naamsa releases October 2023 new vehicle stats as industry awaits MTBPS policy announcement for new energy vehicles

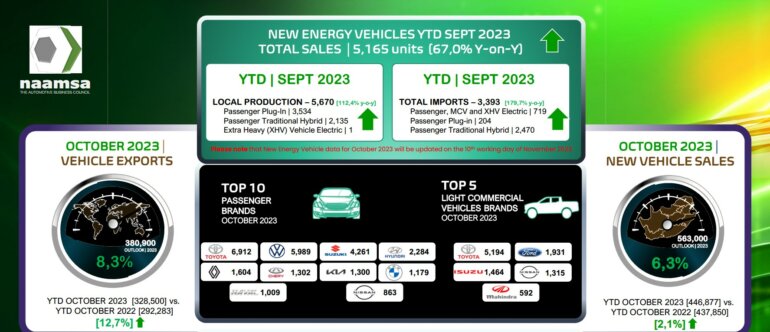

The Automotive Business Council said today that the persisting economic strain on businesses and consumers continued to impact directly on new vehicle sales as aggregate domestic new vehicle sales in October 2023, at 45,445 units, reflected a decline of 905 units, or a fall of 2,0%, from the 46,350 vehicles sold in October 2022. This was the third consecutive month of decline in the new vehicle market. Export sales recorded an increase of 11,411 units, or 39,5%, to 40,302 units in October 2023 compared to the 28,891 vehicles exported in the Transnet strike affected October 2022.

Overall, out of the total reported industry sales of 45,445 vehicles, an estimated 36,468 units, or 80,2%, represented dealer sales, an estimated 5,880 units or 12,9% represented sales to the vehicle rental industry, 4,1% to government, and 2,8% to industry corporate fleets.

The October 2023 new passenger car market at 29,912 units had registered a decline of 1,068 cars, or a loss of 3,5%, compared to the 30,980 new cars sold in October 2022. Car rental sales accounted for a sound 18,3% or 5,468 units of the new passenger vehicles sales.

Domestic sales of new light commercial vehicles, bakkies and mini-buses at 12,361 units during October 2023 had recorded a decline of 387 units, or a loss of 3,0%, from the 12,748 light commercial vehicles sold during October 2022.

Sales for the medium commercial vehicle segment at 807 units reflected an increase of 62 units, or a gain of 8,3%, compared to the 745 medium vehicle sales recorded in the same period last year. The heavy truck and bus segments of the industry reflected a positive performance during the month at 2,365 units, which is an increase of 488 vehicles, or a gain of 26,0%, compared to the 1,877 units sold during the corresponding month last year.

The October 2023 exports sales number at 40,302 units reflected a substantial increase of 11,411 vehicles, or 39,5%, compared to the 28,891 vehicles exported in October 2022. Vehicle exports for the year to date were now 12,7% ahead of the same period last year.

Economic constrains continued to impact new vehicle sales during the month as rising cost of living and restrictive borrowing costs were depressing demand for luxury goods. The new vehicle market’s prolonged recovery from the COVID-19 pandemic continued into 2023 with the expectation that the market would return to the 2019 level after three years. The market was still 1,3% below the pre-pandemic level in 2022 and for the year to date was now 2,1% units ahead of the corresponding period 2022, on track to recover to the pre-pandemic level of 2019. Heavy commercial vehicle sales already exceeded the pre-pandemic level in 2022, supported by the transport of goods forced onto roads due to the rail inefficiencies. The country’s weak economic growth rate, although still marginally positive, remains a key challenge for the new vehicle market going forward in view of the close correlation between new vehicle sales and the GDP growth rate. Alongside faster economic growth, moderate inflation and lower interest rates would go a long way to support the new vehicle market over the medium term.

Vehicle exports reflected a substantial increase during the month compared to the corresponding month 2022 due to the low base effect caused by the Transnet strike force majeure declared and consequent supply chain disruptions at the time. Despite a longer-term global economic outlook which remains clouded by risks to the inflation trajectory, the recent outbreak of the war between Israel and Hamas and the effects of climate change, the vehicle export momentum remains upward for the balance of the year.

The African Growth and Opportunity Act [AGOA] Forum hosted by South Africa from 2 to 4 November 2023 aims to promote economic ties and export opportunities between Sub-Saharan Africa and the United States. AGOA expires on 30 September 2025 and the scheduled expiration makes the future of US-Africa trade relations uncertain. The automotive industry has been South Africa’s major beneficiary under AGOA. In 2022 the US comprised the domestic automotive industry’s 2nd largest export destination with total automotive exports amounting to R24,1 billion. Trade arrangements, such as AGOA, substantively secured, strengthened, and enhanced the domestic automotive industry’s exports and trade flows and the extension of AGOA beyond September 2025 and South Africa’s continued eligibility under the Act will be key focus areas at the Forum.

naamsa is awaiting the long-awaited formal policy pronouncements from the Minister of Finance in the Medium-Term Budget Policy Statement in Parliament today, which would be a critical step to secure the future of the automotive industry in South Africa. The lack of the NEV regulatory framework could result in SA automobile makers facing the threat of losing significant investment for local production.

Finally, naamsa wishes to congratulate the victorious Springboks in successfully defending their World Cup title for the 4th time, not just making our country proud but also setting an exemplary example of embracing nation building and respect for each other.

This was the third consecutive month of decline in the new vehicle market. https://t.co/1drSDDXpKn #ArriveAlive #naamsa #VehicleSales@dealerfloor pic.twitter.com/X5IQ2eBJkb

– Arrive Alive (@_ArriveAlive) November 1, 2023

South Africa's vehicle retailers once again demonstrate resilience in challenging trading conditions – https://t.co/Lfb074PALb #ArriveAlive #VehicleSales #NADA @dealerfloor

– Arrive Alive (@_ArriveAlive) November 1, 2023