Coronavirus highlights importance of personal risk management

COVID-19 demonstrates that in an age of global interdependence and connectivity – including rapid disease transmission – insurance is a mindset requiring individuals to personally manage their own risk exposure.

“Gone are the days of just buying any old travel cover and hopping on a plane,” says Christelle Colman, Insurance Expert at Old Mutual Insure.

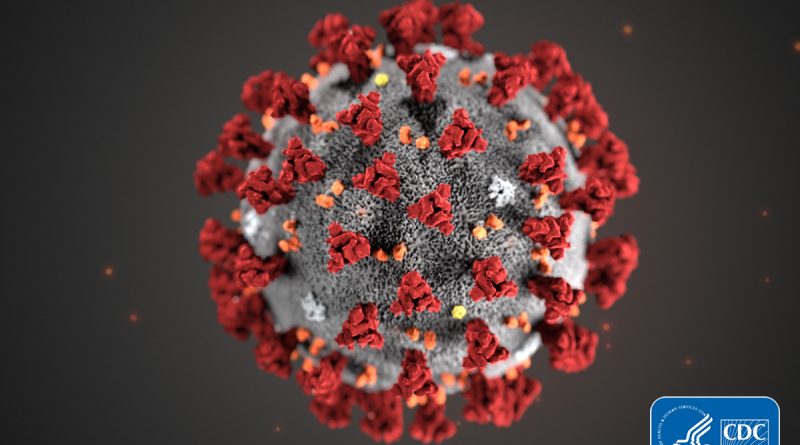

The latest intelligence from Europe Assist, a global third-party insurance support and delivery provider, is that the virus broke out on 31 December 2019 in a live animal and fish market in the Chinese City of Wuhan. The virus is thought to originate from the Chinese horseshoe bat.

COVID-19 initially caused relatively few cases, was managed through energetic isolation measures, and showed no evidence of human to human contagion. Recommendations were limited to avoiding contact with animals and infected patients. No travel restrictions were advised by either Chinese or international authorities. A significant deterioration of the situation was, however, reported by the media over the weekend of 18 January 2020. The Chinese authorities confirmed this the following week, including that the virus could be transmitted, probably through droplets, between humans.

Following these announcements news of the virus spread like wildfire through global and especially social media channels. A range of official bodies issued statements on the virus. The Centre for Disease Control (CDC) in the United States, for example, published a document on 23 January 2020 classifying COVID-19 as a ‘serious public health threat.’ In late January 2020 The World Health Organisation (WHO) also declared the virus a ‘Public Health Emergency of International Concern.’

These and many other organisations have regularly issued updated statements on the existence of the virus, its spread and impact.

As a result, today, “COVID-19 can no longer be classified as unforeseen,” warns Colman.

Consumers need to check whether their travel cover includes cancellation or curtailment caused by COVID-19. Since travel cover generally only applies to unforeseen situations, “given the global media hype and numerous official statements concerning the virus, most travel policies will no longer cover cancellation or curtailment resulting from COVID-19,” warns Colman.

While most medical travel policies are likely to continue to cover policy holders even in cases of COVID-19 infection while abroad, many may not – especially if the situation reaches global epidemic proportions.

Consumers should check whether their travel policy includes treatment for COVID-19 infection. And even if polices do cover COVID-19 infection and treatment, consumers should consider whether, “third-party on-the-ground global service and assistance providers will be able to manage the case load in the case of a global epidemic,” warns Colman.

Currently, should an Old Mutual travel policy holder contract COVID-19 while abroad, “Old Mutual will work through its international third-party emergency assistance service provider – Europe Assistance – to support the treatment of the infected individual on the ground in accordance with the public health rules for diagnosis and treatment of COVID-19 in that country,” says Colman.

Old Mutual will also provide on-the-ground updates to family members. Together with local authorities and our assist services partners, “we will also advise on the necessity or viability of repatriation – or quarantine – and any other support measures ahead of returning home once recovered,” says Colman.

This remains the situation for the moment.

While neither unfounded speculation or panic is advisable, the point is that, consumers should be very circumspect about exactly what travel insurances cover – and what they can deliver in the current situation.

“Ask what your travel policy will cover, what assistance they have on the ground, and what their procedure is in cases of COVID-19 cancellation, infection and treatment,” advises Colman.

Equally important, however, is basic common sense and the application of reasonable caution.

“Don’t travel globally at the moment unless you absolutely have to,” says Colman. “Avoid, especially, large global conferences, spectator sports events or any other gathering involving thousands of people,” she adds. If you must travel, “wear a face mask, avoid unnecessary human contact, carry disinfectant and wash your hands regularly,” she continues.

Finally, in an age of global risk, “take charge,” says Colman.

Risk management is not an off-the-shelf product anymore. Instead, risk management is, today, an attitude and behavioural practice.

“Avoiding and managing risk through research, interrogation, caution and responsible decision making and self-management is as important as tailoring cover to meet specific risks that reputable insurances providers can actually deliver – anywhere in the world,” concludes Colman.