Insurance is South Africa’s most loved FSP industry according to social media data

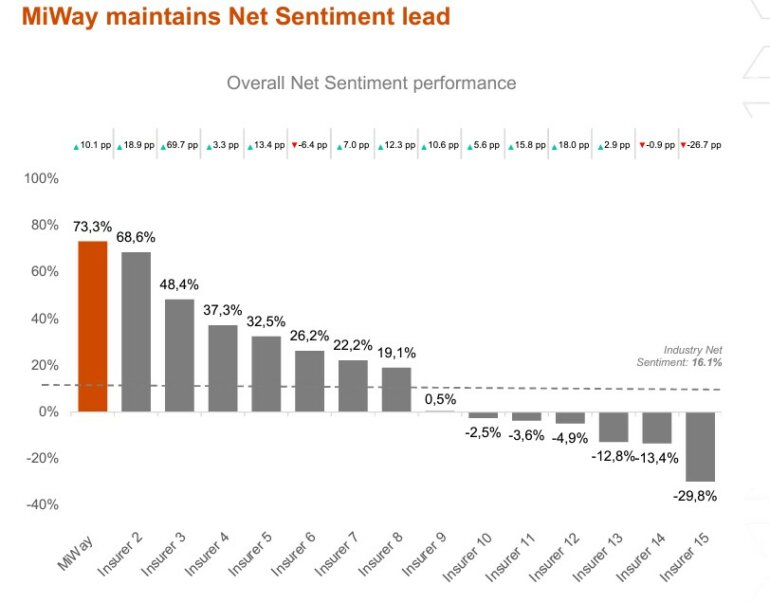

The insurance industry has set the benchmark for Net Sentiment1 with a ranking of 16.1%, outperforming banking (9.4%), retail (3.3%), and telecommunications (-14.0%). Some insurers demonstrated savvy use of social media to drive positive sentiment, thanks in large part to an increase in Hellopeter compliments and educational campaigns.

For the third consecutive year, PwC South Africa has collaborated with DataEQ to benchmark consumer sentiment towards 15 of South Africa’s major insurers. These findings are detailed in our newly released South African Insurance Sentiment Index report. The report analysed over 530,000 public non-enterprise social media mentions for the period of 1 April 2022 to 31 March 2023. This year, the industry achieved a score of 16.1%, marking consistent growth from 6.8% in 2022, and -0.4% in 2021. MiWay maintained its spot atop the performance rankings, registering a Net Sentiment of 73.3%.

Hellopeter, campaigns, and improved customer service drives positivity

The influence of the Hellopeter platform in shaping consumer opinions is undeniable. From making up just 10.8% of insurance-related conversations in 2021, the figure climbed to 22% in 2023. This uptick closely aligns with a significant positive swing in the industry’s overall Net Sentiment.

Another key highlight has been the dramatic improvement in customer service sentiment, an aspect that rebounded from negative Net Sentiment score in 2022 to a commendable 25.3% this year. ‘Staff’ was the most discussed topic within customer service, and the only one to register a positive Net Sentiment. This shift was largely fueled by praise of staff efficiency and responsiveness, particularly on Hellopeter.

Competitions and socially relevant campaigns also saw positive engagement from content that connected brands to their audience in new ways and resulted in a boost of 10 percentage points to industry-wide reputational Net Sentiment.

Liska Kloppers, DataEQ Head of Client Strategy, says: “The surge in conversations about insurance on social platforms like Hellopeter provides an invaluable opportunity for insurers to meet consumers where they are most comfortable and understand consumer needs. While there’s room for growth, the data shows significant progress in customer sentiment specifically due to improved responsiveness from certain insurers. As a data source this offers insights to enhance Insurer’s claims handling and regulatory compliance and investor relations.”

Several areas require attention despite increased positivity

While the industry performs well in many aspects, turnaround time for claims, platform responsiveness and digital security, as well as industry-wide contact difficulties indicate the need for more agile digital solutions. Customers often turned to social media after encountering issues on traditional communication channels, often providing insight into these channel challenges. The need for broader office hours or alternative communication methods stands out, as nearly half of the actionable2 mentions were posted outside regular business hours.

Call centres dominated this discussion, accounting for 63.5% of all complaints about customer service channels. The number of mentions about call centres was significantly larger for the South African insurance industry than it was for banking (14.6%) or telecommunications (16.5%) industries. Email and app-based services generated similar complaints of unresponsiveness.

Riaan Singh, PwC South Africa Digital Transformation Solutions Lead, says: “The insurance industry is seen as a laggard in technology when compared to other vertices like banking. As such, there is a pressing need for insurers to shift from ‘digital’ capabilities to becoming truly tech-enabled. Integrating emerging technologies and advanced analytics can provide robust data insights for a more targeted understanding of how to meet customer needs and increase overall sentiment. Fully utilising AI-enabled tech can circumvent manual processes to effectively and efficiently service and communicate with customers, allowing staff to focus on value-adding engagements.”

This year’s report aims to help industry stakeholders fine-tune their strategies to meet consumer expectations. Not only does it spotlight the industry’s strengths, but also calls out areas that require immediate action, ensuring a sustainable roadmap for years to come.

[1] Public Net Sentiment is a single score which encapsulates how consumers feel about an issue or a brand. This score is calculated by deducting positive sentiment from negative sentiment and is reflected in a single percentage score. All public Crowd-verified data is included in this calculation, meaning it encompasses both operational and reputational conversation.

[2] DataEQ’s RPCS framework identifies conversations that are considered actionable when it presents potential reputational or operational risk (R), purchase interest or intent (P), cancellation threats or intent (C) and requests for service or general feedback (S).

Also view:

Truck and Goods-In-Transit Insurance in South Africa