Against all odds! South Africa’s vehicle sales boomed in May, contrary to expectations

The general feeling among industry commentators in South Africa had pointed to a slowdown in new vehicle sales in May as many consumers turned their attention to investing in solar panels and inverters instead of new cars, while businesses had to contend with increased load shedding in addition to a 10th consecutive hike in the interest rate.

However, the market returned stronger than expected sales during the month, keeping the year-to-date sales total of 218,869 units 3% above the figure for the first five months of 2022. Exports for the same period are up 9.7%.

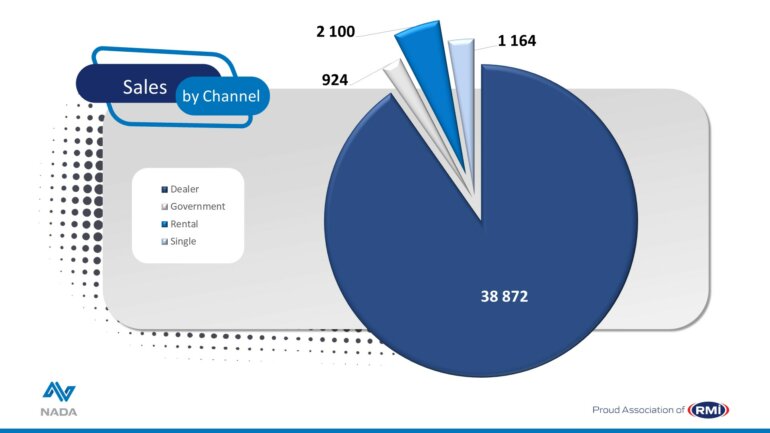

“The retail motor industry is, naturally, delighted at the unexpected extent of the upswing, with dealers responsible for selling 90.2% of the total volume,” commented Gary McCraw, Director of the National Automobile Dealers’ Association (NADA).

“Certain dealers focused on sales before the interest rate announcement to allow customers to take advantage of lower rates. This activity, early in the month, certainly benefited sales volumes during May. However, purchase consideration didn’t deteriorate after the rate increase, driven by the ongoing trend towards smaller, more affordable vehicles,” said McCraw.

The upswing was significant, new vehicle sales increasing 10.1% to 43,060 units compared to the same month a year ago, while exports were up by 67.5%. “However, it is important to note that the low export figure in May 2022 was mainly due to the devastating floods in KwaZulu-Natal the previous month,” said McCraw.

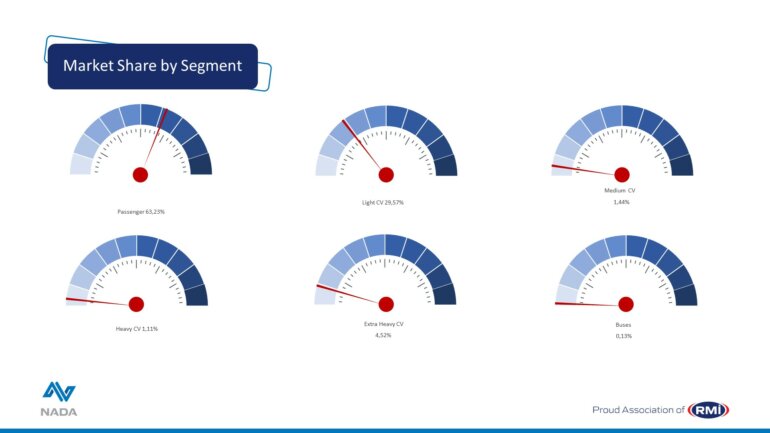

Passenger car volumes were within 15 units of the figure for May 2022, but light commercial vehicle sales were 38.5% higher than a year ago. However, the confidence in the business sector extended to growth of 2.7% in medium truck sales and a whopping 19.3% increase in the heavy truck and bus market. The rental market was not such a big contributor in May, with a 4.7% share of the total sales.

“Prior to the release of these buoyant figures, the prospects seemed rather bleak with the latest interest rate escalations making it difficult for consumers to make repayments on bonds and new car finance that had been doable a year ago. Then trade-ins appeared lower as the national used vehicle groups had a difficult period due to the hangover from a three-year buying frenzy, affecting margins negatively,” explained McCraw.

“A contributing factor to the better-than-expected sales is that several brands have started offering incentives, to encourage new vehicle buyers. This is something we haven’t seen much of since the pandemic. Another factor could be that many dealers have accumulated stock and were concerned about being left with an excessive inventory if the market took a downturn. As a result, they have turned to more aggressive marketing strategies on new models,” added the NADA Director.

“Going forward it will be interesting to see if the pace can continue in an environment where sales growth is seen as being somewhat against the odds,” concluded McCraw.

NADA is a proud constituent association of the Retail Motor Industry Organisation (RMI).