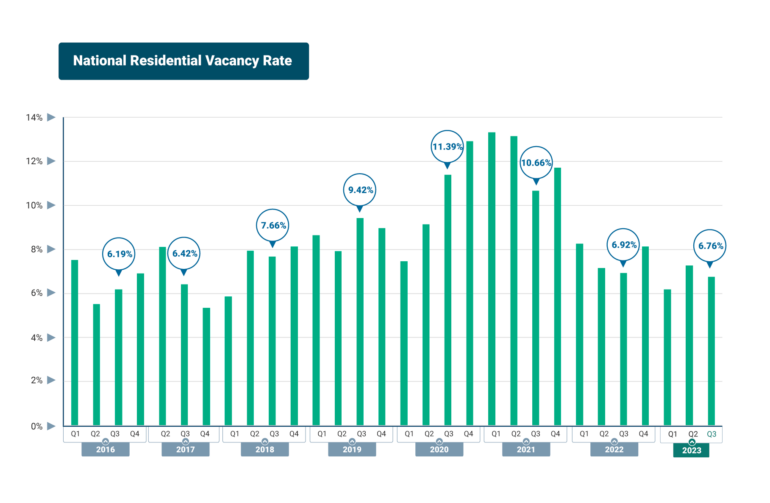

Residential rental vacancies at 6-year low

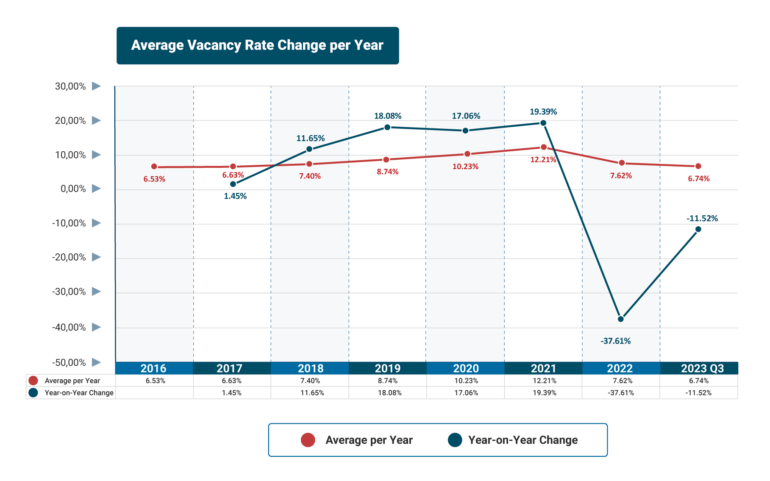

Demand for residential rental property remains strong with residential rental vacancies nationally declining to 6.76% in the third quarter of 2023, the lowest quarter since 2017, according to the latest TPN Credit Bureau Vacancy Survey Report. Year-on-year, overall vacancies have decreased 11.52% on average.

Despite a constrained economy, tenants have continued to meet their rental obligations. The recently published TPN Residential Rental Monitor revealed that tenants in good standing improved overall in the third quarter with relatively healthy escalations.

Waldo Marcus, Industry Principal at TPN Credit Bureau says TPN’s third quarter data indicates that the residential rental market is demonstrating resilience. “Residential rental vacancies are primarily influenced by demand and supply which has leaned more towards higher demand and slower supply. The TPN Rental Market Strength Index remains relatively high at 57.15 points in the third quarter, showcasing a market in equilibrium with slightly more supply but persistent high demand. The increase in employment numbers contributes to the overall positive sentiment.”

The residential rental market, he explains, is in equilibrium when demand and supply are equal at 50 points. “A healthy rental market strength index offers property investors the space to grow their rental while enjoying lower vacancies.”

High youth unemployment amongst those aged 25 to 34 has a negative impact on the residential rental market as these individuals normally enter the rental market at lower rental value band brackets as they start their career journeys.

Benefiting the rental market, on the other hand, are high interest rates which have dissuaded many people from purchasing homes due to the high cost of debt. The downside of high interest rates, however, is that they are impacting investors’ cash flow due to the high cost of debt and escalating maintenance costs. It’s therefore important to ensure a rental unit is not vacant.

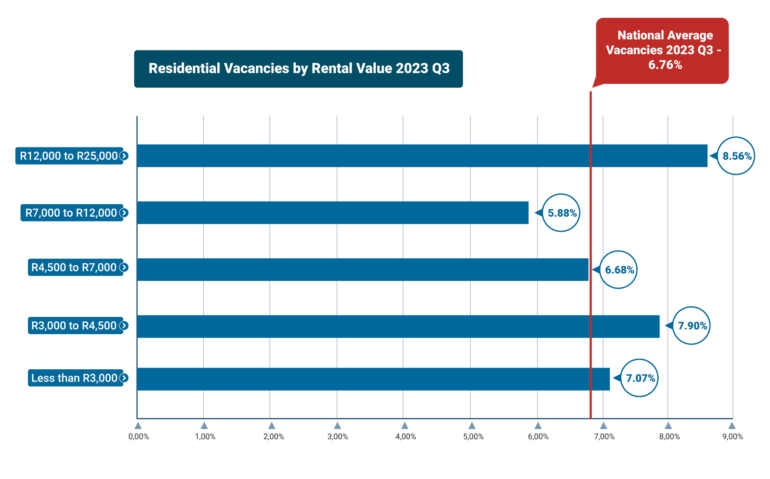

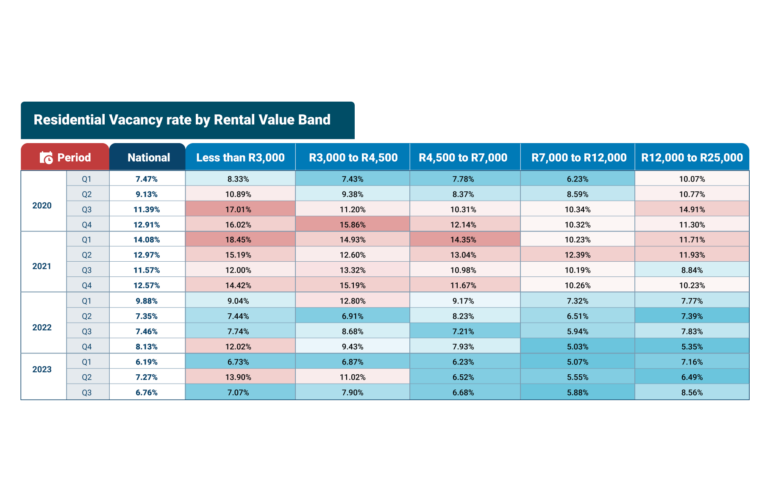

The Vacancy Survey Report reveals that rental units with a rental of R3 000 or less a month have seen a sharp decrease in vacancies between the second and third quarters from 14% to 7.07%. There was a similar pattern in the R3 000 to R4 500 rental band with vacancies decreasing from 11.02% in the second quarter to 7.9% in the third quarter.

This is not an unusual trend, reveals Marcus. “We’ve seen this in the past with a spike in at least one quarter in a calendar year, but which then recovers well but remains above the national vacancy rate.”

Lower rental value bands have seen decreases in the rental population as escalations migrate lower revenue units upwards. This has resulted in an increase in rental units with a rental of R4 500 to R7 000 per month with vacancies increasing for three consecutive quarters from 6.23% in the first quarter, 6.52% in the second quarter and 6.68% in the third quarter.

The R7 000 to R12 000 rental value band saw a similar trend with 5.07% of units vacant in the first quarter, increasing to 5.55% in the second quarter and 5.88% in the third quarter.

Although vacancies are increasing in the mid to higher value bands, they remain below the national average and boast the lowest vacancies overall.

The highest vacancy rate is in the R12 000 to R25 000 rental value band with 8.56% of rental stock vacant in the third quarter, up from 6.49% in the second quarter.

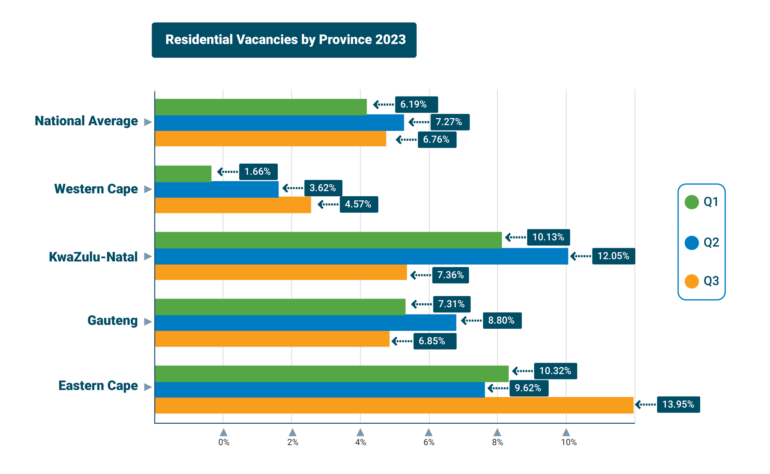

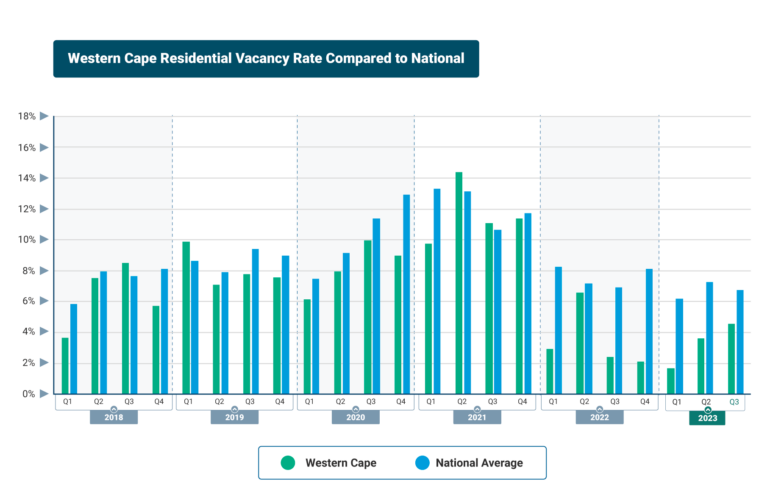

Provinces have experienced varied vacancy rates which is reflected in the TPN Market Strength Index. The province with the highest market strength, the Western Cape, has experienced three consecutive quarters of increased vacancies: 1.66% in the first quarter, 3.62% in the second quarter and 4.57% in the third quarter. The province has a perceived undersupply of rental stock and high demand. Higher vacancies, however, may see the demand rating coming down and, combined with more supply coming online, weaken the Market Strength Index in the latter part of 2024.

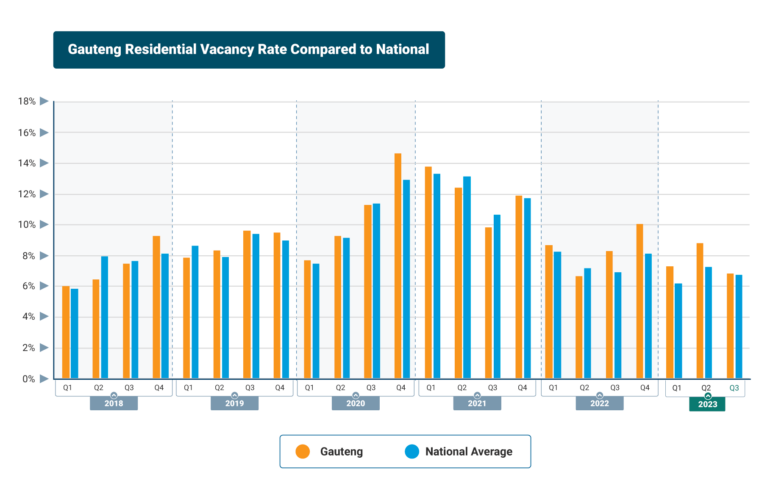

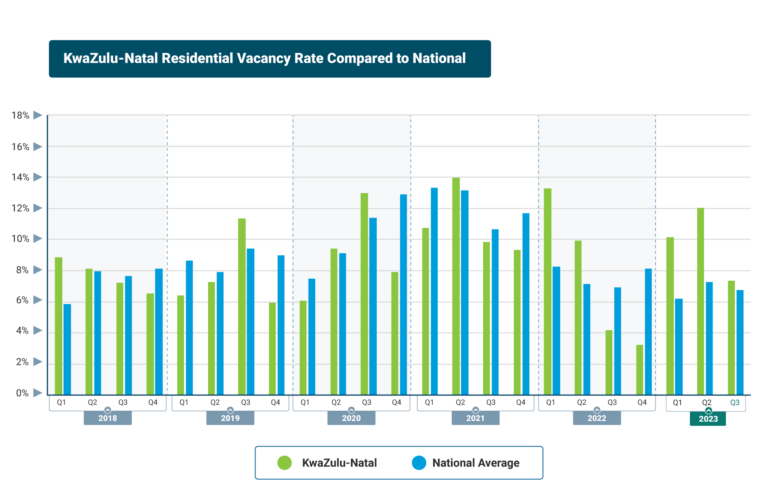

Vacancies decreased in KwaZulu-Natal from 12.05% in the second quarter to 7.36% in the third quarter and in Gauteng from 8.8% in the second quarter to 6.85% in the third quarter. The latter has historically experienced a slightly higher vacancy rate compared to the national average vacancy rate with perceived supply higher than perceived demand, indicating that its rental market has not been in equilibrium for some time. This imbalance has impacted rental growth.

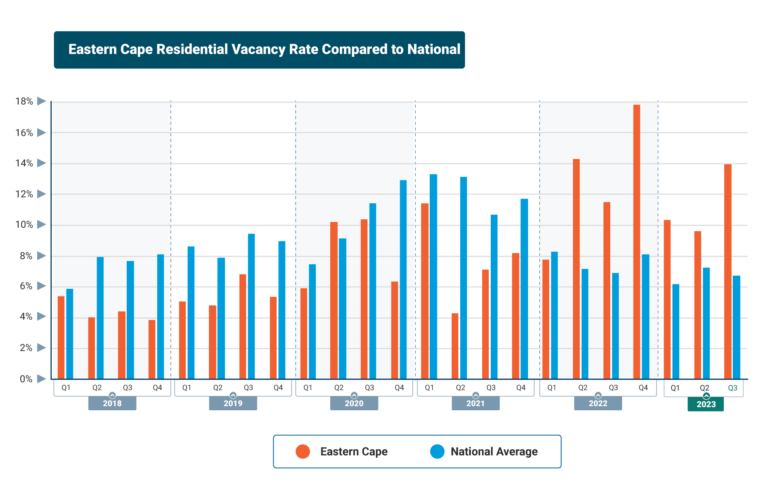

After experiencing decreasing vacancy rates in the first two quarters, the vacancy rate in the Eastern Cape increased to 13.95% in the third quarter. Vacancies in the province are driven by higher supply rather than a low demand.

There is little expectation that interest rates will be coming down any time soon, which will benefit the residential rental market, ensuring it remains an affordable housing alternative.

Higher vacancies are usually reported in the fourth quarter which means 2023 could end with a slightly higher annual vacancy level, cautions Marcus. Despite this potential uptick in vacancies in the fourth quarter, the overall trend for 2023 points to an encouraging decrease in vacancies.