROWTH IN VEHICLE EXPORTS

As a major sector contributing around 7.7% to South Africa’s Gross Domestic Product (GDP), the automotive industry experienced contrasting fortunes during 2018 with domestic new vehicle sales and revenue in respect of new and used vehicles, as well as aftermarket parts and accessories, recording declines in real terms. In contrast, industry export business registered modest gains.

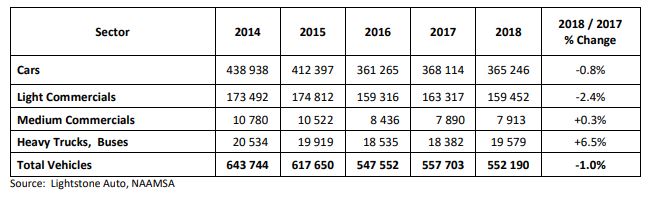

Following the modest improvement in new vehicle sales of 1.9%, in volume terms, in 2017 – new vehicle sales had declined by 1.0% from 552 190 units in 2018 compared to the total of 557 703 units in 2017. The annual decline reflected the weak macro-economic environment, pressure on consumers’ disposable income and fragile business and consumer confidence.

The November, 2018 0.25% increase in interest rates would also have impacted on new vehicle financing and sales. The fall in new car and light commercial vehicle sales occurred despite the strong contribution by the car rental sector during the year, attractive sales incentives by automotive companies and an improvement in new vehicle affordability in real terms. Current market conditions in the two sectors continued to be characterised by a buying down trend with sales of entry-level vehicles, small utility vehicles and crossovers performing well in relative terms.

The premium car segment had continued to experience significant pressure.

The following table summarizes annual aggregate industry sales by sector since 2014

The annual sales should be viewed in context. Twelve years ago (2006) the domestic market recorded an

In 2006 South Africa’s economic growth rate had been 5.6% compared to the 2018 expected growth rate of less than 1.0%. Interestingly, 2018 sales of medium and heavy commercial vehicles had recorded further improvement, in line with the trend over the second half of 2018, and the stronger sales suggested an improvement in capital investment sentiment in South Africa.

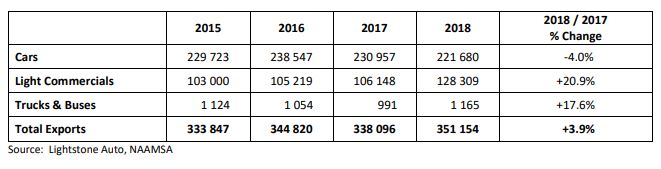

2018 Vehicle exports had registered an annual record industry export figure and total vehicle exports at 351 154 units reflected an improvement of 13 058 vehicle exports or a gain of 3.9% compared to the 338 096 vehicles exported in 2017. Exports of light commercial vehicles and heavy trucks in particular had registered substantial gains, in volume terms, of 20.9% and 17.6%, respectively.

The following table reflects the industry’s export sales performance over the past few years

– Source: Lightstone Auto, NAAMSA

The momentum of export sales had increased over the second half of last year and, based on relatively strong order books reported by most vehicle exporters, exports were expected to reflect further growth in 2019 and subsequent years. The projection for industry export sales for 2019 was currently at 385 000 export units.

3. INDUSTRY PROSPECTS FOR 2019: MODEST IMPROVEMENT AT BEST IN DOMESTIC NEW VEHICLE SALES VERSUS FURTHER RELATIVELY STRONG GROWTH IN VEHICLE EXPORTS AND DOMESTIC PRODUCTION

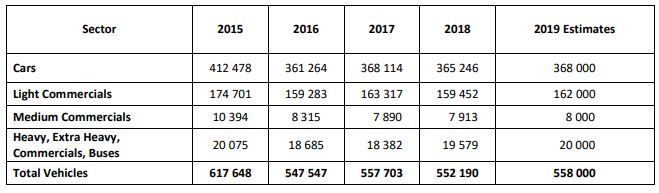

The outlook for 2019 in terms of Industry domestic vehicle sales by sector is summarised in the table hereunder

At this stage an improvement of around 1.0% in aggregate sales volumes is projected. However, most automotive companies are planning their operations on the basis of a flat market in 2019.

Factoring in the expected improvement in exports, domestic production of motor vehicles in South Africa increased increase from 601 178 vehicles produced in 2017 to about 610 000 vehicles in 2018.

An improvement in industry vehicle production of about 8.0% was projected for 2019 to reach about 657 500 units.

South Africa critically needs to achieve higher economic growth to fulfil its potential, address the many challenges confronting the country in terms of development and employment and to deliver improvement in the quality of life. A higher economic growth rate was also essential to support higher domestic new vehicle sales volumes.

4. COMMENT ON THE EXTENSION OF THE AUTOMOTIVE PRODUCTION DEVELOPMENT PROGRAMME (APDP) FROM 2021 THROUGH 2035

NAAMSA welcomed the announcement at the end of November, 2018 by the Minister of Trade and Industry, Dr R Davies, to extend the Automotive Developmental Policy Regime from 2021 through the end of 2035.

Despite the fact that the 2035 objectives of the programme are quite ambitious, the announcement should enable vehicle manufacturers and component suppliers to plan strategically for the future and to finalise investment decisions with confidence and certainty.

At the commencement of the extended programme from 2021 onwards, the levels of support and incentives for vehicle manufacturers will reduce significantly and the only means for vehicle producers to recoup benefits will be through progressive and substantial increases in localisation – whilst remaining internationally competitive in terms of exports.

Vehicle producers and suppliers will have to continue to work together to achieve sustained net cost reductions to ensure that the industry becomes more competitive internationally, to grow vehicle and components export business and to provide affordable products to the local market.

Automotive companies remain determined to rise to the challenges of the Post 2020 programme which will involve incremental localisation, industrialisation and transformation throughout the Automotive Value Chain.

Best wishes for 2019 to the media and all automotive industry stakeholders.

Also view:

Vehicle Finance, Car Insurance and Road Safety

Buying and Selling a Vehicle – Informed decisions and the Vehicle Retailer

The Online Vehicle Retail Market and Safely Selling Vehicles Online