Pent-up demand is helping to keep the South African new vehicle market afloat in 2022

“New car buyers who held off purchases during the pandemic over the past two years are now renewing their vehicles thanks to somewhat normalised retail environments,” said Alex Boavida, Vice-Chairperson of the National Automobile Dealers’ Association (NADA) after reviewing the new vehicle sales returns for May which were distributed by naamsa I The Automotive Business Council today.

“Franchise dealers are noting a trend in the age of vehicles being traded in on new ones,” said Boavida. “Historically, the average age of vehicles exchanged for new models is around three or four years in line with normal ownership cycles. In recent months, however, dealers have seen this age increase to five or six years which indicates some pent-up demand during the pandemic is finally being satisfied after delayed renewals.”

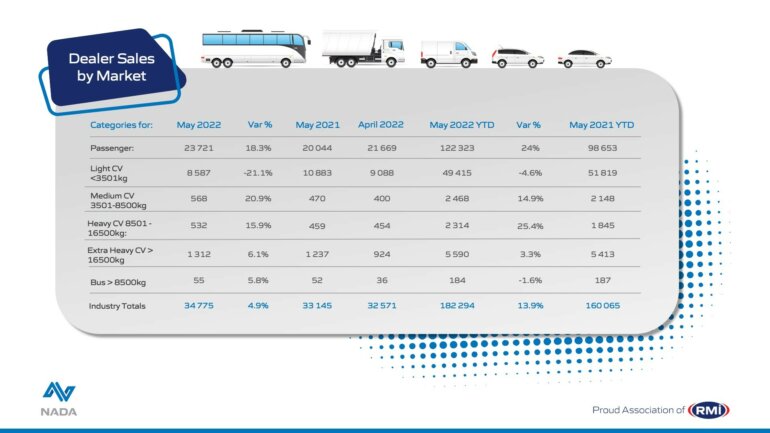

Aggregate domestic new vehicle sales reported by naamsa for May, at 39 177 units reflected an increase of 819 units, or 2.1%, from the 38 358 vehicles sold in May 2021, and a month-on-month growth of 2 009 units compared to April 2022.

Aggregate domestic new vehicle sales reported by naamsa for May, at 39 177 units reflected an increase of 819 units, or 2.1%, from the 38 358 vehicles sold in May 2021, and a month-on-month growth of 2 009 units compared to April 2022.

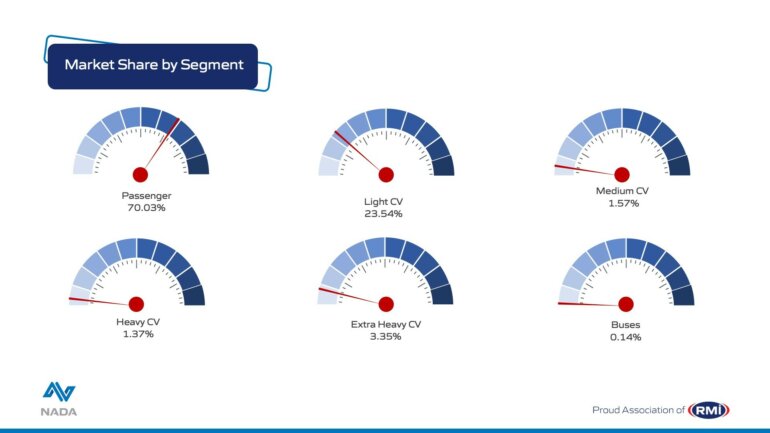

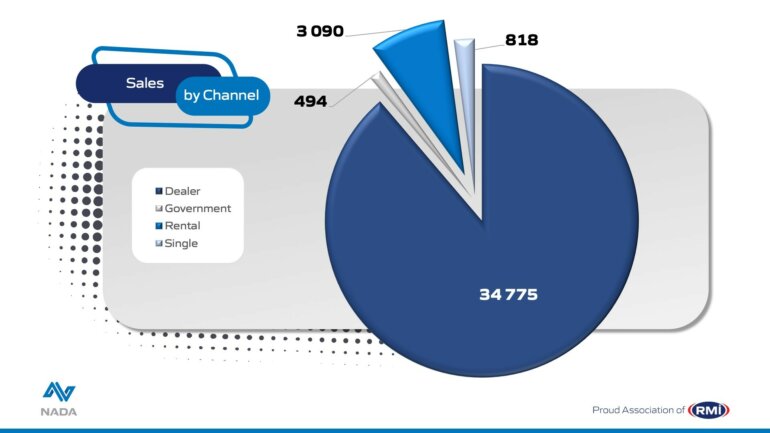

Out of the total reported industry sales, an estimated 34,775 units, or 88.8%, represented dealer sales, 7.9% represented sales to the vehicle rental industry, 1.2% went through government channels, and 2.1% were sold to industry corporate fleets.

“It’s encouraging to see the market performing so well despite the numerous setbacks the motor industry is facing both globally and locally. With interest rate hikes and rising fuel prices, consumers are being hit from all angles with burdens on budgets, but appetite for new cars remains remarkably strong,” continued Boavida.

“Brands offering more affordable product ranges are providing a crutch to the overall industry with aggressive pricing and the ability to deliver thanks to more robust supply levels. Many customers who normally buy in mid and premium segments are now buying downrange, not only to preserve budgets, but because this is where the greatest variety can be found.

“An awakening tourism industry continues to play a key role in passenger vehicle sales with rental agencies restocking fleets after years of little to no activity. Rental sales contributed a substantial 3 090 units to May’s total tally.

“The commercial market showed growth month-on-month, likely as a result of new transportation methods required by business due to restricted rail and sea networks, combined with a healthy recovery of building, mining, manufacturing and agricultural industries. The medium, heavy and extra heavy segments grew by 31.1%, 15% and 41.5% respectively compared to April 2022.

“Total sales in the light commercial space took a big knock year-on-year, with a -22.6% drop compared to May last year. It is evident that the devastating floods in Kwa-Zulu Natal and the subsequent damages to Toyota’s stockyards have played a role in the downturn. Toyota has said it expects stock issues for the next four months as a result. It appears that Ford and Isuzu have filled in the gap, however, with relatively positive LCV sales, indicating that the drop in May is a result of supply issues and not demand.

“Sadly, the global semi-conductor and general parts supply shortages are still wreaking havoc on the industry and suffocating showroom stock levels around the world – particularly in the premium segment. It is difficult to predict when these constraints will ease, but the general industry view is from 2023 onward,” concluded the NADA Vice-Chairperson.

NADA is a constituent association of the Retail Motor Industry Organisation (RMI).

Also view:

Vehicle Finance, Car Insurance and Road Safety

Buying and Selling a Vehicle – Informed decisions and the Vehicle Retailer

The Online Vehicle Retail Market and Safely Selling Vehicles Online

Buying a Quality Used Car and Safety on the Road