Vigilance and Alertness can keep you and your money Safe!

Every day we are confronted with emails and SMS’s and other invitations to disclose our financial details and passwords. With so many financial challenges in this COVID-19 environment, we need to show extra alertness and caution! We would like to share some important insights and Advice from the experts at Standard Bank on how to protect ourselves!

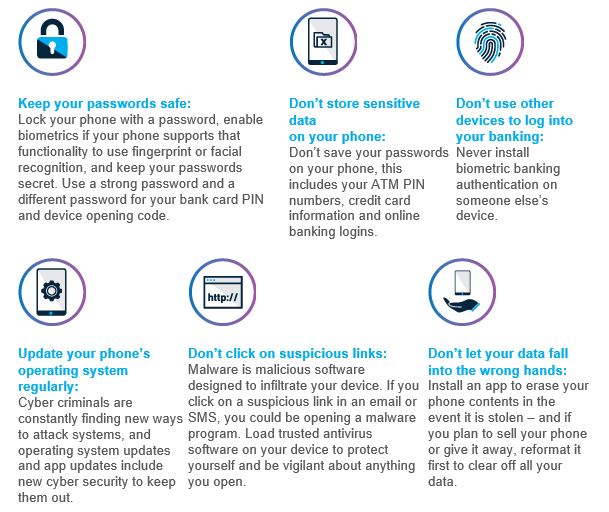

1. Bank safely on your phone

Fraudsters are counting on you to make these common mistakes, so be proactive to protect yourself:

What if your phone is lost or stolen?

• Contact us immediately on the 24-hour fraud hotline on 0800 020 600 (South Africa) or

+27 10 249 0100 (International), to deactivate your digital banking profile and block your bank account.

• Contact your mobile service provider to block your SIM card and handset, request that all incoming SMSs are blocked to prevent criminals from accessing any One Time Pins (OTPs).

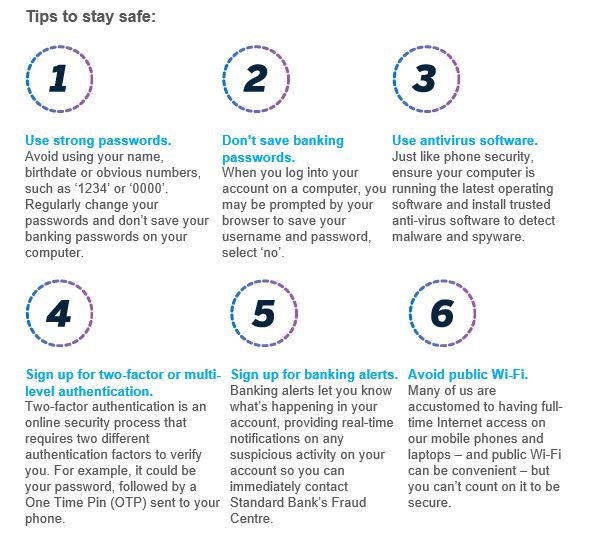

2. Bank safely online

What happens if your computer gets hacked, lost or stolen? Follow these tips to protect your banking information:

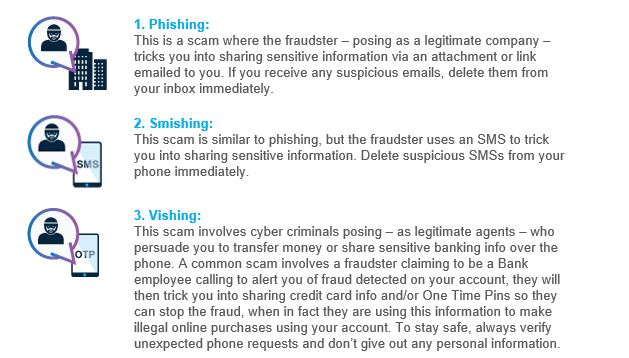

3. Beware of phishing, smishing and vishing scams

Beware of the following scam tactics:

Tips to stay safe:

1. Remember, Standard Bank will never ask you for your sensitive data over the phone or via an SMS or email. This includes passwords, PINs and One Time Pins (OTPs).

2. If anyone contacts you asking you for your personal details, do not respond. Call the Standard Bank Fraud Centre immediately on 0800 020 600 (South Africa) or

+27 10 249 0100 (International).

3. Register for MyUpdates for free, unlimited SMS or email alerts to monitor all your transactions so you can keep track of what’s happening on your accounts in real-time.

Also view:

Safety from Vehicle Scams and Fraudsters when Buying and Selling Vehicles