Help… there’s a crisis

As The Insurance Apprentice 2024 progresses through its demanding challenges, contestants are reminded of the gravity of their roles in addressing real-world industry issues. The journey so far has been marked by intense competition, showcasing the resilience and skill of those vying for the title.

The recent surge in kidnapping cases has raised alarm bells within the industry, prompting experts to emphasise the importance of specialised crisis management. According to Catia Folgore, Product Head of Crisis Management at iTOO, kidnapping has evolved into a lucrative enterprise for organised syndicates, with victims carefully targeted and ransom demands meticulously calculated.

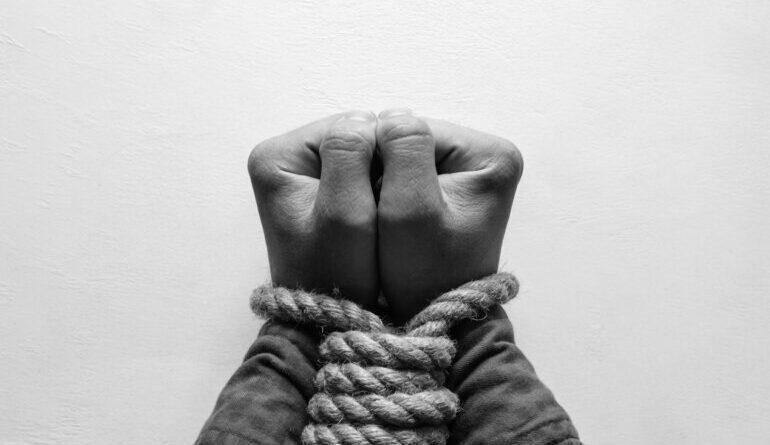

In episode five of The Insurance Apprentice, sponsored by iTOO Special Risks, a special risk insurance provider, contestants are thrust into the role of incidenJoncket response consultants. Tasked with addressing a simulated kidnapping scenario involving an employee of Taken.com, an SME expanding into a foreign market, contestants must navigate the complexities of crisis management.

The stakes are high as contestants are tasked with devising comprehensive strategies to ensure the safe return of the kidnapped employee while effectively managing communication with stakeholders. The challenge not only tests their analytical skills but also their ability to provide support to the employee’s family, colleagues, and other stakeholders affected by the crisis.

Head Judge Simon Colman, Co-Judge Nox Dlamini, and sponsor Judge Marissa van der Westhuizen, General Liabilities Claims Manager at iTOO Special Risks, will assess the contestants’ proposals based on their effectiveness and ability to address the multifaceted challenges posed by the scenario.

Did the contestants rise to the occasion and provide innovative solutions that meet the needs of stakeholders? Viewers can tune in to witness the drama unfold and gain valuable insights into crisis management in the insurance industry.