Insurance presents a way to keep on saving, even in tough times

Job cuts, high interest rates, meagre wage increments, and an ever-escalating cost of living, have left South Africans grappling with financial challenges. In such trying times, it’s imperative to reduce any expenses that prevent us from achieving our financial and life goals. Cutting back on insurance is, however, not a way to do that.

South Africa’s savings and investments culture is poor. The country’s savings rate is a dismal 0.5%, well below peers like Brazil and India. There is an urgent need to look at innovative ways to save and, most importantly, still survive life’s unforeseen setbacks.

Savings can play an important role in helping one deal with unforeseen circumstances. We also save for specific goals such as further studies, buying a car or first home, welcoming an addition to the family and planning for retirement. As budget-tight consumers we must realise that insurance, along with savings and investments, can play a key role in achieving these goals.

Affordability is often the issue. In tough times the ability to save and still keep up with monthly insurance premiums seems impossible. This can tempt consumers to cut out grudge purchases like insurance. However, it’s in challenging times that savings and insurance come into their own.

Planning for the unexpected

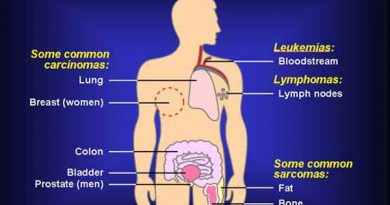

Without any savings to rely on, consider the impact of a loss due to unexpected circumstances. Loss of income due to retrenchment, disability, severe illness, or death, without appropriate cover, could force one into using savings to cope. Insurance helps you cope with such unforeseen circumstances, across the many eventualities that may incur.

Struggling consumers often either cancel or default on their insurance policies. There are alternatives to that, however. You could take a break from short-term saving in order to maintain the risk cover that protects your family from financial ruin. For example, an endowment life policy can serve as a long-term savings solution. Although our first thought would be to rather maintain our savings and not insurance cover, consider for example, whether our savings would ever be enough to adequately enable us to afford the cost of losing a home, car, or income.

Our ability to work and earn an income is our most valuable yet often overlooked asset. Illness or disability can jeopardise future personal and financial aspirations. If you are the primary breadwinner in your family, insurance products like life, disability, and critical illness coverage ensure that your loved ones are financially secure in the event of your inability to work. Having life cover in place will help ensure that you can still cover expenses such as a home loan, education, or general living expenses when you are no longer able to work.

In the event of an unforeseen circumstance, or your untimely death, how will your loved ones cope with outstanding debts, such as a bond? Loss of income is another risk. In the current economy, businesses are grappling with closures and workforce downsizing. Within this context, it’s important to look at income protection that covers your income, should you lose your job, and pays you some, or all, of it for a set period of time.

A life insurance policy can have extended advantages such as a lump sum payout to beneficiaries on the passing of a breadwinner; and providing more comprehensive benefits in the eventuality of disability and / or critical illness. You can also consider asset protection that covers your valuable belongings. While rainy day savings are essential, they may not cover all of the unexpected expenses, such as significant vehicle repairs typically handled by motor insurance.

If you are unable to afford insurance, rather than cancel and have no form of cover, rather consider strategies to reduce your monthly premium as this will give you peace of mind knowing you have some cover in place. To ensure affordability, you can reduce your monthly premiums by consolidating your short-term policies, bringing different types of policies, such as car and home cover, together into a single policy. This can save on commercial and administrative costs. Alternatively, you could also consider a change of the sum assured or benefits selected under the policy to reduce monthly premiums.

Without a doubt, insurance offers a complementary strategy to savings. It can help with some of life’s setbacks and can serve as a valuable tool in securing one’s future – if its benefits are understood and used optimally.