What do customers really want from an insurer – Hollard shares more this customer month

October is Customer Month and the first week of the month is officially designated as Customer Service Week, a global event dedicated to honouring the essential role of customer service and the devoted professionals who tirelessly serve and support customers day in and day out. It’s an opportunity to shine the spotlight on the unsung heroes behind every successful business.

As part of Hollard Life Solutions’ strategy to amplify its commitment to customers, the insurer, in 2022, introduced its customer promise, with a commitment to “Be Human, Stay Connected, and Get it Done”. As we move into 2023, our core message remains exactly that: we all have a shared responsibility to our customers.

“A big part of this customer promise is to ensure that our entire team embraces these values and considers the implications of their actions both for themselves and their respective teams or departments,” says Vhutshilo Nesamari, senior customer manager for Hollard Life Solutions.

“Customers are the foundation of our business, and our team understands that we are accountable to our customers, regardless of the role one may play as an individual within the business. We hold each other accountable – and embrace the idea of customers holding us accountable-an essential aspect in acknowledging the crucial role customers play in our operations,” says Nesamari.

According to Hollard, business has a responsibility to fortify their commitment to the customers, who are the backbone of any business. To create a customer-centric experience that ensures that we remain human and stay connected to the evolving needs of the customer it’s important that at the heart of every customer strategy, businesses focus on motivating, inspiring, and empowering their internal teams to be able to effectively meet the needs of customers at all times.

“At this time of the year, we focus on how we deliver to our customers, from the policy holders to our partners as well as the agents and advisors. We also use this time to recognise our frontline staff, who are the public face of the company, dealing directly with customer services, queries, and complaints.

“Part of our brand purpose is to deliver a win-win-win, for the customer, the advisors, our partners, and the company,” Nesamari says.

What customers want

According to Hollard, there are two key trends that the insurer has observed around what customers really want, particularly within the life insurance sector. Customers want to be able to contact their insurer easily and resolve whatever query they may have. And they want their insurer to be transparent and trustworthy. They expect their insurer to deliver products as intended and promised.

“These two trends speak to the basics of insurance need and desirability in knowing that the customer can have the peace of mind that, if an unforeseen event occurs, they are able to get assistance, in the way outlined as part of the specific product and its benefits,” Nesamari says. “That is our Customer Promise.”

Nesamari says that insurance companies have done much over the past decade to ensure that their brands are more relatable, with intentional effort put into insurance products and policy wordings to make sure they are easier to understand. “Insurers have also placed a significant amount of effort into developing products and services that are easily accessible and affordable to consumers who were previously excluded from accessing these kinds of financial products and services,” says Nesamari.

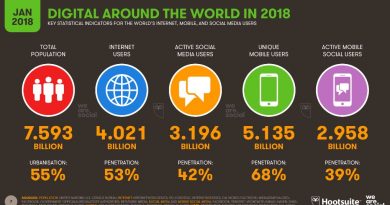

In addition, digitisation has made engaging with customers and customers engaging with their insurers simpler and faster.

“Furthermore, insurers have developed products and partnerships aimed at creating intentional value-adding benefits for customers as well as attempting to address social challenges in South Africa,” says Nesamari, pointing to the Hollard Highway Heroes and Women in Transport campaigns.

Insurers have also proven their adaptability in times of crisis, adds Nesamari, pointing to how insurers responded to the Covid-19 pandemic by implementing support measures and offering special provisions for affected customers.

Many ways to interact

The multiple platforms available to customers to engage with Hollard Life Solutions have also made interactions easier and more accessible, from phone calls to e-mails, from in-person consultations to live chats online as well as via social media. The introduction of these multifaceted communication channels has been necessary because customers have evolved and as such, they can use the different communication channels for their insurance needs.

“Over the past two and a half years, we have been focusing our efforts towards actively understanding customers and being more intentional in conducting research and focus groups to understand our customers’ needs, their experiences, pain points, and drivers of positive experiences.

“Our focus has been on also identifying ways in which we can best deliver to our partners and brokers to build their businesses and ultimately deliver the best value to our policyholders – the customers,” Nesamari adds.

She notes that it is important to create a conducive environment across businesses for customers to share their thoughts and experiences to enable continuous improvement of products, services, and experiences, Nesamari adds.

Of importance in driving seamless service in insurance, customers also need to make sure that they keep their personal information and contact details up to date – including that of nominated beneficiaries. This will in turn enable the insurer to keep in contact with the customers to make any changes or updates on their policies.

“This will also enable their beneficiaries to have a positive and simple claims experience,” says Nesamari.