Noose tightens on new vehicle sales during September

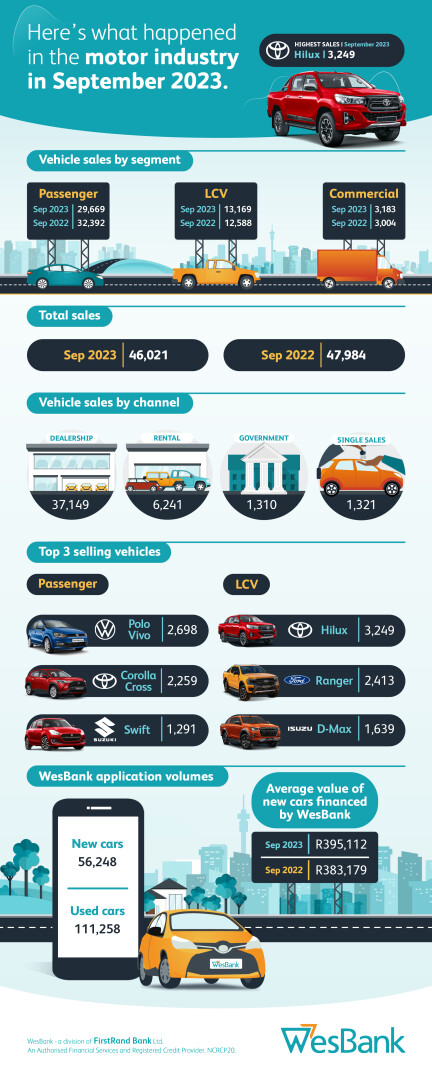

Uncertainty seems to be getting the better of consumers and business as new vehicle sales registered their second consecutive month of declines year-on-year. According to figures released by naamsa | the Automotive Business Council, SA’s new vehicle sales fell 4.1% in September to 46,021, but should be considered within some context.

“September sales show the biggest decline in market performance year-on-year since December 2021,” says Lebo Gaoaketse, Head of Marketing and Communication at WesBank. “However, comparisons remain theoretical given the market’s prolonged recovery from the pandemic and a broader context and assessment is necessary for a more realistic view of activity and sentiment.”

WesBank had described August’s performance as showing the first potential signs of strain amidst numerous economic headwinds. That month’s sales had declined 3.1% year-on-year, one of the first significant signs of strain for the industry since before the pandemic. “The fact that there are now two consecutive months of strain, September seemingly bigger than August, provides some measure of concern for new vehicle sales,” says Gaoaketse. “But it is the signs of the trend that are concerning, not the outright numbers.”

Looking more closely at September’s sales performance shows a marginally bigger volume of sales (294 units) than the previous month despite the apparently greater decline year-on-year. August’s sales had displayed an even more significant gain in volume month-on-month of over 2,000 units, despite sales reducing year-on-year.

“While the cold data shows two months of negative growth, a market of 46,000 units is in line with volumes during 2019,” says Gaoaketse. “This indicates a continued resilience and sustained slow recovery as experienced and predicted in the aftermath of the pandemic. Whilst there is no doubt that the market has major headwinds to overcome, new vehicle sales continue to defy the odds.”

Passenger cars continued to lose market share, September sales in the segment down 8.4% to 29,669 units. The appeal and suitability of Light Commercial Vehicles also continued to preserve volumes, that segment is up 4.6% to 13,169 sales.

The consecutive months of declines have softened year-to-date sales to 2.5% compared to the first nine months of last year, but the market went through the 400,000-unit volume. Sales for the year recorded 401,315 units compared to the 391,500 sold by the end of September 2022.

“The reprieve in September from further interest rate hikes will be welcomed in constrained household budgets,” concluded Gaoaketse. “But other economic pressures from fuel prices, inflation, restricted income growth, and the energy crisis will continue to play on consumer and business confidence and sentiment to make new vehicle purchase decisions.”

Pent up demand for new vehicles but "wait and see" approach from buyers https://t.co/eia2Mbajs4 #ArriveAlive #VehicleSales #NADA @dealerfloor pic.twitter.com/o8ltx0a7i1

– Arrive Alive (@_ArriveAlive) October 2, 2023

naamsa releases September new vehicle stats https://t.co/t9ZW1zbJkT #ArriveAlive #VehicleSales #naamsa @dealerfloor pic.twitter.com/WllhA8j6NH

– Arrive Alive (@_ArriveAlive) October 2, 2023