Erratic growth continues in the new vehicle market

South Africa’s motor industry waited with anticipation for April’s new vehicle sales to see whether March’s impressive results were anomalous or indicative of the start of a substantial growth trend. March’s sales broke through the 50,000-unit volume last experienced in October 2019, but April sales faced a few more challenges than usual in its attempts to maintain pace.

The traditional impact of numerous public holidays during the month reduces selling days, but it was the unexpected devastation of flooding in KwaZulu Natal that caused the most disruption in the market’s fitful recovery. These local challenges continue to be amplified by the ongoing global impacts of COVID-19 and the Eastern European conflict, resulting in little reprieve from supply constraints.

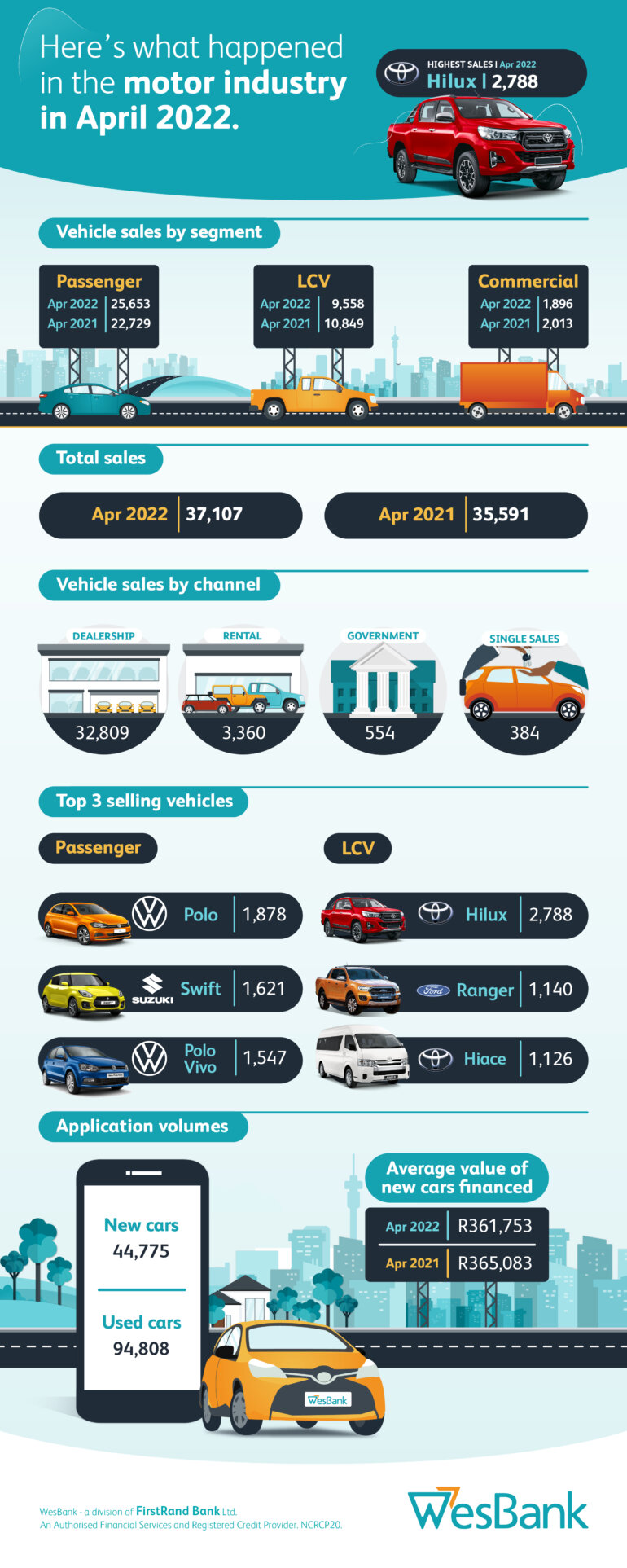

Despite these conditions, South Africa’s new vehicle market gallantly continued to show growth year-on-year, but could not meet March’s exceptional results. According to naamsa | the Automotive Business Council, April’s new vehicle sales grew 4.3% to 37,107 units when compared to the same month last year.

“The market shouldn’t be dismayed by April results,” says Lebogang Gaoaketse, Head of Marketing and Communication at WesBank. “Volatility is the only constant within the market, especially impacted by erratic supply beyond the manufacturers’ control. April’s volumes remain on the high end of last year’s performance and therefore shouldn’t be cause for any alarm.”

Light Commercial Vehicles (LCVs) took the brunt of the sales impact, down 11.9% on April last year to 9,558 units. The dealers faired marginally better in the segment, down 7.1% and retailing 9,088 LCVs off the showroom floor.

Passenger cars swung the other way and increased 12.9% for their 25,653 unit share of the total volume. The dealers took advantage and retailed 21,897 units, up 14.9% year-on-year.

“As the country’s new vehicle market recovers, it is natural for WesBank’s new-to-used vehicle ratio to shift,” says Gaoaketse. “While the bank continues to finance over two used vehicles for every new one, the ratio is shifting in favour of new vehicles. The real challenge will be the availability of good used vehicle stock given the market performance of the past two years, which will continue to stimulate new vehicle sales.”

The year-to-date picture continues to look positive, showing growth of 14.8% compared to the same period last year. New vehicle sales to the end of April reported 173,299 units compared to the 151,022 sold during the first four months of last year.

“While this is largely thanks to the strong first quarter, the market is expected to continue to its erratic recovery throughout the year,” concludes Gaoaketse.

Also view:

Vehicle Finance, Car Insurance and Road Safety

Buying and Selling a Vehicle – Informed decisions and the Vehicle Retailer

The Online Vehicle Retail Market and Safely Selling Vehicles Online

Buying a Quality Used Car and Safety on the Road