Rental market remains strong for now, but investor returns are likely to remain muted

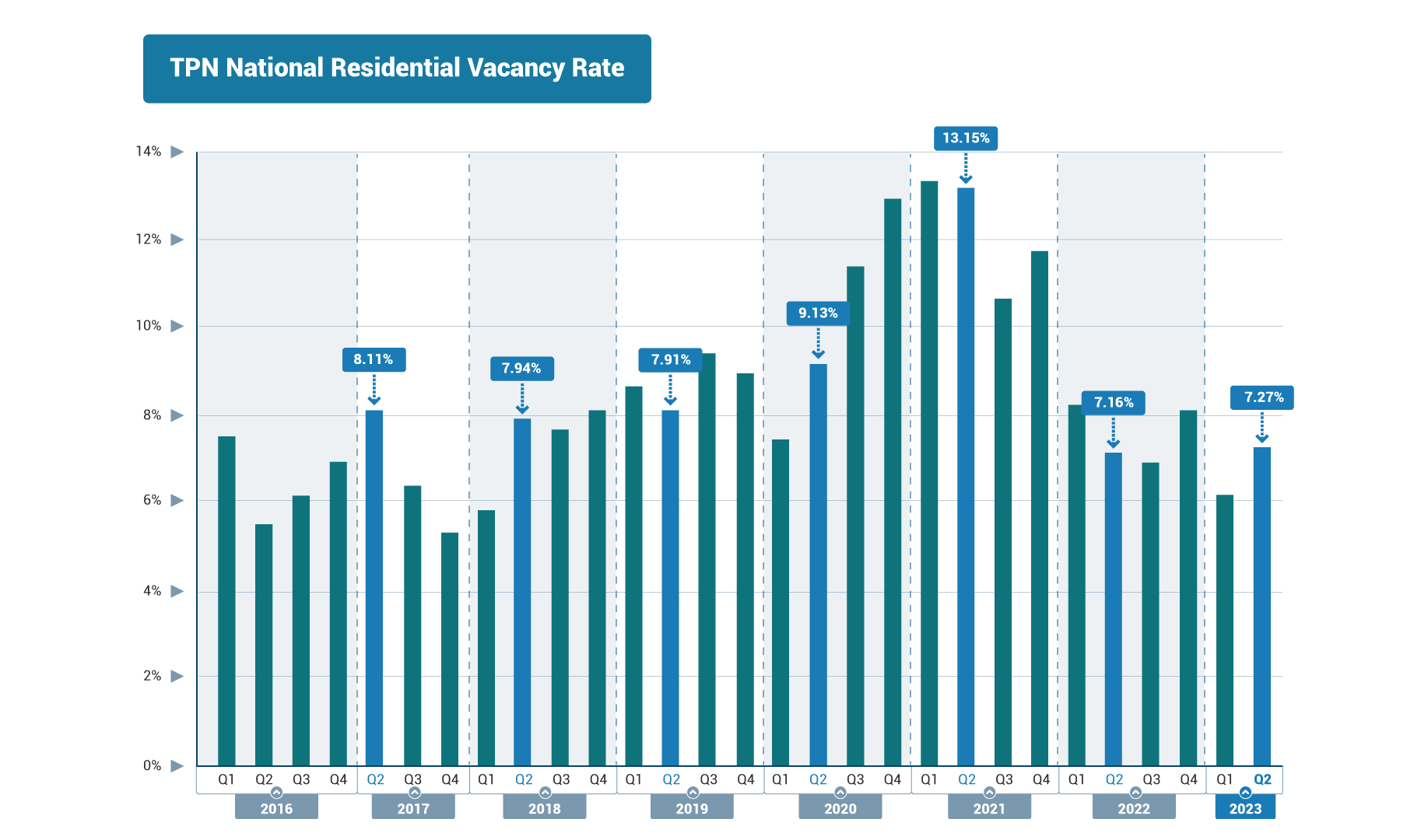

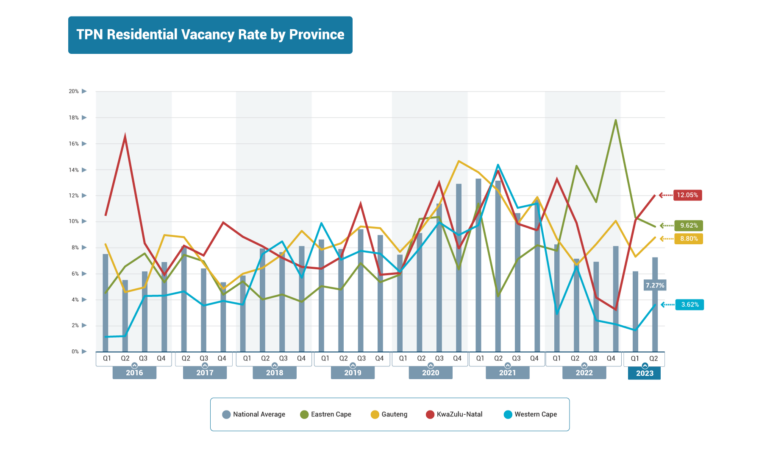

South Africa’s residential rental market has remained strong with vacancies nationally seeing only a small increase from 6.19% in the first quarter to 7.27% in the second quarter of 2023, according to TPN’s Vacancy Survey Report for the second quarter. This is despite the economic pressures facing consumers.

Vacancies are a key indicator for property investment. Consumer demand drives vacancies in the residential rental market and is influenced by whether consumers choose to purchase a property or rent it. The number of units available for rent and high capital costs also have an influence on the vacancy rate.

The number of vacant residential rental properties in the second quarter is very similar to the vacancy rate in the second quarter of 2022 at 7.16% but lower than the pre-pandemic vacancy rate of 8% in 2018 and 8.11% in 2017.

In recent quarters, vacancies have primarily been quelled by higher interest rates. During the pandemic, house prices saw healthier capital growth as a result of low-interest rates. However, the Reserve Bank’s aggressive interest rate hike cycle has slowed this capital growth. The mounting economic challenges facing consumers have helped the rental market to regain the losses it incurred during the pandemic by accelerating rental growth and improving collections and occupancy rates.

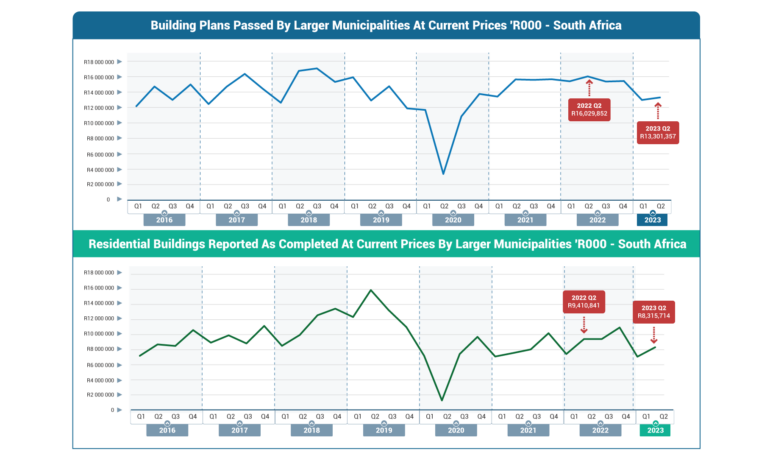

Around the country, there has been a slowdown in the supply of residential stock. Larger municipalities have reported that the value of completed new buildings dropped by R1.45 billion in the first half of 2023 compared to the same period in 2022.

Waldo Marcus, Industry Principal at TPN Credit Bureau explains that reduced stock entering the market will impact consumers in two direct ways: firstly, it will ensure less supply to choose from which will drive escalations higher, and secondly, an increase in housing cost will make it even more difficult for new buyers to enter the market given that it is already plagued by high interest rates.

“For residential property investors, this indicates a market environment characterised by higher demand and less competing supply in the short and medium term. Limited inventory coming online in the near future means more competition to find and place good quality tenants to ensure a decent return on investment,” he says.

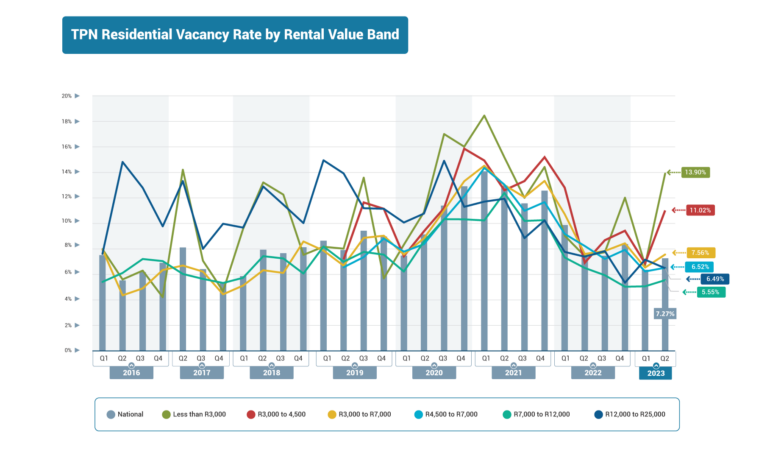

TPN’s data reveals that lower rental value bands are experiencing higher vacancy rates. Properties at the lowest end of the TPN rental value band had a vacancy rate of 13.9% in the second quarter of 2023. In the R3 000 to R4 500 rental band, the vacancy rate rose to 11%. The best-performing rental units are those priced between R7 000 and R12 000 per month with a vacancy rate of 5.5%, followed by units priced between R12 000 to R25 000 per month with a vacancy rate of 6.49%.

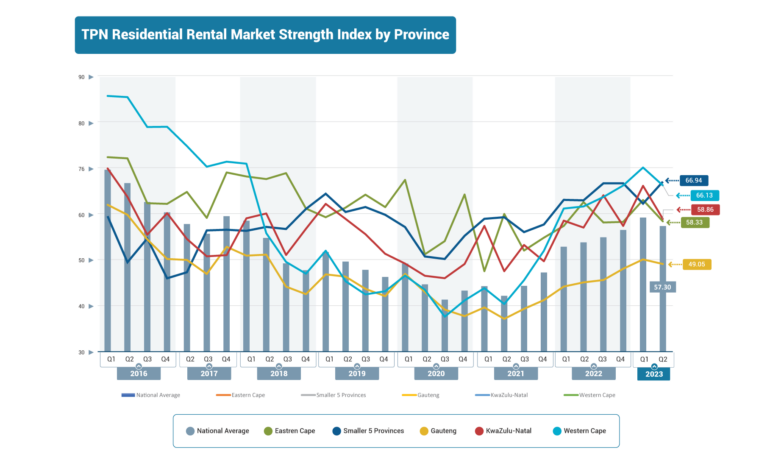

The Eastern Cape is the only province that has seen a small improvement in occupancies with the vacancy rate improving from 10.32% in the first quarter to 9.62% in the second quarter. The province has also seen a gradual increase in the value of completed properties.

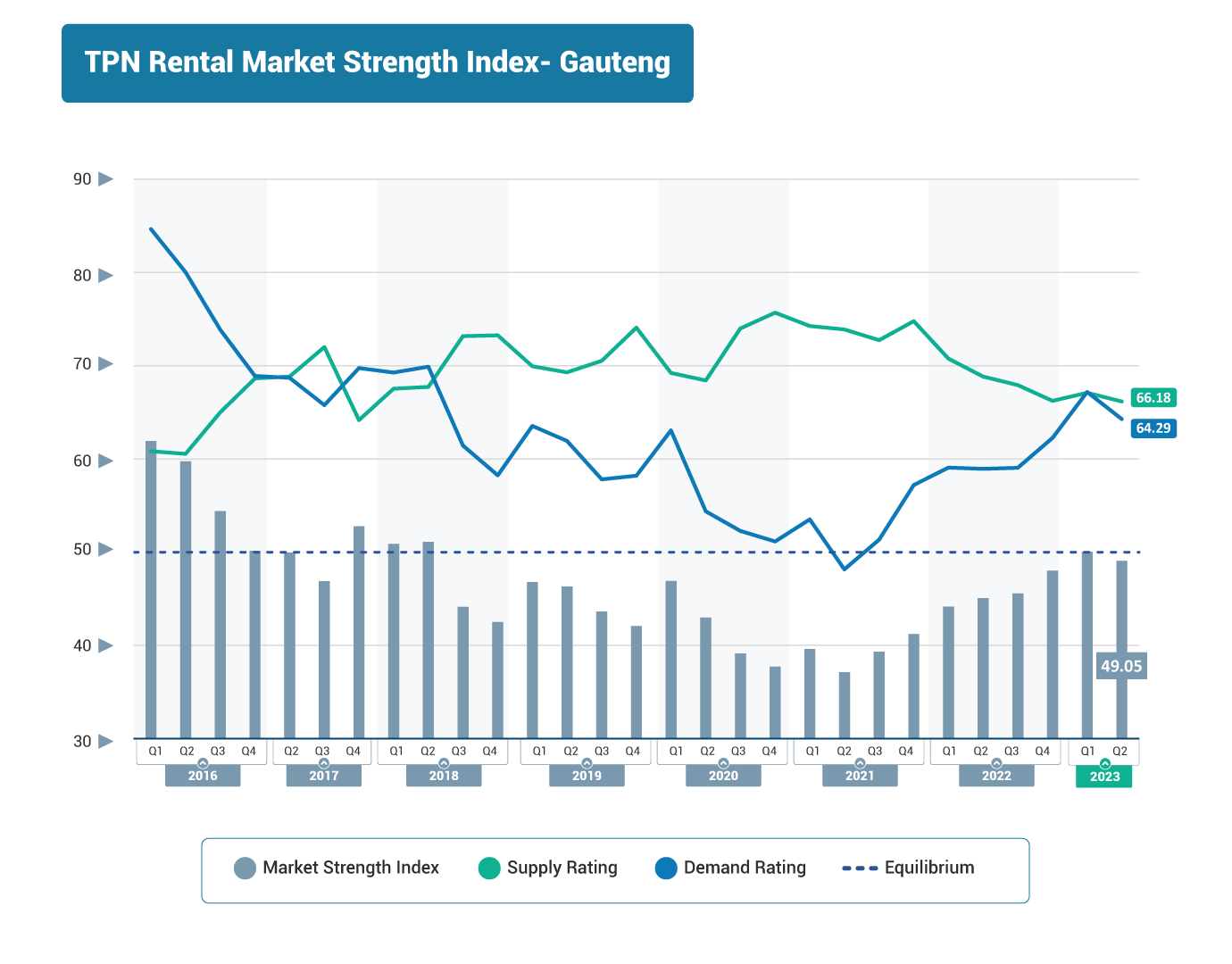

Gauteng’s occupancy levels were down slightly in the second quarter to 82.2% but remains above the national average of 92.73%. Escalations have been slow with a weak market strength expected to tame rental growth.

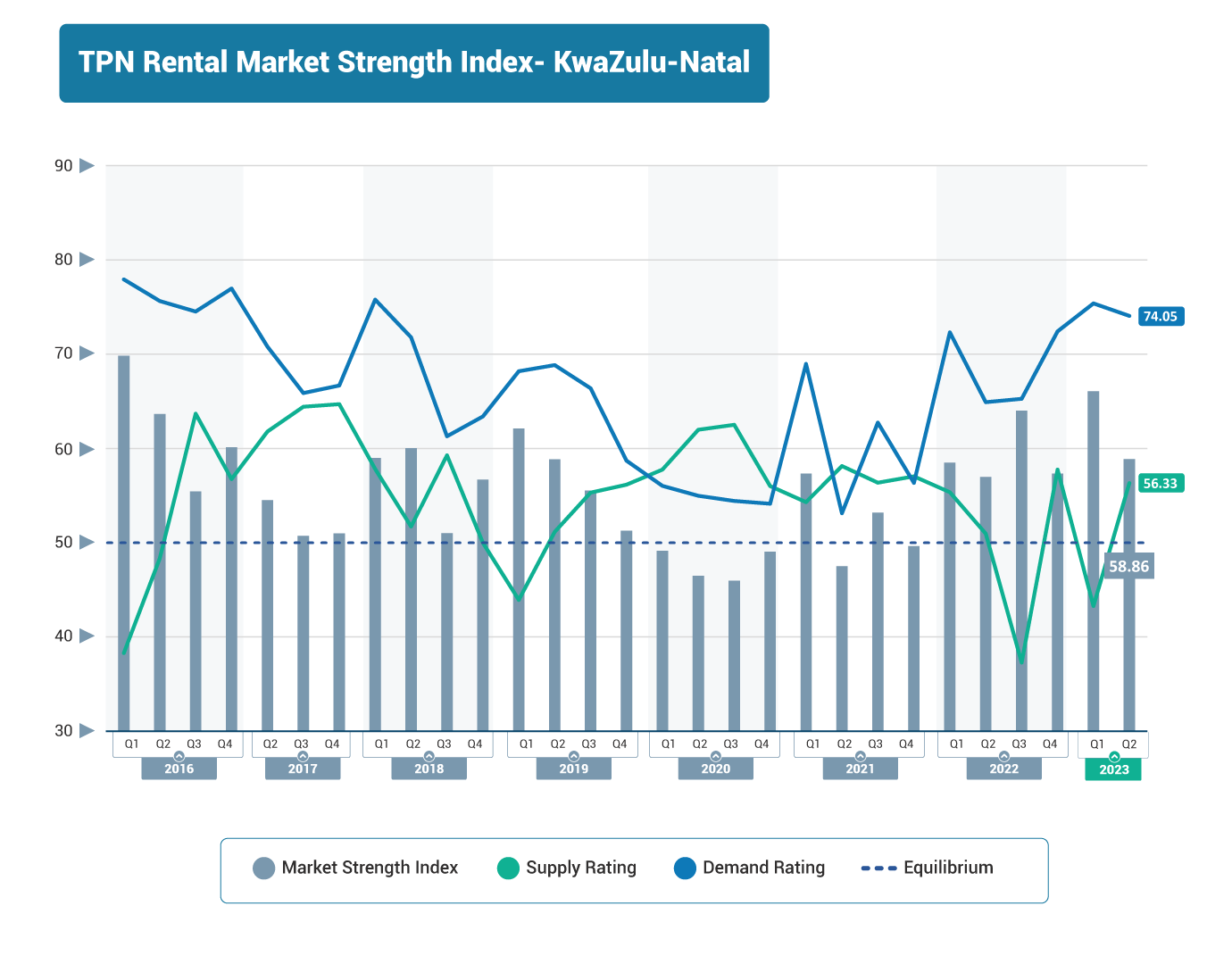

In KwaZulu-Natal, vacancies continued to rise in the second quarter to 12.06% from 10.13% in the first quarter. The province currently has the lowest occupancy rate in South Africa. However, an increase in the value of new building plans submitted indicates a potential increase in the number of new residential properties.

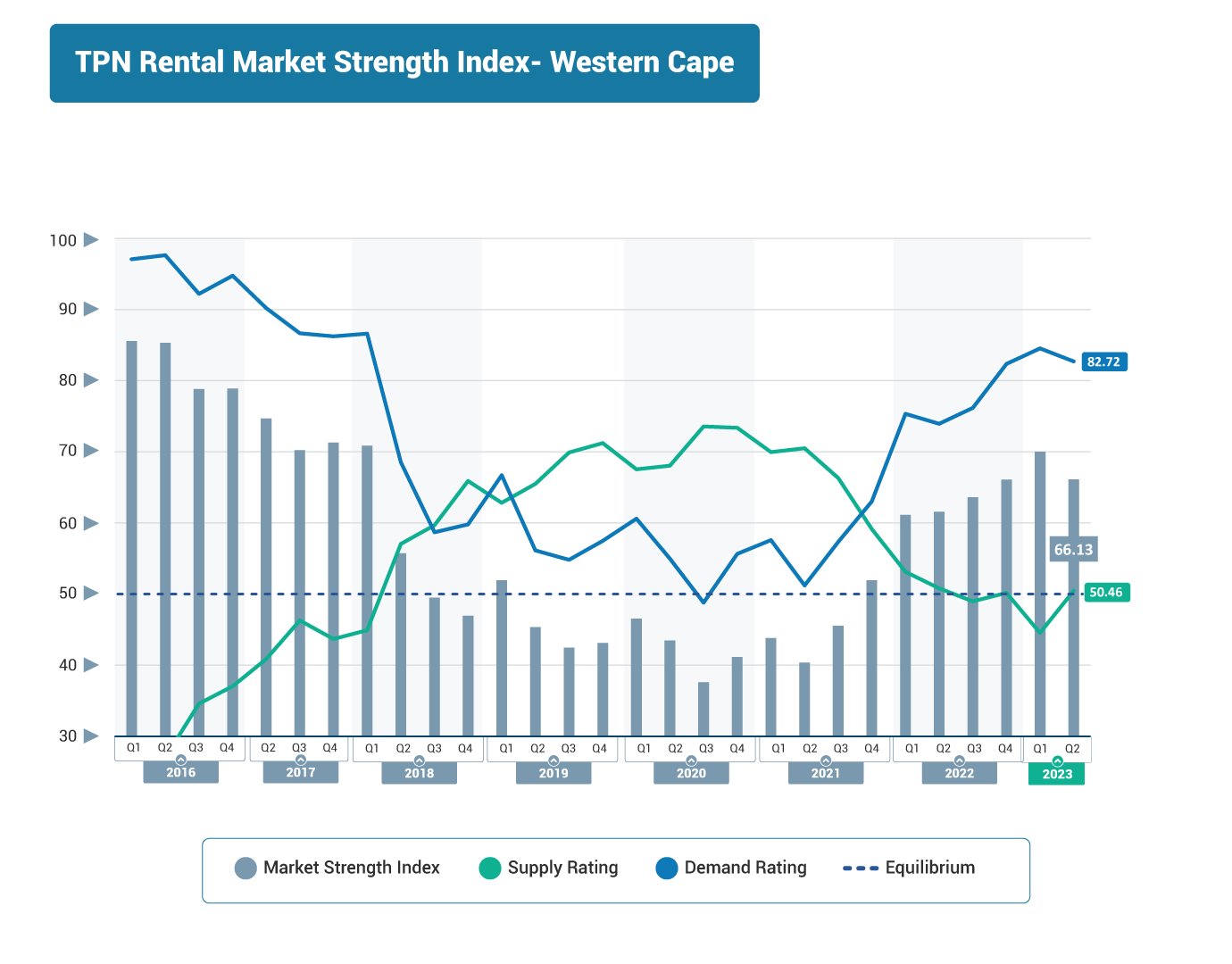

The Western Cape has the lowest number of vacant units with a vacancy rate of just 3.62% and the highest TPN Market Strength Index of all provinces at 66.13 points. The index measures perceived demand and supply availability within the residential market. Equilibrium is achieved when demand and supply are equal. An index above 50 points means higher demand than supply in the current environment. A perceived lack of residential rental stock combined with a strong demand rating is stimulating rental escalations in the Western Cape.

The annual average vacancy rate has been increasing steadily since 2016, points out Marcus, adding that declining confidence levels don’t bode well for potential house buyers and investors.

“Although investors have seen a healthy recovery since 2020 with improved escalations, lower vacancies and a relative slowdown in new supply coming online, declining confidence levels indicate that landlords need to be cognisant of balancing rental growth with vacancies,” he says. “Although early indications are that inflation is under control locally, global economies continue to exhibit strain which has the potential to impact the volatile rand – which could result in imported inflation. We’re unlikely to see an easing of interest rates in the short-term which means both consumers and property investors will remain under economic pressure.”

He predicts that although demand for rental property is likely to remain high, without the economic means to fulfil these demands, returns for investors may remain muted.