TransUnion Vehicle Pricing Index Q2 2021

Executive Summary

The global automotive industry had another challenging quarter with lockdown restrictions and temporary closures. The South African market faces its own trials with political and civil unrest. Business continuity is uncertain amid Covid-19’s third wave, intermittent lockdowns, increased unemployment, an unfavourable exchange rate, lower GDP growth and added pressure on disposable income.

We’re entering a quarter where dealers may look for alternative streams of income.

New and used VPI

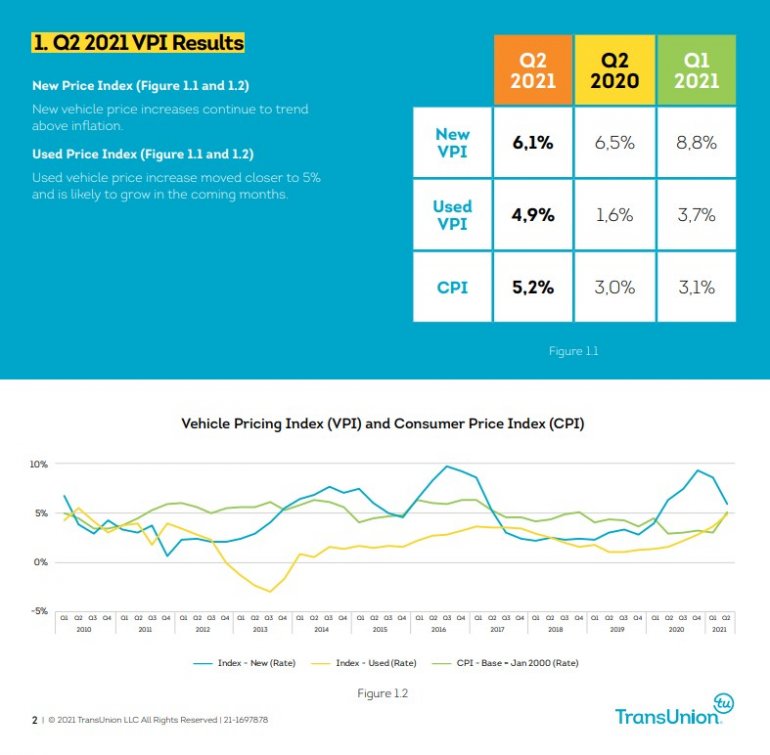

The TransUnion SA Vehicle Pricing Index (VPI) for new and used vehicle pricing moved to 6.1% and 4.9% in Q2 2021 from 6.5% and 1.6% in Q2 2020. The VPI increased significantly in the used passenger market and could surpass new vehicle pricing this year.

The index measures the relationship between the increase in vehicle pricing for new and used vehicles from a basket of passenger vehicles from the top 15 volume manufacturers.

Macroeconomics

The macroeconomic outlook has improved with the latest figures showing annualised negative GDP growth in Q2 2021 of -3.2%, an improvement from Q1 2021 of -4%.

Consumer confidence remains below 0 (as throughout 2020), with business confidence increasing to 50% from its highest level in 2020. Household debt to income has increased drastically from 2019 to 2020, adding significant pressure on consumers’ disposable income. The exchange rate has strengthened against the dollar over the quarter aiding OEM imports.

Finance volumes

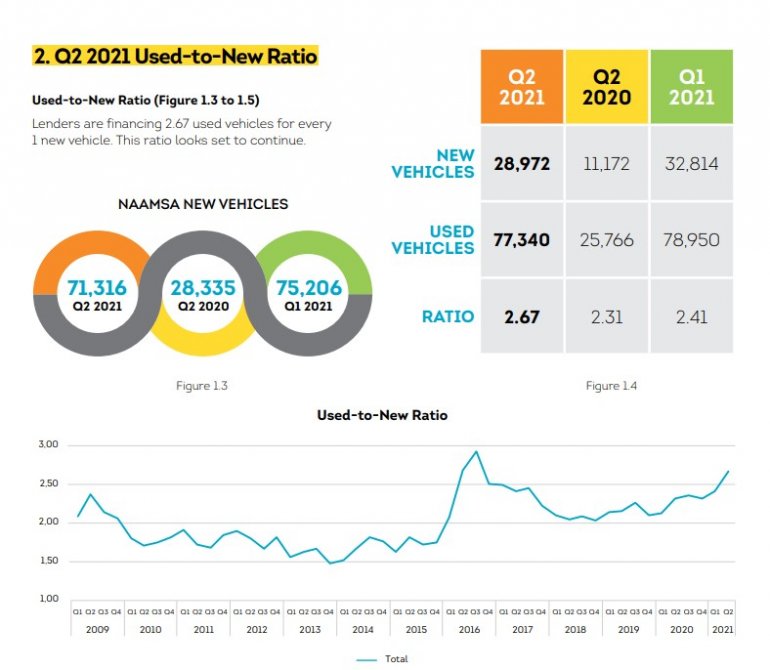

Total financial agreement volumes in the passenger market increased from Q2 2020 to Q2 2021 by 64%. New passenger finance deals increased YoY by 52%, but used passenger vehicle deals increased by 70% due to lockdowns in Q1 2020 when the sector registered no sales in April 2020.

The used-to-new vehicles finance ratio increased to 2.67 in the used market, 35% of vehicles are under two years old.

Demo models financed made up 4% (down from 6% in Q1 2021), with consumers opting for older cars as disposable income pressure increased. The body type of vehicles purchased in Q2 2021 shows high demand for new SUVs and used hatchbacks.

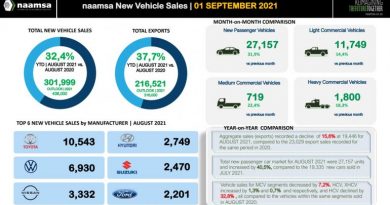

According to Naamsa, there has been a YoY increase of 52% in new passenger vehicles for Q2 2021 vs. Q2 2020.

New and used sales

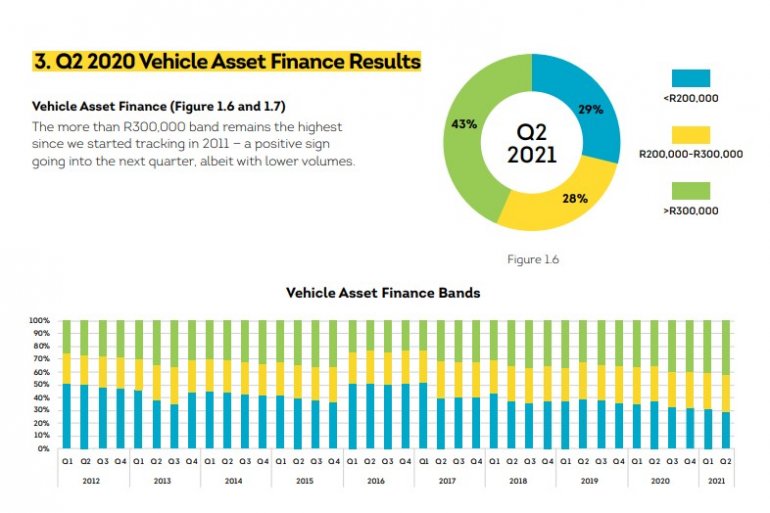

The percentage of sales financed below R200,000, R200,000–R300,000 and over R300,000 moved from under R200,000 into the more than R300,000 bracket.

The lower sales volume suggests reduced purchasing power and a suppressed appetite for more expensive vehicles. We expect this to continue in the coming months as vehicle prices increase in real terms.

Exports

The export market has been resilient through the pandemic and will recover as the global economy picks up. Total exports increased from Q1 2020 to Q1 2022. Continued growth depends on

international restrictions.

Interest vs. inflation

High inflation has offset the benefit of lower interest rates, heightening demand for quality used vehicles over new purchases. Limited supply is moving the used vehicle pricing index closer to that of new vehicle price increases.

This trend will see used vehicle price increases surpass those of new vehicles in 2021.

Right to repair

The South African automotive market has adopted right to repair laws to induce competition and sustainability. Aftermarket and value-added products will be priced separately from new vehicles.

This will allow transparency,introduce more options for the consumer and create new opportunities for businesses.

Latest Lockdowns and Civil Unrest Could Stunt Auto Industry’s ‘Green Shoots’, says TransUnion https://t.co/27BMgOik3k #ArriveAlive #VehicleSales @TransUnionSA pic.twitter.com/2CI4L2IWmw

— Arrive Alive (@_ArriveAlive) August 5, 2021